- United Kingdom

- /

- Machinery

- /

- AIM:CPH2

Discover UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, there remains potential in identifying smaller companies that can offer unique growth opportunities. Penny stocks, though considered a niche area of investment today, can still provide value when backed by strong financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £476.63M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.18 | £840.18M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £4.20 | £193.46M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.55 | £191.24M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.334 | £208.83M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.50 | £188.48M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4975 | $284.56M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.91 | £70.81M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Clean Power Hydrogen (AIM:CPH2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Clean Power Hydrogen plc is a green hydrogen technology and manufacturing company focused on developing hydrogen and oxygen production solutions, with a market cap of £27.49 million.

Operations: No specific revenue segments have been reported for this green hydrogen technology and manufacturing company.

Market Cap: £27.49M

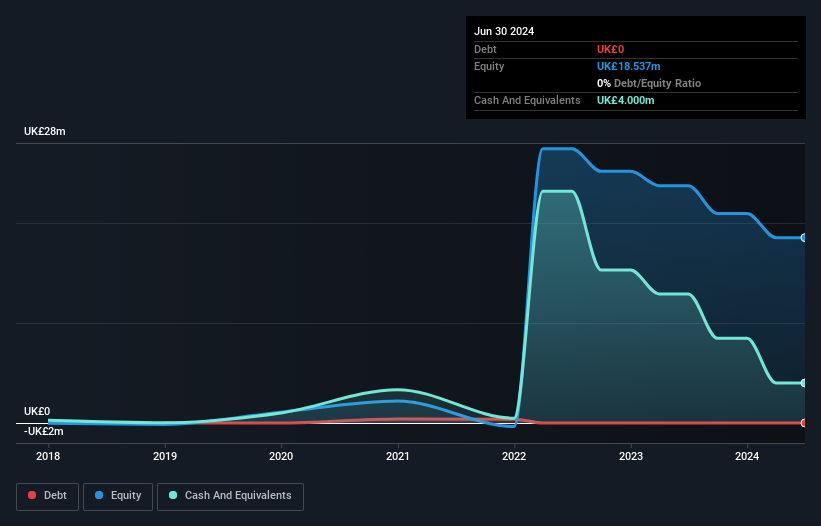

Clean Power Hydrogen plc, with a market cap of £27.49 million, is currently pre-revenue and unprofitable, focusing on transitioning to commercialisation with its MFE220 electrolyser units. Recent agreements include a significant Licence Agreement with Hidrigin for manufacturing in Ireland and sales contracts expected to generate initial revenues by 2025. Despite this progress, the company faces challenges such as less than one year of cash runway and an inexperienced board and management team. However, it remains debt-free with short-term assets exceeding liabilities, positioning it for potential growth within the green hydrogen sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Clean Power Hydrogen.

- Learn about Clean Power Hydrogen's future growth trajectory here.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eleco Plc offers software and related services across the United Kingdom, Scandinavia, Germany, other parts of Europe, the United States, and internationally with a market cap of £112.83 million.

Operations: The company's revenue segment is comprised of £30.77 million from Software.

Market Cap: £112.83M

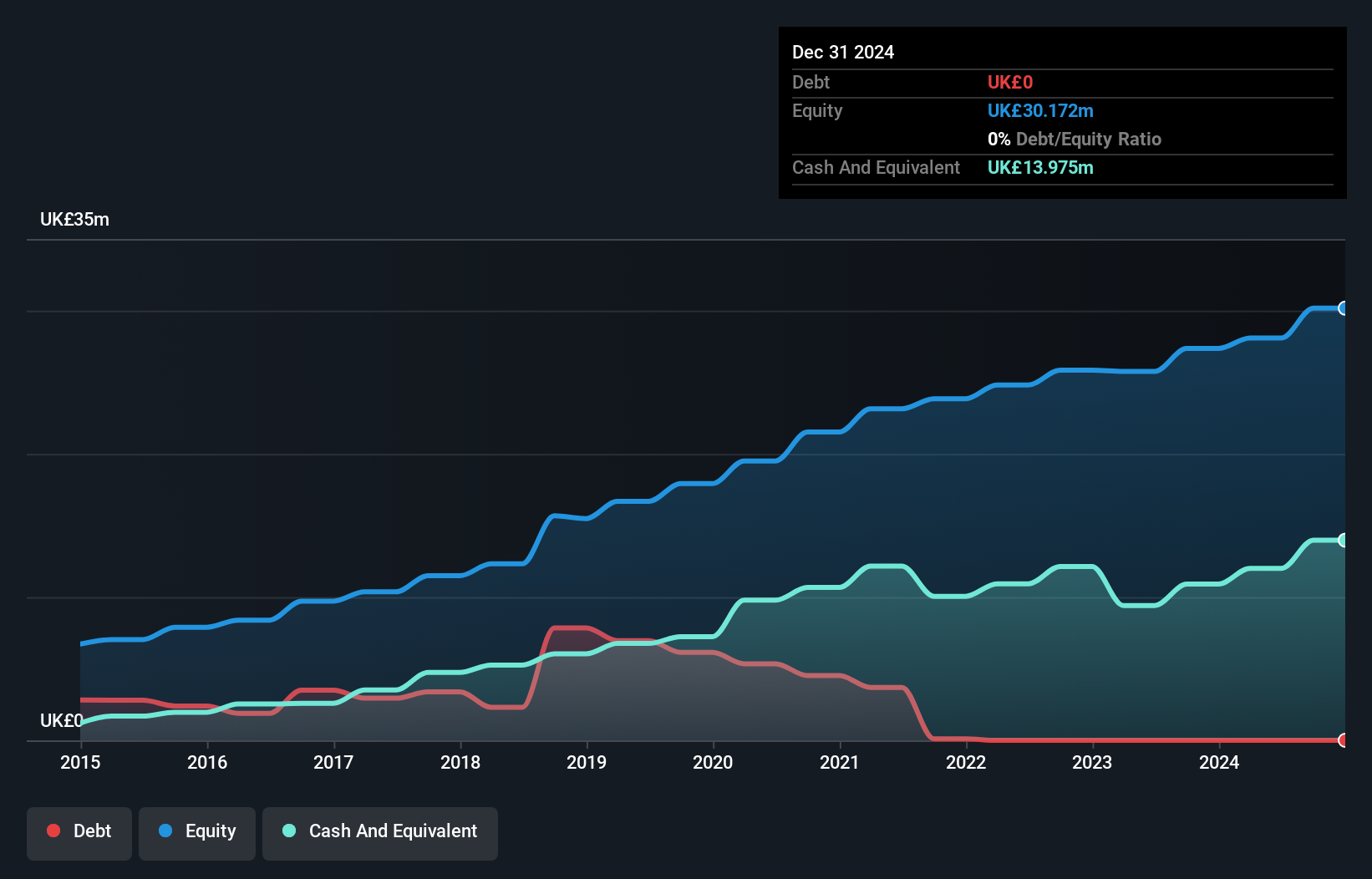

Eleco Plc, with a market cap of £112.83 million, has shown robust earnings growth of 40.3% over the past year, surpassing the software industry average. The company is debt-free and maintains strong financial health with short-term assets covering both short and long-term liabilities. Recent half-year results reported sales of £16.25 million and net income of £1.28 million, reflecting improved profit margins from 7.8% to 9.5%. Despite an inexperienced board, Eleco's management team is seasoned, contributing to high-quality earnings and consistent dividend increases, including a recent interim dividend boost to 0.30 pence per share.

- Click here to discover the nuances of Eleco with our detailed analytical financial health report.

- Gain insights into Eleco's future direction by reviewing our growth report.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Polar Capital Holdings plc is a publicly owned investment manager with a market cap of £476.63 million.

Operations: The company generates revenue primarily from its Investment Management Business, which amounted to £197.25 million.

Market Cap: £476.63M

Polar Capital Holdings, with a market cap of £476.63 million, demonstrates strong financial stability as it operates debt-free and maintains high-quality earnings. The company's earnings grew by 14.5% over the past year, outpacing its five-year average decline of 6.1%, reflecting improved profit margins from 18.9% to 20.7%. Despite a dividend yield of 9.3% that isn't well covered by earnings or cash flows, Polar Capital is trading at good value compared to peers and industry standards, with analysts predicting a potential stock price increase of 23.5%. Its seasoned management team further strengthens its investment appeal.

- Unlock comprehensive insights into our analysis of Polar Capital Holdings stock in this financial health report.

- Understand Polar Capital Holdings' earnings outlook by examining our growth report.

Summing It All Up

- Unlock more gems! Our UK Penny Stocks screener has unearthed 469 more companies for you to explore.Click here to unveil our expertly curated list of 472 UK Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CPH2

Clean Power Hydrogen

Clean Power Hydrogen plc, a green hydrogen technology and manufacturing company, engages in the development of hydrogen and oxygen production solutions.

Flawless balance sheet moderate.