- United Kingdom

- /

- Construction

- /

- LSE:SFR

June 2024 Insight Into Three UK Stocks Estimated Below Value

Reviewed by Simply Wall St

As the British parliamentary election looms and market caution heightens, investors are closely monitoring the FTSE 100, which shows a mixed response amid global economic uncertainties. Amidst this cautious environment, identifying undervalued stocks becomes crucial as they may offer potential for appreciation when market sentiment stabilizes. In such times, a good stock often features solid fundamentals like strong balance sheets and consistent earnings, which can provide some resilience against market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kier Group (LSE:KIE) | £1.40 | £2.73 | 48.7% |

| Morgan Advanced Materials (LSE:MGAM) | £3.13 | £6.09 | 48.6% |

| Mercia Asset Management (AIM:MERC) | £0.295 | £0.58 | 49.3% |

| Loungers (AIM:LGRS) | £2.68 | £5.26 | 49.1% |

| Deliveroo (LSE:ROO) | £1.286 | £2.48 | 48.1% |

| Nexxen International (AIM:NEXN) | £2.47 | £4.91 | 49.7% |

| Franchise Brands (AIM:FRAN) | £1.51 | £2.96 | 49% |

| Elementis (LSE:ELM) | £1.44 | £2.80 | 48.5% |

| Aston Martin Lagonda Global Holdings (LSE:AML) | £1.512 | £2.95 | 48.7% |

| eEnergy Group (AIM:EAAS) | £0.055 | £0.11 | 49.8% |

We're going to check out a few of the best picks from our screener tool

Aston Martin Lagonda Global Holdings (LSE:AML)

Overview: Aston Martin Lagonda Global Holdings plc is a global luxury sports car manufacturer with operations spanning design, development, and marketing, boasting a market capitalization of approximately £1.25 billion.

Operations: The company generates revenue primarily through its automotive segment, which amounted to £1.60 billion.

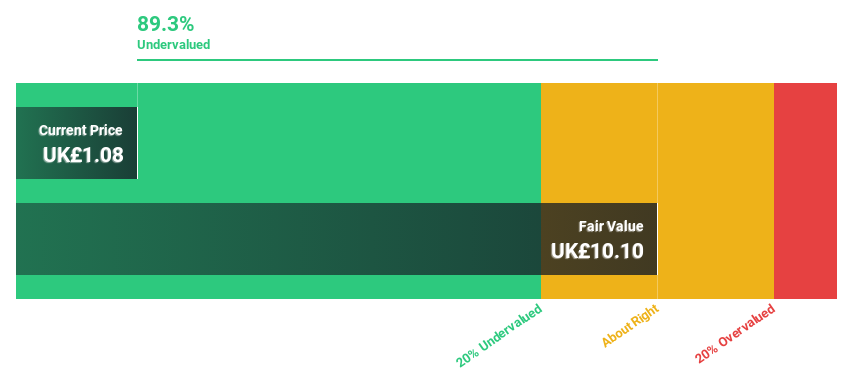

Estimated Discount To Fair Value: 48.7%

Aston Martin Lagonda Global Holdings is trading at £1.51, significantly below the estimated fair value of £2.95, indicating a potential undervaluation based on discounted cash flows. Despite recent challenges, including a substantial net loss reported in Q1 2024, the company is expected to become profitable within three years with an anticipated earnings growth of 81.69% per year. However, its forecasted Return on Equity remains low at 1.7%, suggesting cautious optimism for long-term growth prospects.

- The growth report we've compiled suggests that Aston Martin Lagonda Global Holdings' future prospects could be on the up.

- Click here to discover the nuances of Aston Martin Lagonda Global Holdings with our detailed financial health report.

NCC Group (LSE:NCC)

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe, with a market capitalization of approximately £481.38 million.

Operations: The company generates revenue primarily through its Cyber Security segment, which contributes £251.90 million, and its Escode division, which adds another £65.10 million.

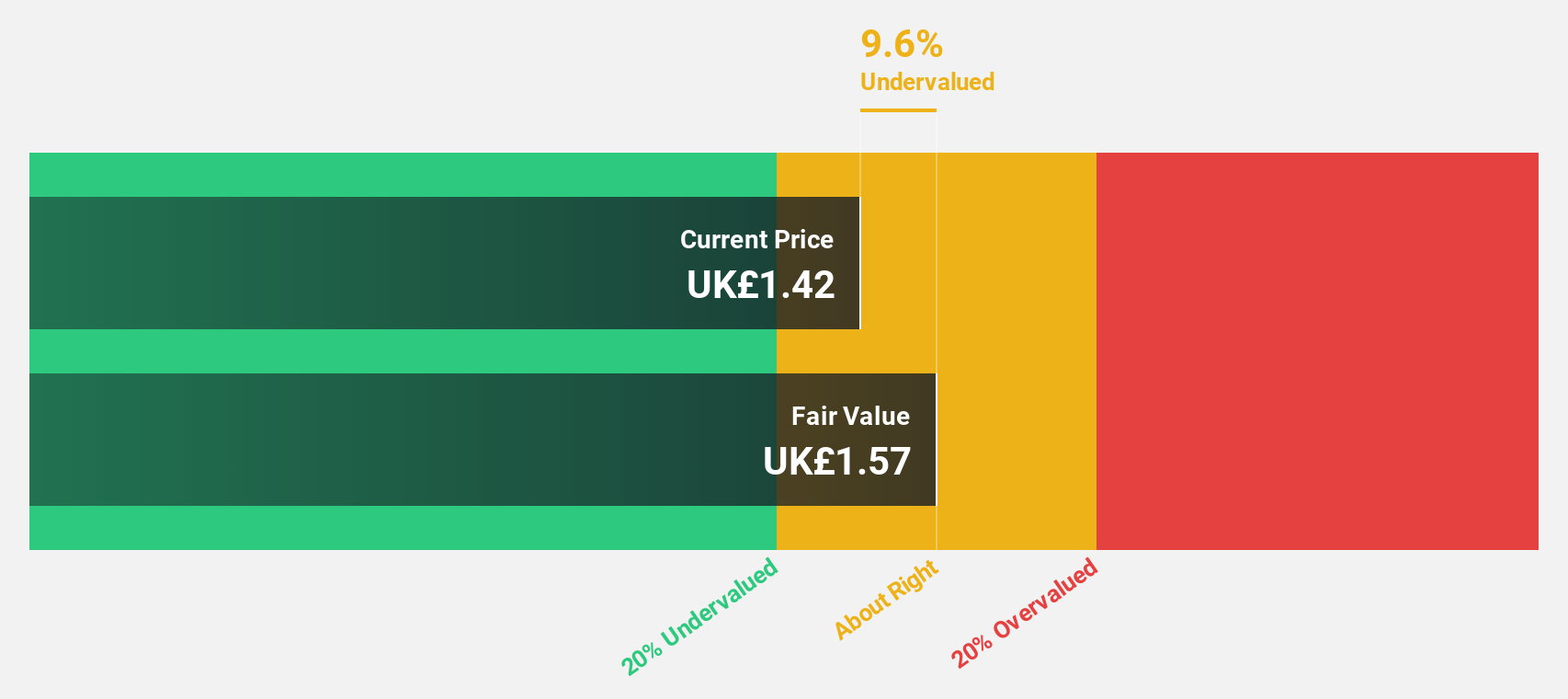

Estimated Discount To Fair Value: 33.5%

NCC Group, priced at £1.54, is considered undervalued by approximately 33.5% against its fair value of £2.31, based on discounted cash flow analysis. Recent corporate guidance anticipates revenues around £100 million for the upcoming quarter, with a steady dividend of 3.15p expected in October 2024. While earnings are projected to surge by 94.04% annually, the company's return on equity is forecasted to remain low at 6.2%, highlighting potential concerns over profitability and efficiency in capital use.

- Our growth report here indicates NCC Group may be poised for an improving outlook.

- Navigate through the intricacies of NCC Group with our comprehensive financial health report here.

Severfield (LSE:SFR)

Overview: Severfield plc is a UK-based structural steelwork company involved in design, manufacturing, fabrication, construction, and erection of steel structures across the UK, Republic of Ireland, Europe, and India, with a market cap of approximately £232.86 million.

Operations: The core construction operations of the company generate revenue of £463.47 million.

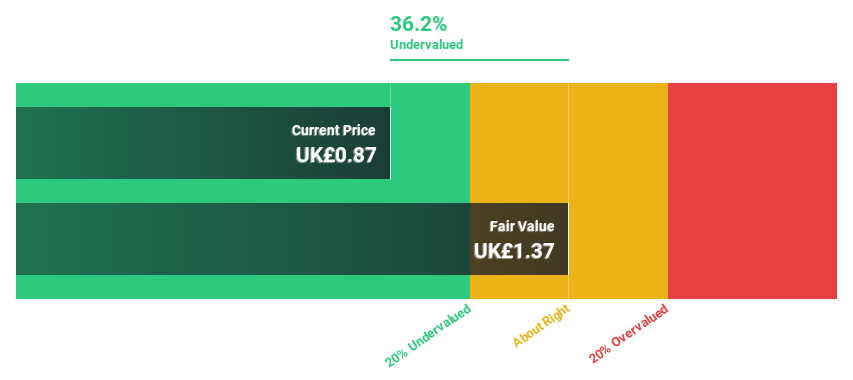

Estimated Discount To Fair Value: 29.3%

Severfield, trading at £0.76, is perceived as undervalued with a fair value estimate of £1.07. Despite a recent dip in sales to £463.47 million and net income falling to £15.9 million, the company's earnings are expected to grow by 23.38% annually, outpacing the UK market forecast of 12.5%. Analyst consensus suggests a potential price increase of 46.5%. However, concerns include a volatile share price and an unstable dividend track record which might deter risk-averse investors.

- Insights from our recent growth report point to a promising forecast for Severfield's business outlook.

- Dive into the specifics of Severfield here with our thorough financial health report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 65 Undervalued UK Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Severfield, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SFR

Severfield

A structural steelwork company, engages in the designing, manufacturing, fabrication, construction, and erection of steelwork activities in the United Kingdom, Republic of Ireland, Europe, and India.

Moderate with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives