- United Kingdom

- /

- Commercial Services

- /

- LSE:MER

Discover January 2025's Top Undervalued Small Caps With Insider Action In UK

Reviewed by Simply Wall St

The United Kingdom's market landscape has been impacted by weak trade data from China, leading to declines in the FTSE 100 and FTSE 250 indices as global economic concerns weigh heavily on investor sentiment. Despite these challenges, small-cap stocks can present unique opportunities for investors seeking potential growth, particularly when there is notable insider action indicating confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.4x | 1.3x | 41.21% | ★★★★★☆ |

| Tracsis | 311.0x | 1.9x | 48.97% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.12% | ★★★★★☆ |

| Sabre Insurance Group | 11.7x | 1.5x | 10.28% | ★★★★☆☆ |

| iomart Group | 24.8x | 0.7x | 32.09% | ★★★★☆☆ |

| NCC Group | NA | 1.4x | 20.70% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 49.73% | ★★★★☆☆ |

| Telecom Plus | 18.1x | 0.7x | 30.13% | ★★★☆☆☆ |

| Alpha Group International | 10.5x | 4.9x | -35.83% | ★★★☆☆☆ |

| THG | NA | 0.3x | -604.88% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Restore (AIM:RST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Restore is a company that provides secure lifecycle services and digital & information management solutions, with a market capitalization of £0.52 billion.

Operations: Secure Lifecycle Services and Digital & Information Management are the primary revenue streams, contributing £104.4 million and £172.5 million, respectively. The gross profit margin has shown fluctuations, reaching 42.90% in June 2024 after peaking at 45.75% in December 2021. Operating expenses have been a significant cost factor, consistently exceeding £88 million in recent periods.

PE: 86.8x

Restore, a company in the UK market, has shown insider confidence with Charles Skinner purchasing 100,000 shares for £280K. Despite flat revenue expectations for FY24 due to market uncertainty before the Autumn Budget, earnings are forecasted to grow by 48% annually. The company's financial position is stable but relies on external borrowing. Recent board changes include appointing Patrick Butcher as a non-executive director, potentially strengthening governance with his extensive CFO experience.

- Click here to discover the nuances of Restore with our detailed analytical valuation report.

Understand Restore's track record by examining our Past report.

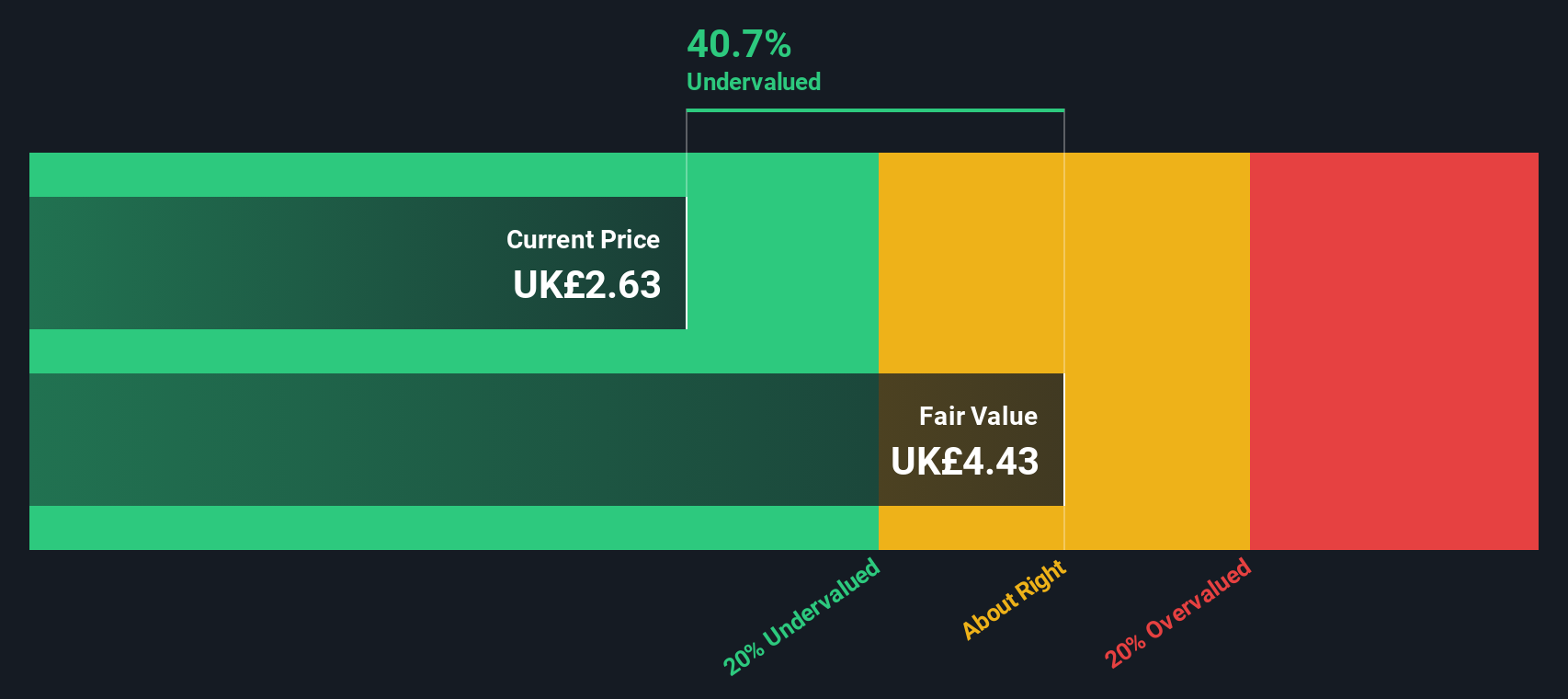

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mears Group is a UK-based company specializing in providing management and maintenance services, with a market cap of approximately £0.36 billion.

Operations: The company generates revenue primarily from management (£591.63 million) and maintenance (£551.73 million) services. Over recent periods, the gross profit margin has shown an upward trend, reaching 21.68% as of June 2024, indicating improved efficiency in managing costs relative to revenue growth. Operating expenses are a significant component of the cost structure, with general and administrative expenses consistently forming a large portion of these costs.

PE: 7.9x

Mears Group, a notable player in the UK market, has recently seen insider confidence with Andrew C. Smith purchasing 25,000 shares for £91,100. This move reflects a 6% increase in their holdings and suggests optimism about the company's prospects despite earnings forecasts predicting a decline of 15.6% annually over the next three years. The company relies entirely on external borrowing for funding, which carries higher risk compared to customer deposits. Recent developments include Angela Lockwood's appointment as Senior Independent Director following Dame Julia Unwin's retirement and an upward revision of revenue guidance to £1.1 billion for 2024, indicating potential growth opportunities amidst financial challenges.

- Navigate through the intricacies of Mears Group with our comprehensive valuation report here.

Assess Mears Group's past performance with our detailed historical performance reports.

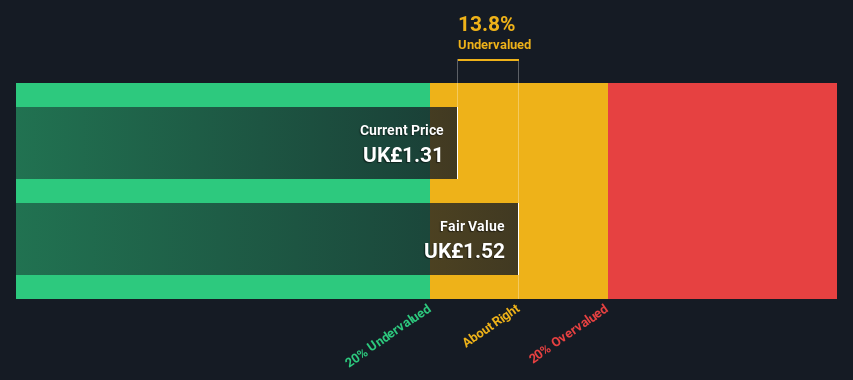

Sabre Insurance Group (LSE:SBRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sabre Insurance Group is a UK-based insurance company specializing in underwriting motor vehicle, taxi, and motorcycle insurance with a market capitalization of £0.21 billion.

Operations: The company generates revenue primarily from motor vehicle insurance, excluding taxis, with significant contributions from taxi and motorcycle segments. Over recent periods, the gross profit margin has shown variability, reaching 37.30% by mid-2024. Operating expenses have been a notable component of the cost structure, impacting net income margins.

PE: 11.7x

Sabre Insurance Group, a UK-based company, recently reported a rise in gross written premiums to £186.5 million for the nine months ending September 2024, up from £162.2 million the previous year. Their 'Ambition 2030' strategy aims for at least £80 million in profit before tax by 2030, targeting around 10% annual growth. Despite relying solely on external borrowing, insider confidence is evident with share purchases over the past year, suggesting potential value recognition within this smaller company segment.

Turning Ideas Into Actions

- Reveal the 34 hidden gems among our Undervalued UK Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MER

Mears Group

Provides various outsourced services to the public and private sectors in the United Kingdom.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives