- United Kingdom

- /

- Specialty Stores

- /

- AIM:VTU

Epwin Group Leads The Charge In UK Penny Stocks Spotlight

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, there remains a niche investment area that continues to intrigue investors: penny stocks. Although considered a somewhat outdated term, penny stocks still offer potential growth opportunities by focusing on smaller or newer companies with strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.85 | £293.89M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.20 | £159.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.74 | £421.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.10 | £395.29M | ✅ 3 ⚠️ 2 View Analysis > |

| FRP Advisory Group (AIM:FRP) | £1.24 | £306.06M | ✅ 4 ⚠️ 0 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.814 | £1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.00 | £159.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 404 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Epwin Group (AIM:EPWN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Epwin Group Plc manufactures building products for the repair, maintenance and improvement, social housing, and new build markets in the United Kingdom, Europe, and internationally with a market cap of £131.71 million.

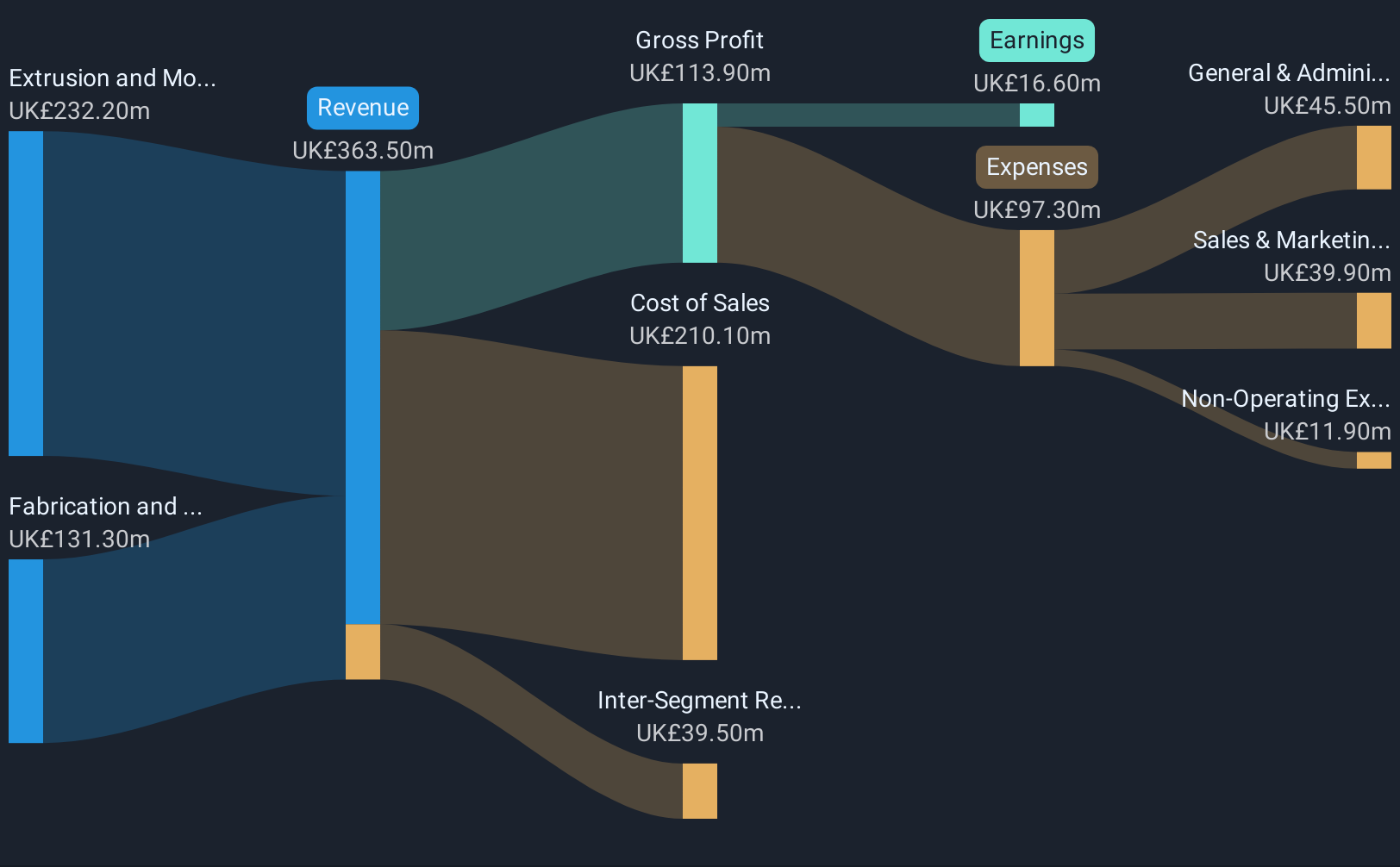

Operations: Epwin Group generates revenue through its Extrusion and Moulding segment, which accounts for £232.2 million, and its Fabrication and Distribution segment, contributing £131.3 million.

Market Cap: £131.71M

Epwin Group Plc, with a market cap of £131.71 million, has shown resilience in the penny stock space through robust financial performance and strategic initiatives. The company reported sales of £324 million for 2024, with net income rising to £16.6 million from the previous year. Its earnings growth of 78.5% surpasses industry averages despite forecasted declines ahead. A seasoned management team and stable weekly volatility enhance investor confidence, while a satisfactory net debt to equity ratio (13.2%) indicates prudent financial management. The recent share buyback and increased dividend reflect a commitment to shareholder value amidst an unstable dividend track record.

- Get an in-depth perspective on Epwin Group's performance by reading our balance sheet health report here.

- Gain insights into Epwin Group's future direction by reviewing our growth report.

Logistics Development Group (AIM:LDG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Logistics Development Group plc is an investment company with a market capitalization of £62.07 million.

Operations: Logistics Development Group plc has not reported any specific revenue segments.

Market Cap: £62.07M

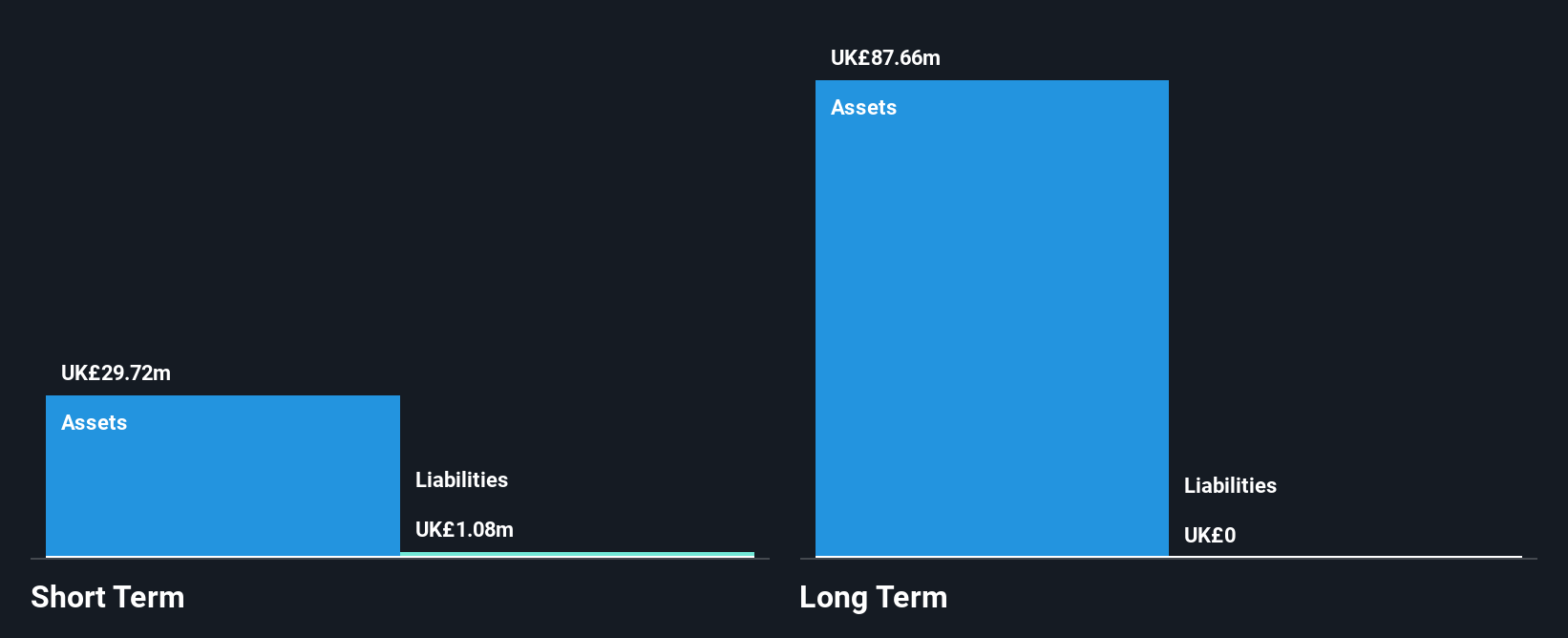

Logistics Development Group plc, with a market cap of £62.07 million, has transitioned to profitability, reporting net income of £18.82 million for the thirteen months ended December 31, 2024. The company is pre-revenue and debt-free, eliminating concerns over interest payments and showcasing a strong balance sheet with short-term assets significantly exceeding liabilities (£29.7M vs £1.1M). Despite its low Return on Equity (14.9%), LDG's Price-To-Earnings ratio (3.6x) suggests potential value compared to the broader UK market (16.2x). Recent strategic moves include a substantial share buyback program aimed at enhancing shareholder value amidst an inexperienced board tenure averaging 2.3 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Logistics Development Group.

- Understand Logistics Development Group's track record by examining our performance history report.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer in the United Kingdom with a market cap of £201.07 million.

Operations: The company generates revenue of £4.76 billion from its gasoline and auto dealership operations.

Market Cap: £201.07M

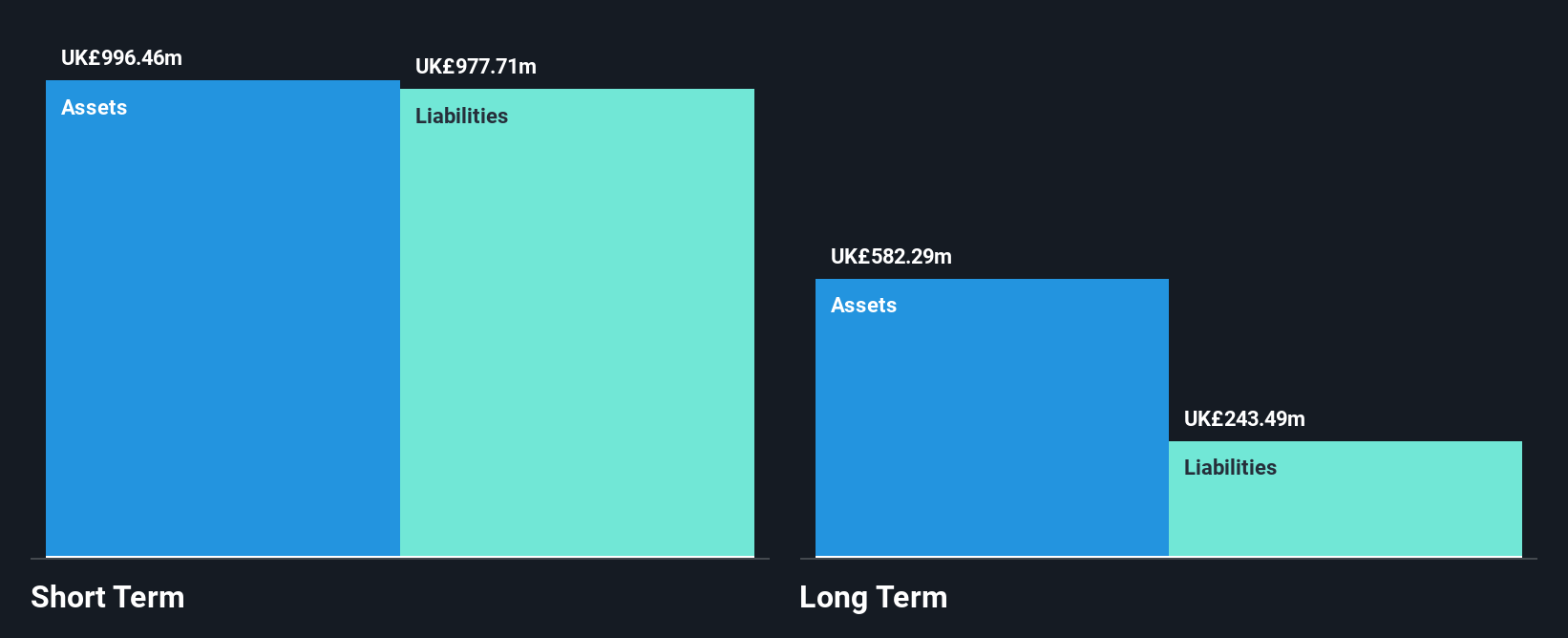

Vertu Motors plc, with a market cap of £201.07 million, faces challenges as its net income declined to £18.1 million from the previous year's £25.71 million despite revenue growth to £4.76 billion. The company is actively seeking acquisitions while maintaining strict investment criteria and has reduced capital expenditure for the upcoming year to manage costs effectively amidst sector uncertainties. Although its short-term assets exceed liabilities, profit margins remain thin at 0.4%. Vertu's management and board are experienced with an average tenure of 6.4 years, providing stability in navigating financial volatility and strategic decisions on dividends and buybacks.

- Unlock comprehensive insights into our analysis of Vertu Motors stock in this financial health report.

- Gain insights into Vertu Motors' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Reveal the 404 hidden gems among our UK Penny Stocks screener with a single click here.

- Contemplating Other Strategies? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VTU

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives