- United Kingdom

- /

- Commercial Services

- /

- LSE:RTO

Rentokil Initial (LSE:RTO) Appoints Brian Baldwin as Non-Executive Director, Boosting Strategic Leadership

Reviewed by Simply Wall St

Rentokil Initial (LSE:RTO) is navigating a dynamic period marked by both opportunities and challenges. Recent highlights include a 4% revenue growth to £2.8 billion and significant brand visibility initiatives, contrasted with modest performance in the Pest Control category and competitive pressures. In the discussion that follows, we will explore Rentokil Initial's core advantages, critical issues, growth strategies, and key risks to provide a comprehensive overview of the company's current business situation.

Explore the full analysis report here for a deeper understanding of Rentokil Initial.

Strengths: Core Advantages Driving Sustained Success For Rentokil Initial

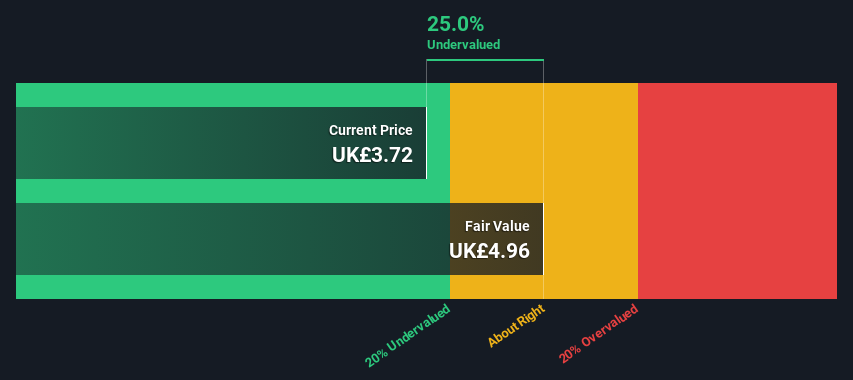

Rentokil Initial has demonstrated revenue growth, with a 4% increase to £2.8 billion, driven by top-line growth across all regions. The company's profitability is also notable, with group adjusted operating profit rising by 4.7% to £455 million. The successful execution of its bolt-on M&A program, which included 23 acquisitions generating annualized revenues of £81 million, underscores its strategic acumen. Additionally, the company’s brand awareness initiatives, such as the Terminix It campaign, have significantly boosted visibility, reaching 96 million people. Although the Price-To-Earnings Ratio stands at 24.1x, the stock is trading below the estimated fair value of £6.01, currently priced at £3.77, indicating potential undervaluation.

To explore how Rentokil Initial's valuation metrics are shaping its market position, check out our detailed analysis of Rentokil Initial's Valuation.

Weaknesses: Critical Issues Affecting Rentokil Initial's Performance and Areas For Growth

Rentokil Initial faces several challenges, particularly in North America, where growth rebuilding efforts are ongoing. Colleague retention, although improved to 73.1%, still indicates room for enhancement. The Pest Control category's performance was modest, growing only 1.1% due to a drag from the products distribution business. Furthermore, customer retention at 79.8% is stable but not exemplary. Financially, the company is considered expensive with a Price-To-Earnings Ratio of 24.1x compared to the industry average of 14.5x and peer average of 14.6x, which may deter value-focused investors.

To gain insights into Rentokil Initial's historical performance, explore our detailed analysis of past performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Rentokil Initial has significant growth opportunities, particularly through market expansion and strategic investments. The acquisition of the second-largest pest control company in India positions the company favorably in a high-growth market. Investments in growing the underlying contract portfolio are expected to yield positive results. Additionally, targeted customer marketing initiatives aim to improve retention rates. The company anticipates over $200 million in net synergies from integration efforts, enhancing operational efficiency and profitability. Revenue growth is forecasted at 4.2% per year, outpacing the UK market's 3.7% growth rate.

Threats: Key Risks and Challenges That Could Impact Rentokil Initial's Success

Rentokil Initial faces significant competitive pressures, particularly in retention rates, which are crucial for organic growth. Economic factors, such as inflationary pressures, pose risks despite successful margin protection through pass-through pricing. Operational risks associated with integration processes could potentially disrupt customer satisfaction. Moreover, increased regulatory pressures, especially in food safety, add to the operational challenges. The company's debt coverage by operating cash flow is a concern, highlighting potential financial vulnerabilities. Additionally, the highly volatile share price over the past three months indicates market instability, which could impact investor confidence.

Conclusion

Rentokil Initial's strong revenue growth and profitability, driven by strategic acquisitions and effective brand awareness campaigns, highlight its operational efficiency and market presence. However, challenges in North American growth and modest performance in the Pest Control category indicate areas needing improvement. The company's strategic investments and market expansion efforts, especially in high-growth markets like India, present significant growth opportunities. The current stock price of £3.77, below the estimated fair value of £6.01, suggests potential for future appreciation. The company's ability to navigate competitive pressures, economic factors, and operational risks will be crucial in realizing its growth potential and enhancing investor confidence.

Shareholder in Rentokil Initial? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Rentokil Initial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:RTO

Rentokil Initial

Provides route-based services in North America, Europe, the United Kingdom, Asia, the Middle East, North Africa, Turkey, and Pacific.

Average dividend payer low.

Similar Companies

Market Insights

Community Narratives