- United Kingdom

- /

- Capital Markets

- /

- LSE:IHP

James Halstead And 2 More Promising UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. In such a climate, investors often seek opportunities in various market segments, including penny stocks—typically smaller or newer companies that can offer both affordability and potential growth. Although the term "penny stocks" may seem outdated, these investments can still present valuable prospects for those focusing on firms with solid financial foundations and clear paths to growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.68 | £523.96M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.20 | £258.52M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.36 | £150.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.4148 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.839 | £322.08M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.71 | £277.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.4345 | £123.17M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.1953 | £191.81M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £72.22M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

James Halstead (AIM:JHD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: James Halstead plc manufactures and supplies flooring products for both commercial and domestic markets globally, with a market cap of £600.17 million.

Operations: The company's revenue is derived entirely from the manufacture and distribution of flooring products, amounting to £268.52 million.

Market Cap: £600.17M

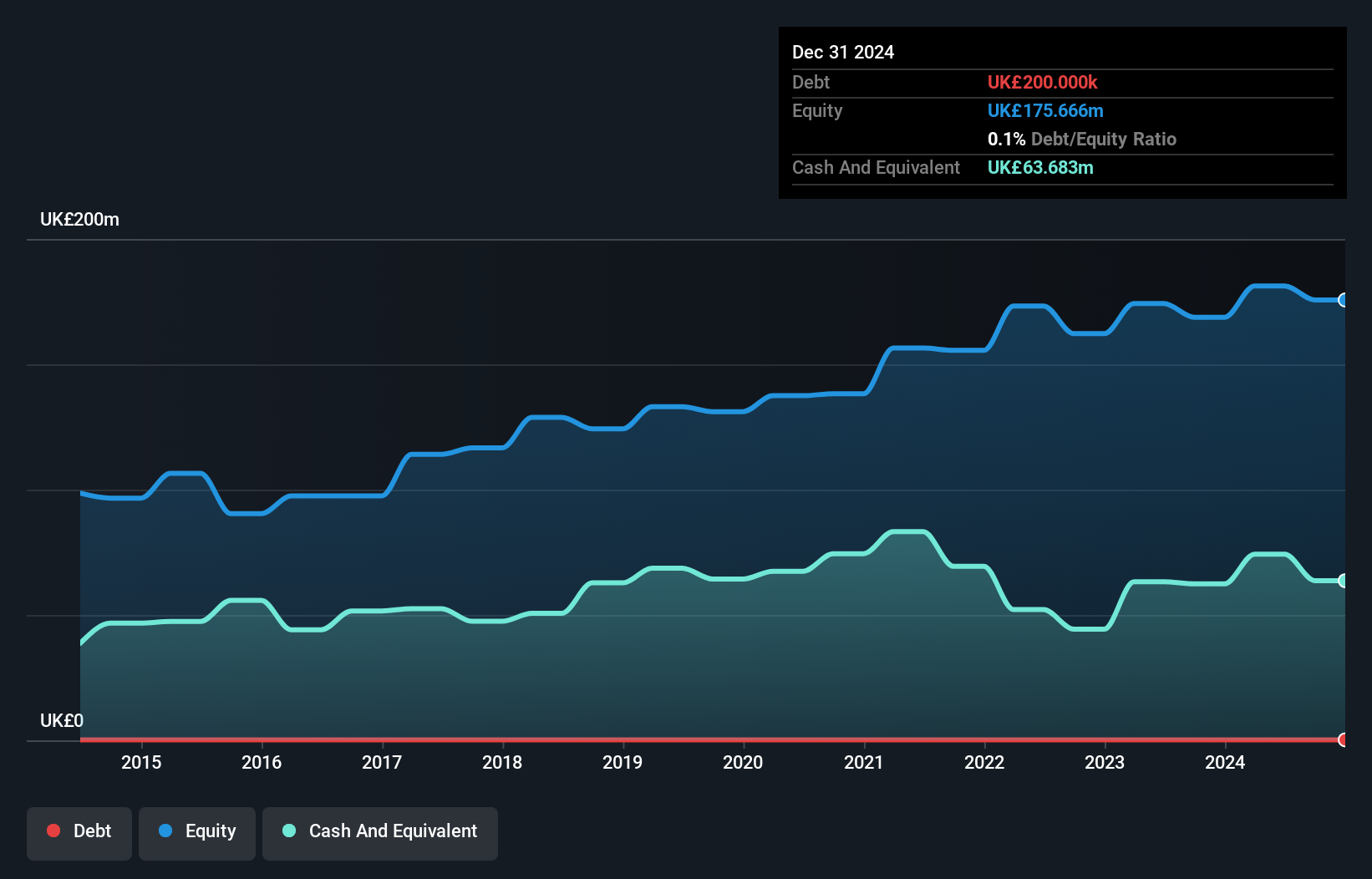

James Halstead plc, with a market cap of £600.17 million and revenue of £268.52 million, has shown stable financial health despite recent challenges in earnings growth. The company boasts high-quality earnings and a strong balance sheet, with short-term assets significantly exceeding liabilities and cash reserves surpassing total debt. While its return on equity is robust at 24.1%, the dividend yield of 5.9% isn't fully covered by free cash flow, raising sustainability concerns. Recent guidance suggests sales and profits will slightly decline but remain within expectations, supported by solid cash generation and an experienced board overseeing operations.

- Click here to discover the nuances of James Halstead with our detailed analytical financial health report.

- Evaluate James Halstead's prospects by accessing our earnings growth report.

Savannah Resources (AIM:SAV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Savannah Resources Plc is involved in the exploration and development of lithium properties, with a market cap of £95.84 million.

Operations: The company's revenue segments include £1.93 million from its lithium operations in Portugal and £1.11 million from headquarters, corporate activities, and other sources.

Market Cap: £95.84M

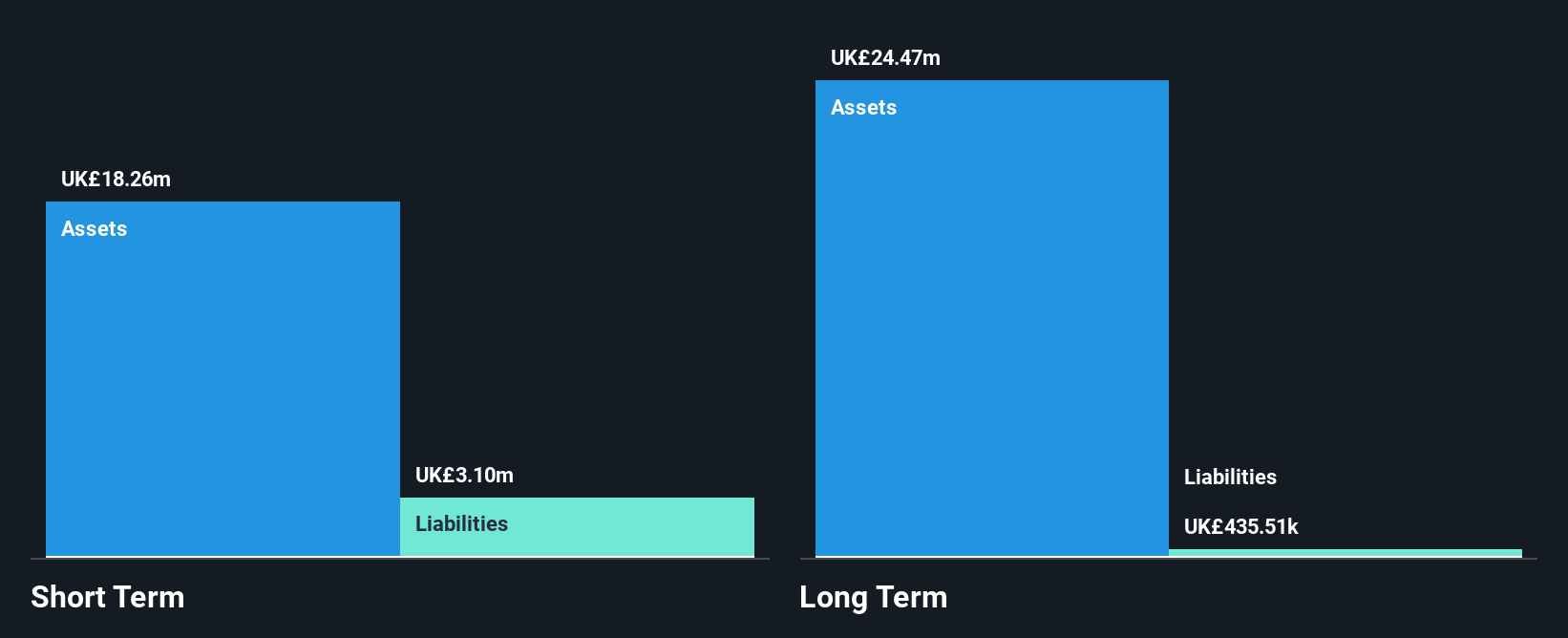

Savannah Resources, with a market cap of £95.84 million, is pre-revenue and currently focused on its lithium exploration and development projects in Portugal. Recent announcements highlight the completion of Phase 2 drilling for its Definitive Feasibility Study, which indicates potential resource upgrades at key deposits like Pinheiro and Reservatorio. Despite being debt-free with sufficient cash runway for over a year, the company remains unprofitable with increasing losses over the past five years. The management team and board are relatively inexperienced, but recent equity offerings suggest efforts to bolster financial stability as they progress towards updated JORC Resource estimates expected soon.

- Take a closer look at Savannah Resources' potential here in our financial health report.

- Review our growth performance report to gain insights into Savannah Resources' future.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc, with a market cap of £1.17 billion, offers software and services to clients and financial advisers in the UK and Isle of Man through its subsidiaries.

Operations: The company's revenue is primarily derived from its Investment Administration Services (£74.7 million), Insurance and Life Assurance Business (£72 million), and Adviser Back-Office Technology (£5 million) segments.

Market Cap: £1.17B

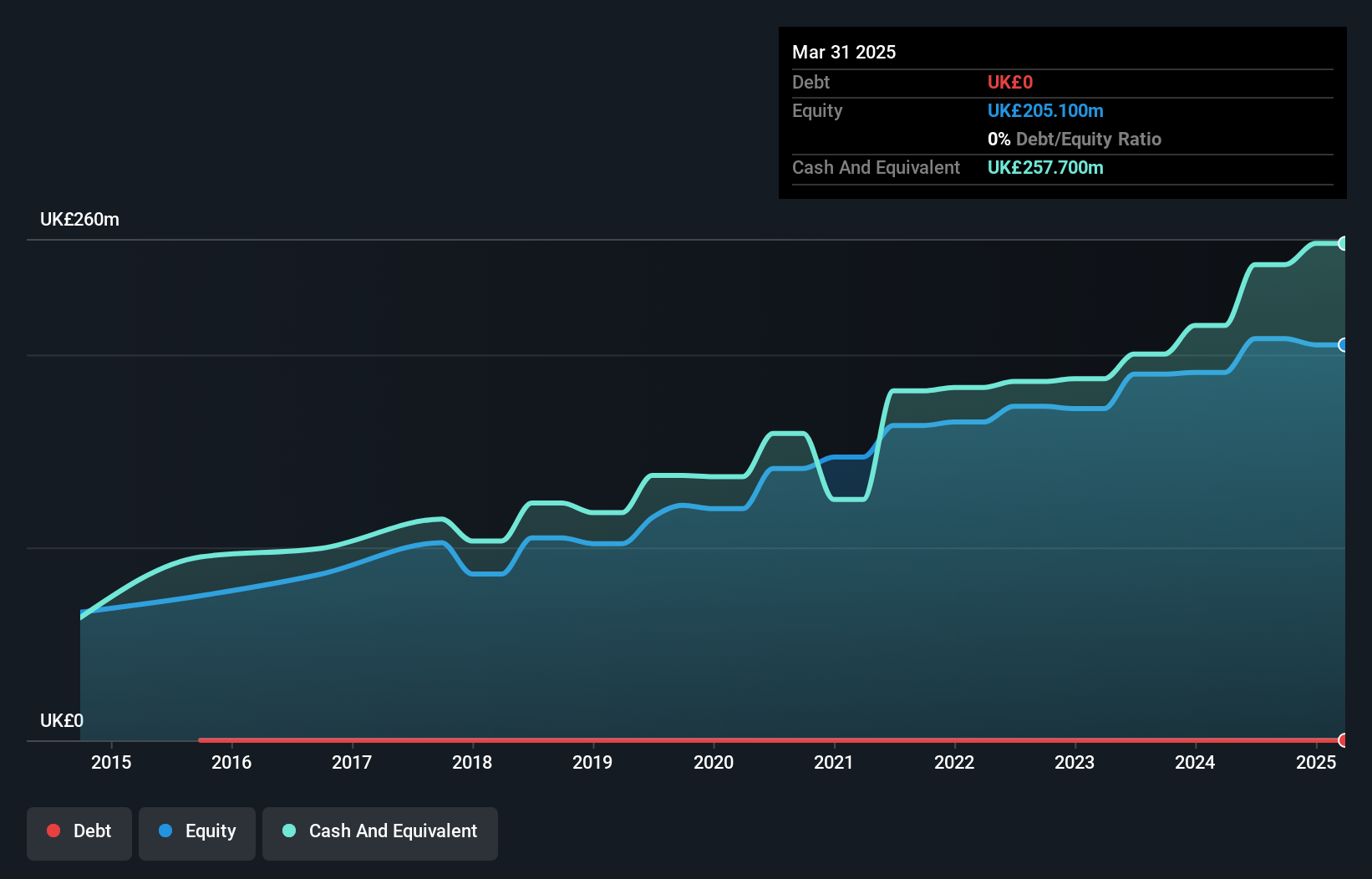

IntegraFin Holdings, with a market cap of £1.17 billion, is not classified as a penny stock but offers insight into the sector's dynamics. The company is debt-free and exhibits high-quality earnings with a strong Return on Equity of 23.8%. Although recent earnings growth has been negative, the firm maintains stable weekly volatility and seasoned management. Short-term assets significantly exceed liabilities, providing financial stability. Recent guidance indicates continued strong net inflow momentum and efforts to manage revenue margins effectively in FY26, despite challenges from reduced platform revenue margins due to lower charging bands influenced by positive market movements.

- Unlock comprehensive insights into our analysis of IntegraFin Holdings stock in this financial health report.

- Understand IntegraFin Holdings' earnings outlook by examining our growth report.

Summing It All Up

- Reveal the 299 hidden gems among our UK Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IHP

IntegraFin Holdings

Provides software and services for clients and UK financial advisers in the United Kingdom and Isle of Man.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives