- United Kingdom

- /

- Trade Distributors

- /

- AIM:BRCK

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has faced challenges recently, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, impacting investor sentiment. Despite these broader market pressures, investors continue to seek opportunities in various segments, including penny stocks. Though often considered a relic of past trading days, penny stocks represent a niche where smaller or newer companies can offer significant potential when supported by strong financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.658 | £55.62M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.57 | £265.48M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.295 | £228.25M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.454 | £252.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.40 | £274.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.07 | £347.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.615 | £348.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.946 | £150.87M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.644 | £2.01B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.335 | £36.25M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Brickability Group (AIM:BRCK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brickability Group Plc, with a market cap of £191.69 million, supplies, distributes, and imports building products in the United Kingdom through its subsidiaries.

Operations: The company's revenue is primarily derived from its Bricks and Building Materials segment (£380.56 million), followed by Importing (£90.55 million), Contracting (£88.22 million), and Distribution (£63.21 million).

Market Cap: £191.69M

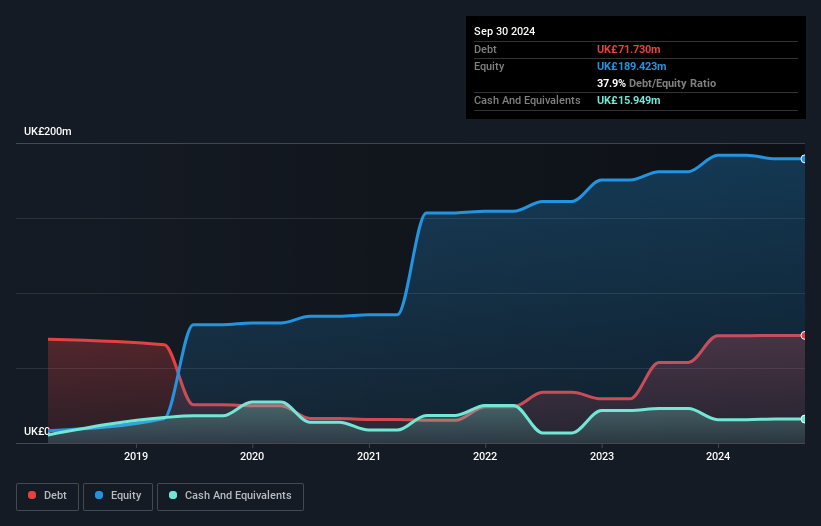

Brickability Group Plc, with a market cap of £191.69 million, has experienced fluctuating earnings growth, showing a negative trend over the past year despite a positive five-year average. Trading at 22.1% below its estimated fair value implies potential undervaluation. The company's financial health is supported by well-covered interest payments and debt levels, although profit margins have declined from 4.3% to 1.4%. Short-term assets exceed liabilities, indicating solid liquidity, but the dividend yield of 5.62% may not be sustainable given current earnings coverage challenges and low return on equity at 4.4%.

- Click here and access our complete financial health analysis report to understand the dynamics of Brickability Group.

- Gain insights into Brickability Group's future direction by reviewing our growth report.

Epwin Group (AIM:EPWN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Epwin Group Plc manufactures and sells building products in the United Kingdom, Europe, and internationally, with a market cap of £126.77 million.

Operations: Epwin Group Plc does not report specific revenue segments.

Market Cap: £126.77M

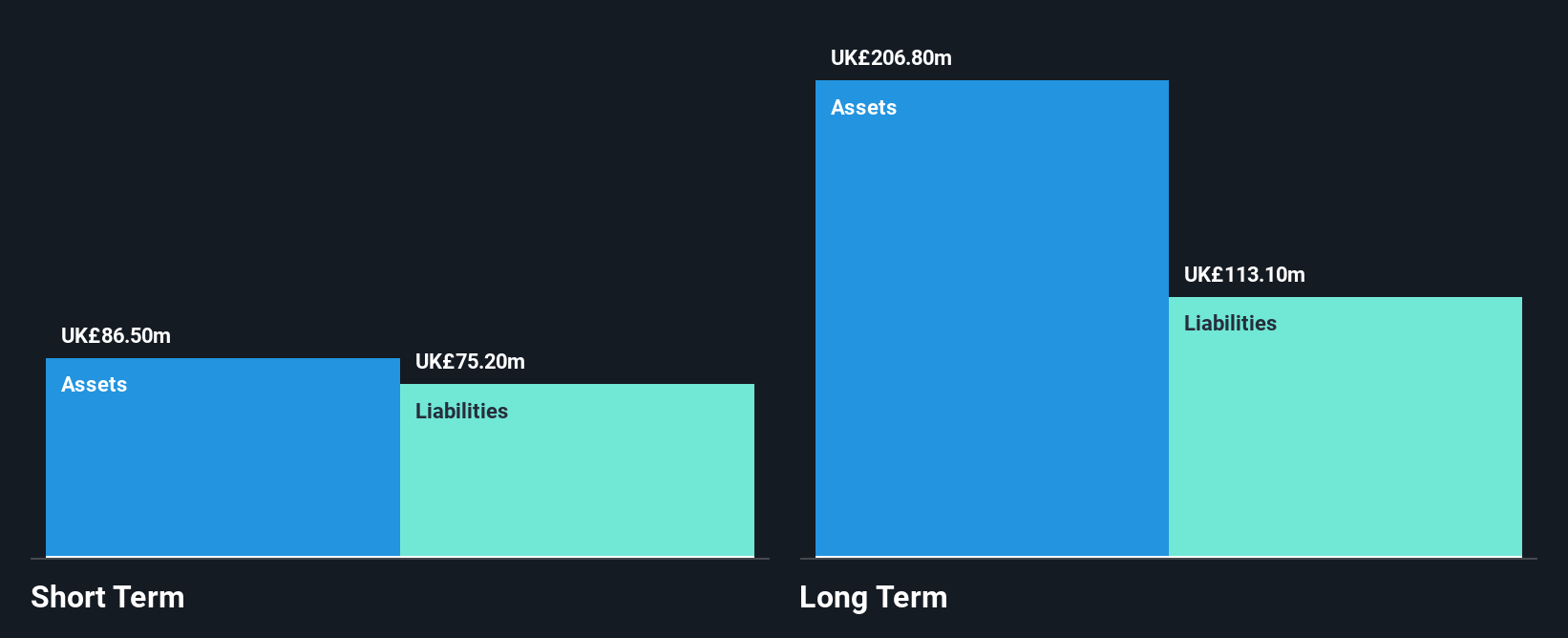

Epwin Group Plc, with a market cap of £126.77 million, shows a robust financial position despite challenges in revenue growth. The company reported sales of £324 million for 2024, down from the previous year, but net income rose significantly to £16.6 million. Earnings per share improved substantially, indicating high-quality earnings and profit margin growth from 2.7% to 5.1%. The dividend increase aligns with its policy of twice-covered payouts by adjusted profits after tax; however, the track record remains unstable. Debt levels are well-managed with satisfactory net debt to equity ratio and strong interest coverage by EBIT and operating cash flow.

- Get an in-depth perspective on Epwin Group's performance by reading our balance sheet health report here.

- Examine Epwin Group's earnings growth report to understand how analysts expect it to perform.

Kore Potash (AIM:KP2)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kore Potash plc, along with its subsidiaries, focuses on the exploration and development of potash minerals in the Republic of Congo and has a market cap of £83.18 million.

Operations: Kore Potash plc does not report any specific revenue segments.

Market Cap: £83.18M

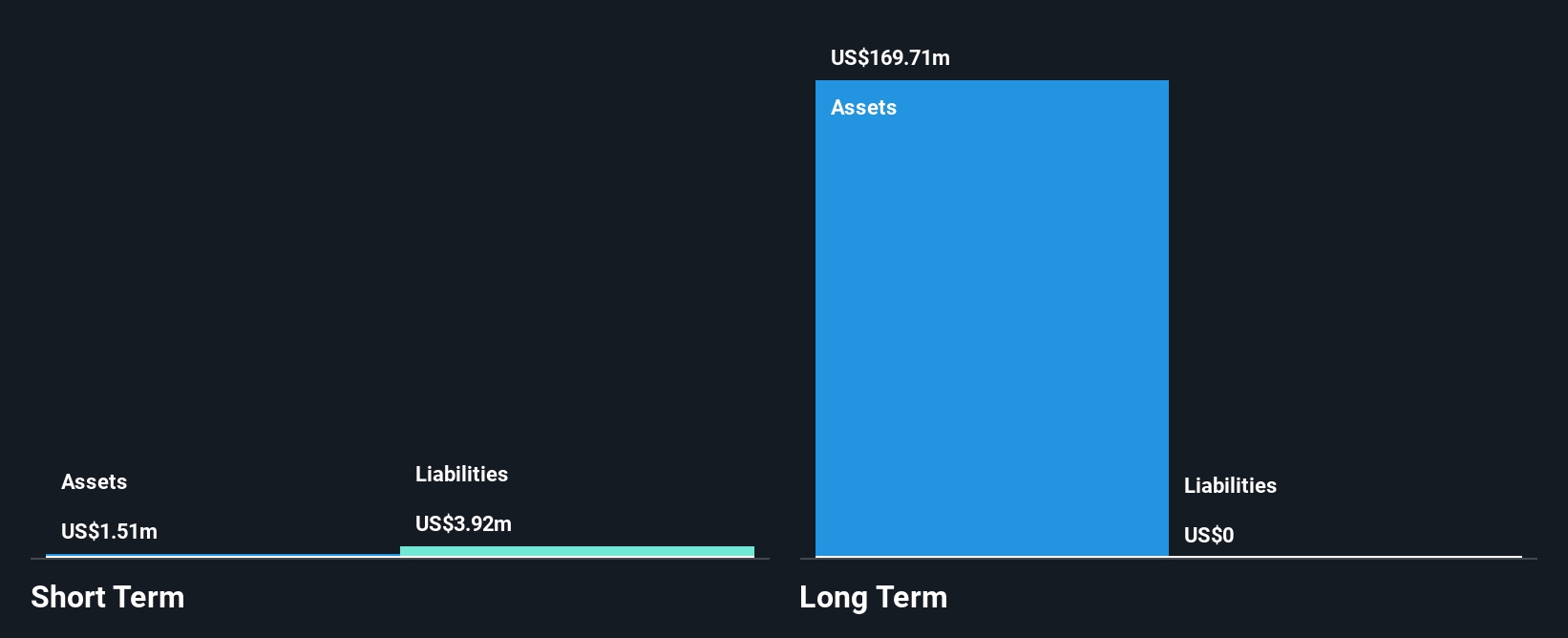

Kore Potash, with a market cap of £83.18 million, remains a speculative investment due to its pre-revenue status and recent financial challenges. The company reported a net loss of US$1.15 million for 2024, with auditors expressing doubts about its ability to continue as a going concern. Despite having no debt and reducing losses by 32.9% annually over five years, Kore Potash faces volatility in share price and insufficient short-term asset coverage for liabilities. Recent capital raising efforts aim to support the development of the Kola Project, though funding arrangements remain non-binding and uncertain at this stage.

- Navigate through the intricacies of Kore Potash with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Kore Potash's track record.

Next Steps

- Take a closer look at our UK Penny Stocks list of 391 companies by clicking here.

- Contemplating Other Strategies? We've found 22 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brickability Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BRCK

Brickability Group

Supplies, distributes, and imports building products in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives