- United Kingdom

- /

- Professional Services

- /

- AIM:BEG

3 UK Penny Stocks With Market Caps Over £100M

Reviewed by Simply Wall St

The UK market has been flat over the last week but is up 11% over the past year, with earnings expected to grow by 14% per annum in the coming years. While 'penny stocks' might seem like a term from yesteryear, they continue to offer intriguing investment opportunities by highlighting smaller or newer companies that can provide growth at accessible price points. By focusing on those with strong balance sheets and solid fundamentals, investors can uncover hidden gems that combine stability with potential upside.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.875 | £189.41M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.04 | £791.19M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.095 | £402.8M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.55 | £177.83M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.325 | £316.35M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.50 | £192.3M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.53 | £227.33M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.395 | £118.72M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.935 | £68.62M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.45 | $269.74M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK and has a market cap of £143.94 million.

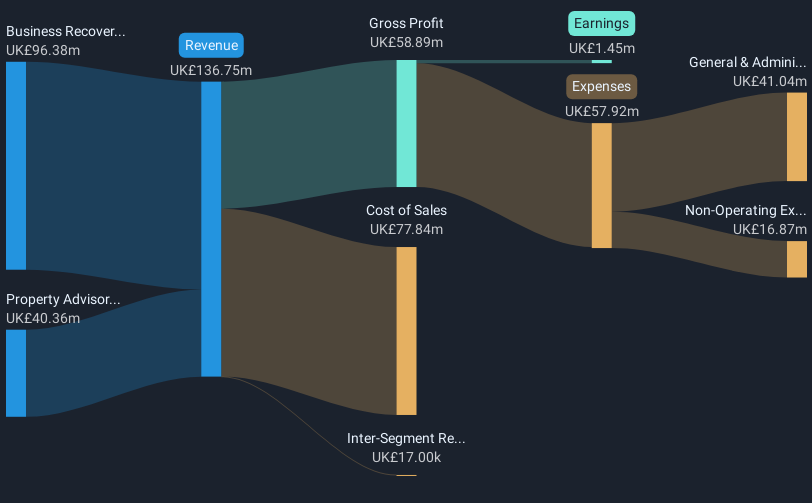

Operations: The company's revenue is derived from two main segments: Property Advisory, contributing £40.36 million, and Business Recovery and Advisory, generating £96.38 million.

Market Cap: £143.94M

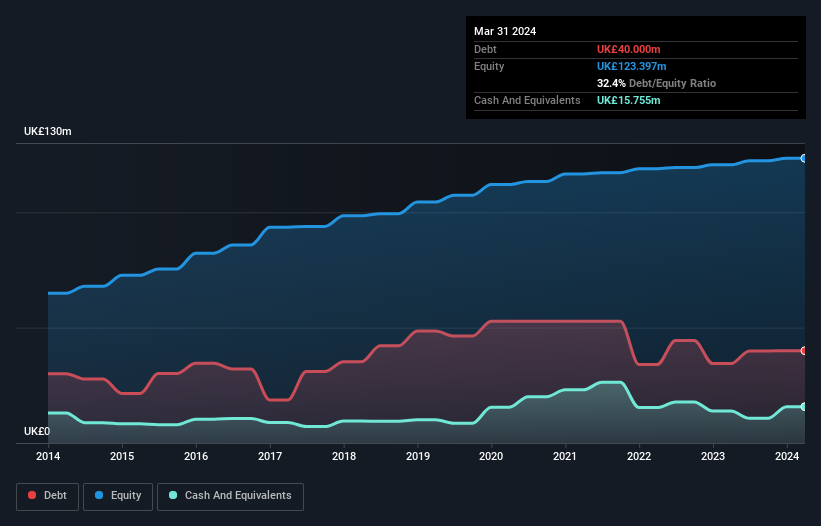

Begbies Traynor Group, with a market cap of £143.94 million, derives revenue from Property Advisory (£40.36M) and Business Recovery and Advisory (£96.38M). The company has managed to reduce its debt-to-equity ratio significantly over the past five years and maintains a satisfactory net debt level at 1.8%. Despite negative earnings growth recently, analysts forecast a robust 50.24% annual earnings increase going forward. The board's experience adds stability, but recent significant insider selling could be concerning for investors. A new share buyback program aims to repurchase up to 10% of issued shares by December 2025, potentially supporting the stock price.

- Click here to discover the nuances of Begbies Traynor Group with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Begbies Traynor Group's future.

Fintel (AIM:FNTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £276.09 million.

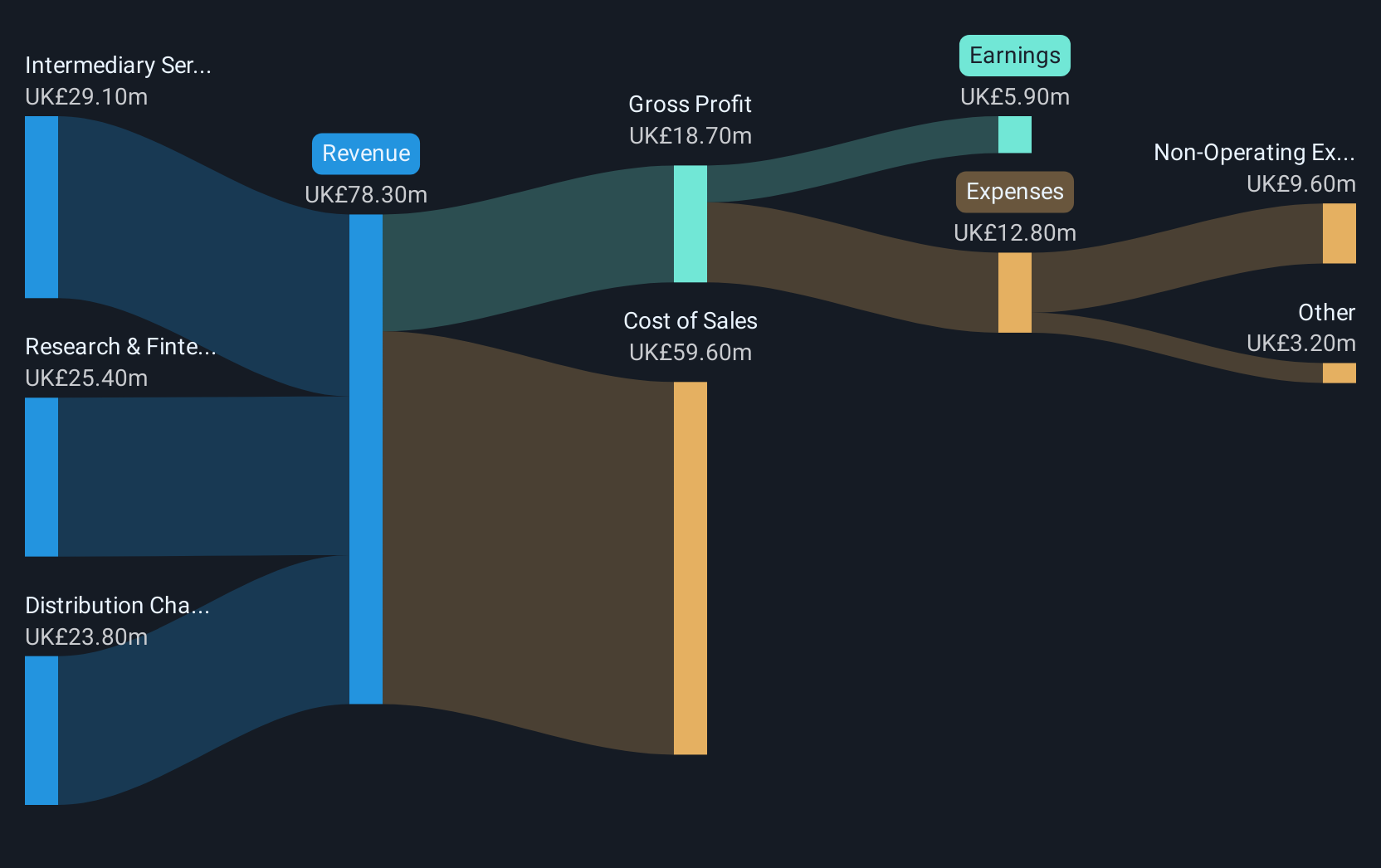

Operations: Fintel's revenue is derived from three main segments: Research & Fintech (£24.2 million), Distribution Channels (£21.4 million), and Intermediary Services (£23.3 million).

Market Cap: £276.09M

Fintel Plc, with a market cap of £276.09 million, shows mixed financial health indicators. While its debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT, short-term assets fall short of covering both short- and long-term liabilities. Recent earnings reveal a decrease in net income to £2.1 million from £3.3 million year-on-year, alongside lower profit margins at 8.6%. Despite this decline, Fintel's management and board bring seasoned experience to the table. The company announced an increased interim dividend of 1.2 pence per share for H1 2024, reflecting shareholder commitment amidst challenges.

- Jump into the full analysis health report here for a deeper understanding of Fintel.

- Explore Fintel's analyst forecasts in our growth report.

iomart Group (AIM:IOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: iomart Group plc provides cloud and managed hosting services in the United Kingdom and internationally, with a market cap of £101.17 million.

Operations: The company's revenue is derived from two main segments: Easyspace, contributing £12.47 million, and Cloud Services (including non-recurring), which accounts for £114.58 million.

Market Cap: £101.17M

iomart Group, with a market cap of £101.17 million, presents a mixed outlook among UK penny stocks. The company is in exclusive talks for the potential acquisition of Kookaburra Topco Limited, which could enhance its growth strategy and cloud service offerings if it proceeds. Financially, iomart's net debt to equity ratio is satisfactory at 19.6%, and interest payments are well covered by EBIT (3.3x). However, challenges include declining earnings growth (-7.9%) and low return on equity (5.2%). Short-term assets cover liabilities (£42.2M vs £41.1M), but long-term liabilities remain uncovered (£66.4M).

- Unlock comprehensive insights into our analysis of iomart Group stock in this financial health report.

- Understand iomart Group's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 467 UK Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Begbies Traynor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BEG

Begbies Traynor Group

Provides professional services to businesses, professional advisors, large corporations, and financial institutions in the United Kingdom.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives