- United Kingdom

- /

- Medical Equipment

- /

- AIM:EMVC

3 UK Penny Stocks With Market Caps Under £20M To Consider

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges. Despite these broader market concerns, investors often turn their attention to penny stocks for potential opportunities that might not be as affected by international headwinds. While the term 'penny stocks' may seem outdated, these smaller or newer companies can offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

EMV Capital (AIM:EMVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMV Capital plc is a venture capital firm focusing on seed, growth capital, and early to mid-stage investments, with a market cap of £11.84 million.

Operations: The company's revenue is generated from the development of intellectual property, amounting to £1.81 million.

Market Cap: £11.84M

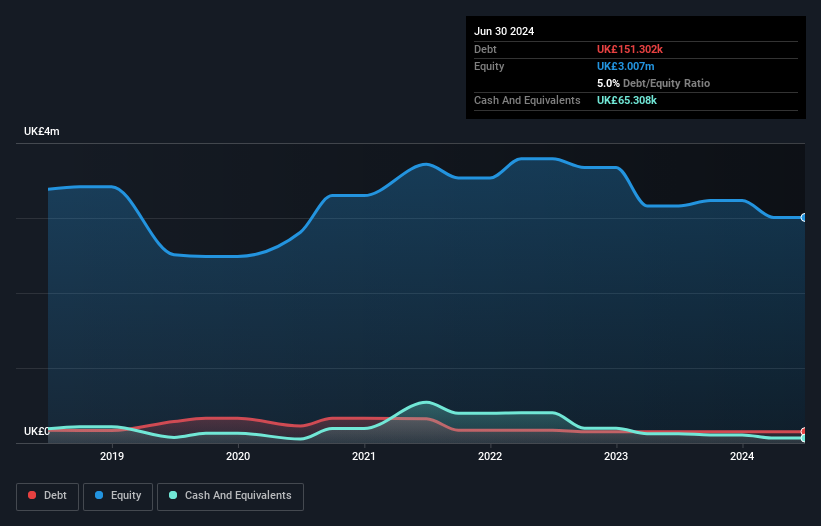

EMV Capital plc, with a market cap of £11.84 million, is currently unprofitable and lacks meaningful revenue (£2 million). Its earnings have declined by 4.5% annually over the past five years, and it faces challenges in covering short-term liabilities (£3.6M) with its assets (£1.3M). The company has experienced shareholder dilution recently and has increased its debt to equity ratio from 3.6% to 6.1%. Despite these issues, EMV Capital forecasts a significant revenue growth of over 50% per year and has raised additional capital through recent equity offerings totaling £3 million in December 2024.

- Jump into the full analysis health report here for a deeper understanding of EMV Capital.

- Examine EMV Capital's earnings growth report to understand how analysts expect it to perform.

Seascape Energy Asia (AIM:SEA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seascape Energy Asia plc is a full-cycle exploration and production company that acquires oil and gas assets in Norway, Malaysia, South-East Asia, and the United Kingdom with a market cap of £17.85 million.

Operations: No revenue segments have been reported for the company.

Market Cap: £17.85M

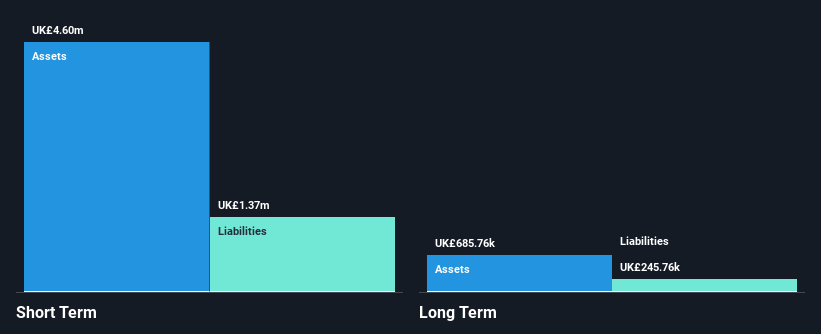

Seascape Energy Asia plc, with a market cap of £17.85 million, is pre-revenue and debt-free. Despite having short-term assets (£4.6M) that exceed both its long-term (£245.8K) and short-term liabilities (£1.4M), the company faces challenges due to its unprofitability and inexperienced management team (0.7 years average tenure). The share price has been highly volatile recently, although it remains stable compared to UK stocks overall volatility levels. Seascape completed a successful Block 2A farm-out and raised £1.998784 million through a follow-on equity offering in December 2024, extending its cash runway beyond three months.

- Navigate through the intricacies of Seascape Energy Asia with our comprehensive balance sheet health report here.

- Evaluate Seascape Energy Asia's historical performance by accessing our past performance report.

Tectonic Gold (OFEX:TTAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tectonic Gold Plc focuses on the exploration, research, and development of mineral assets in Australia and has a market cap of £1.44 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £1.44M

Tectonic Gold Plc, with a market cap of £1.44 million, is pre-revenue and has reduced its net loss significantly from £0.524 million to £0.152 million over the past year. The company maintains a satisfactory net debt to equity ratio of 2.9% and has not meaningfully diluted shareholders recently. Despite high share price volatility, Tectonic's experienced management team (6.2 years average tenure) and board (8.8 years average tenure) are notable strengths. However, short-term assets (£401.9K) fall short of covering short-term liabilities (£445K), though they do exceed long-term liabilities (£166.4K).

- Click here and access our complete financial health analysis report to understand the dynamics of Tectonic Gold.

- Understand Tectonic Gold's track record by examining our performance history report.

Turning Ideas Into Actions

- Explore the 469 names from our UK Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMV Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EMVC

EMV Capital

A venture capital firm specializing in seed, growth capital, early and mid stage investments.

Moderate with adequate balance sheet.