- United Kingdom

- /

- Commercial Services

- /

- AIM:SFT

Ebiquity And 2 Other Promising UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting ongoing global economic uncertainties. Amidst these broader market fluctuations, investors often turn their attention to penny stocks as potential opportunities for growth. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer unique investment prospects when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.645 | £520.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.17 | £175.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.78 | £11.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.095 | £15.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.54 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.47 | £71M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.882 | £710.88M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 290 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ebiquity (AIM:EBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ebiquity plc, along with its subsidiaries, offers media investment analysis services across the United Kingdom, Ireland, North America, Continental Europe, and the Asia Pacific, with a market capitalization of £20.50 million.

Operations: The company's revenue is derived from four primary regions: £7.26 million from Apac, £15.27 million from The Americas, £33.49 million from the UK & Ireland, and £20.79 million from Continental Europe.

Market Cap: £20.5M

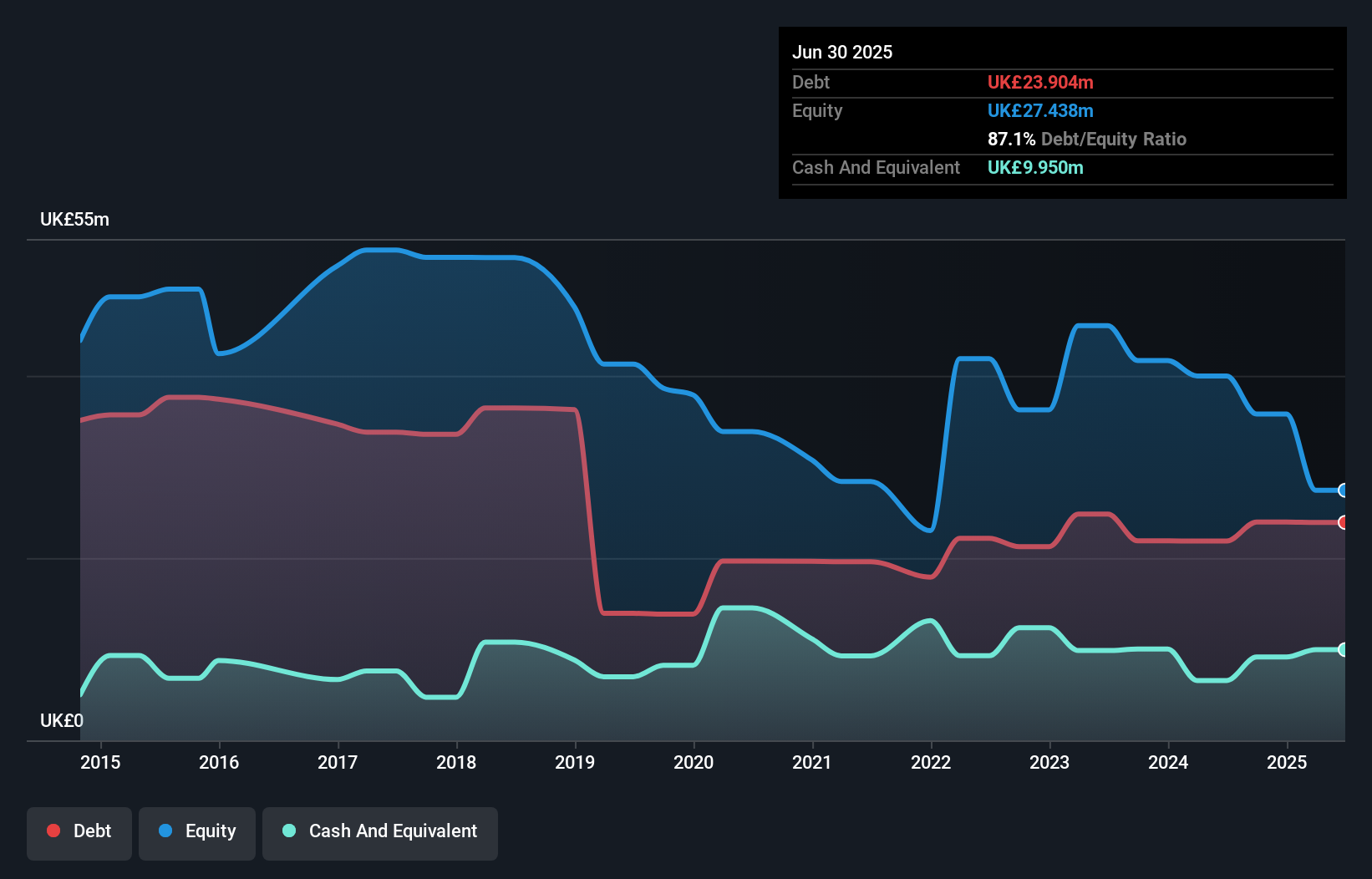

Ebiquity plc, with a market cap of £20.50 million, has shown stability in its cash runway despite being unprofitable and experiencing increased losses over the past five years. The company's revenue is primarily derived from the UK & Ireland and Continental Europe, with recent earnings showing minimal sales growth but a significant net loss increase to £9.94 million for the half-year ended June 2025. Recent board changes include appointing Christopher Sweetland as Director, which might influence strategic direction amidst challenges like high debt levels and volatile share prices. Revenue is forecasted to grow modestly at 7.13% annually.

- Click to explore a detailed breakdown of our findings in Ebiquity's financial health report.

- Review our growth performance report to gain insights into Ebiquity's future.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eleco plc is a software and services provider operating in the UK, Scandinavia, Germany, Europe, the US, and internationally with a market cap of £124.57 million.

Operations: The company generates £34.50 million in revenue from its software segment.

Market Cap: £124.57M

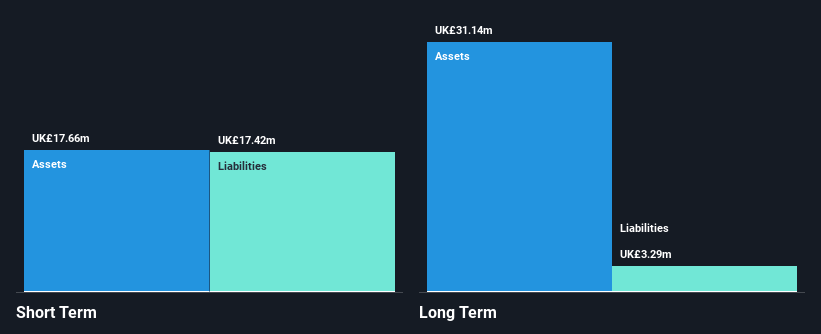

Eleco plc, with a market cap of £124.57 million, has demonstrated solid earnings growth, with recent half-year results showing sales of £18.35 million and net income rising to £1.65 million. The company benefits from an experienced management team and board, both averaging over three years in tenure. Eleco's earnings have outpaced the software industry average recently and are forecasted to grow by 14% annually. Despite being debt-free and having strong short-term assets (£19.7M), it faces challenges covering its short-term liabilities (£21.8M). A recent dividend increase reflects confidence in its financial health amidst stable volatility levels.

- Click here and access our complete financial health analysis report to understand the dynamics of Eleco.

- Examine Eleco's earnings growth report to understand how analysts expect it to perform.

Software Circle (AIM:SFT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Software Circle plc, along with its subsidiaries, licenses a range of software across regions including the UK, Ireland, Europe, Belgium, the Netherlands, France, New Zealand, South Africa and the US; it has a market cap of £89.72 million.

Operations: The company's revenue is primarily derived from its Graphics & Ecommerce segment (£8.68 million), followed by Health & Social Care (£3.55 million), Professional & Financial Services (£3.13 million), Property (£1.62 million), and Education (£1.29 million).

Market Cap: £89.72M

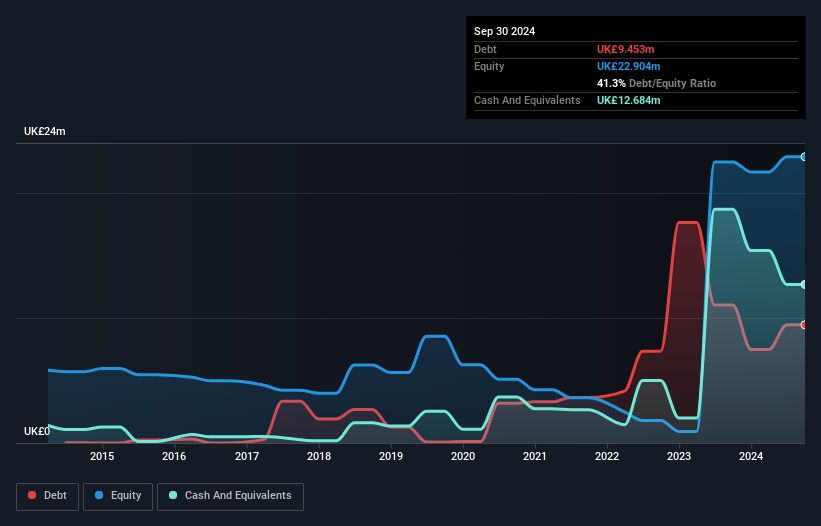

Software Circle plc, with a market cap of £89.72 million, has shown resilience despite being unprofitable. The company reported increased sales of £18.27 million for the year ending March 31, 2025, reducing its net loss significantly from the previous year to £0.329 million. It maintains a satisfactory net debt to equity ratio of 7.4% and has not diluted shareholders recently. Its cash runway is strong at over three years due to positive free cash flow growth of 61.3% annually, although its return on equity remains negative at -1.54%. Management and board tenure averages indicate experienced leadership stability amidst stable weekly volatility levels.

- Click here to discover the nuances of Software Circle with our detailed analytical financial health report.

- Gain insights into Software Circle's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Explore the 290 names from our UK Penny Stocks screener here.

- Seeking Other Investments? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SFT

Software Circle

Software Circle plc, together with its subsidiaries, licenses various software in the United Kingdom, Ireland, Europe, Belgium, the Netherlands, France, New Zealand, South Africa, and the United States.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives