- United Kingdom

- /

- Metals and Mining

- /

- OFEX:ORM

3 Promising Penny Stocks On UK Exchange With Over £0 Market Cap

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, impacting companies with significant ties to the Chinese economy. Amid these broader market fluctuations, investors often turn their attention to penny stocks—an investment category that offers potential growth opportunities at lower price points. Although the term "penny stocks" might seem outdated, it still refers to smaller or newer companies that can provide value when backed by strong financials and a clear growth trajectory.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.355 | £172.56M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.935 | £391.36M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.437 | $254.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.11 | £470.86M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.47 | £315.6M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.38M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ADVFN (AIM:AFN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ADVFN Plc, along with its subsidiaries, develops and offers financial information and research services online both in the United Kingdom and internationally, with a market cap of £5.79 million.

Operations: The company generates revenue of £4.44 million from its financial information services.

Market Cap: £5.79M

ADVFN Plc, with a market cap of £5.79 million, reported revenues of £4.44 million for the year ending June 2024, down from the previous year. Despite its unprofitability and negative return on equity (-23.1%), ADVFN maintains more cash than debt and has sufficient short-term assets to cover liabilities. The company is enhancing its investor platform with new mobile apps and a Live Chat feature, currently in phased rollout to refine user experience based on feedback. While earnings have declined significantly over five years, no shareholder dilution occurred recently, offering some stability amidst high share price volatility.

- Unlock comprehensive insights into our analysis of ADVFN stock in this financial health report.

- Assess ADVFN's previous results with our detailed historical performance reports.

K3 Business Technology Group (AIM:KBT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: K3 Business Technology Group plc, with a market cap of £35.32 million, offers computer software and consultancy services across the United Kingdom, the Netherlands, Ireland, Europe, the Middle East, Asia, and the United States.

Operations: The company's revenue is derived from two main segments: K3 Products, generating £13.10 million, and Third Party Solutions, contributing £25.88 million.

Market Cap: £35.32M

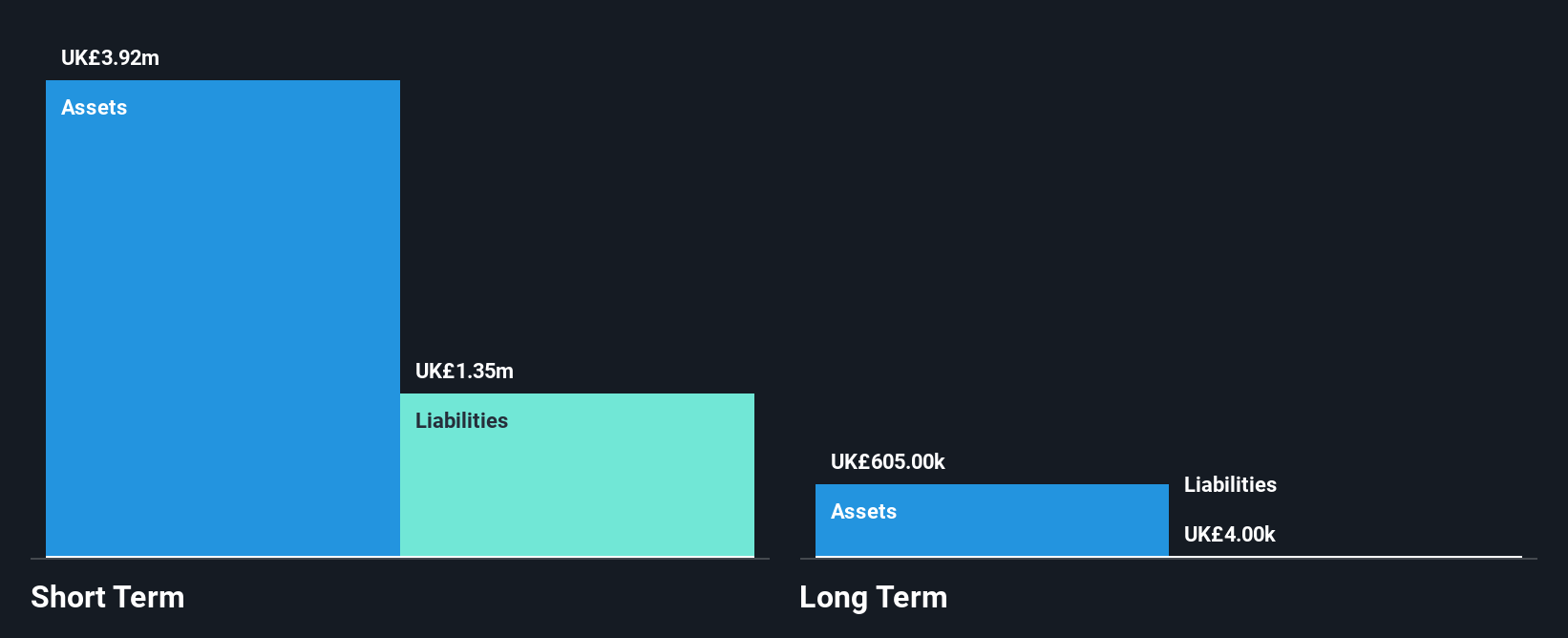

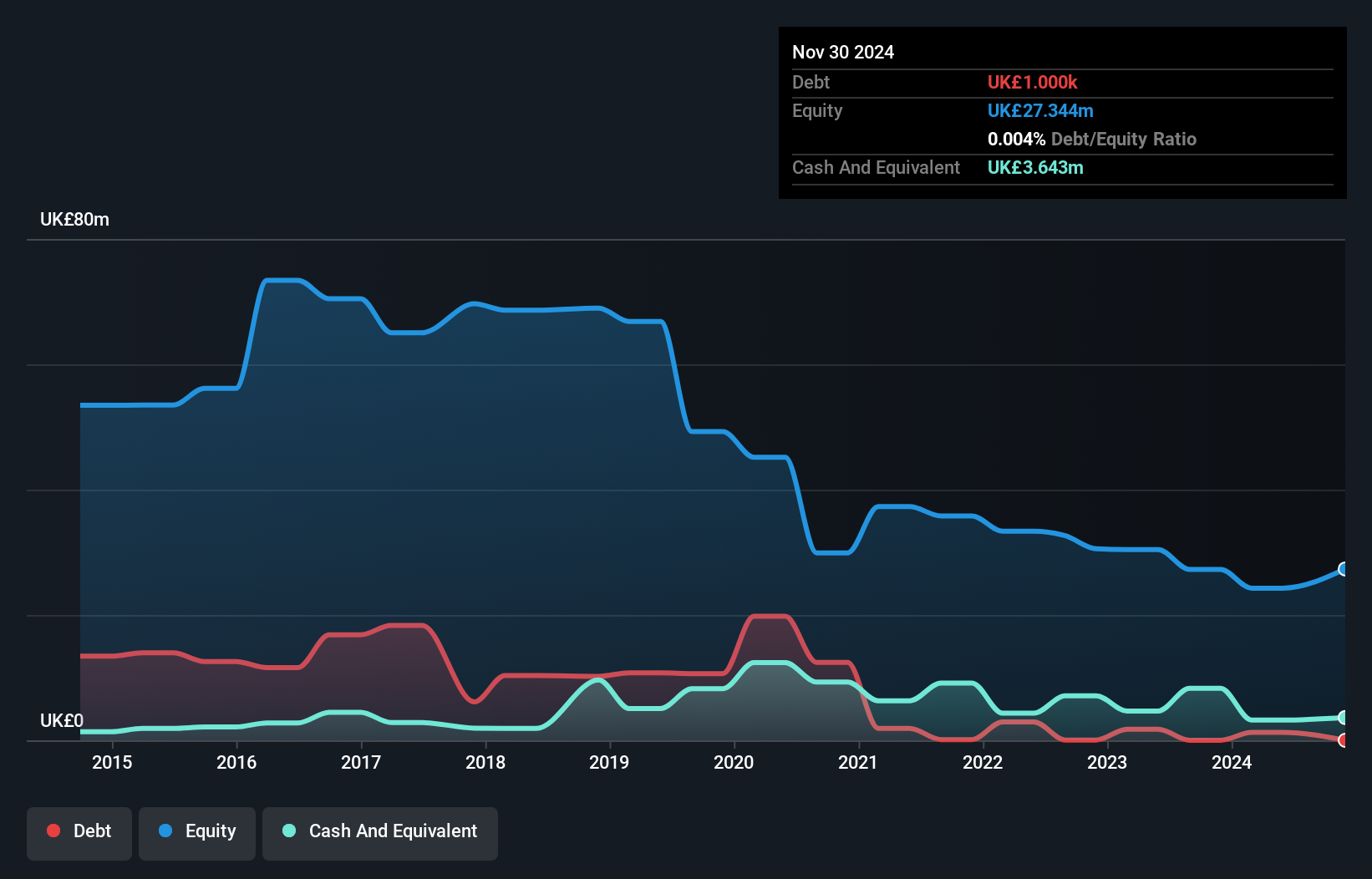

K3 Business Technology Group, with a market cap of £35.32 million, operates across multiple regions and derives revenue from K3 Products (£13.10 million) and Third Party Solutions (£25.88 million). Despite being unprofitable, the company has reduced losses by 8.8% annually over five years and maintains more cash than debt, with a sufficient cash runway for over three years at current free cash flow levels. Its short-term assets do not cover short-term liabilities but exceed long-term liabilities. The board is experienced; however, the management team is relatively new, potentially impacting strategic continuity amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of K3 Business Technology Group.

- Understand K3 Business Technology Group's track record by examining our performance history report.

Ormonde Mining (OFEX:ORM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ormonde Mining plc is a natural resource company focused on the exploration and development of mineral resource projects in Ireland, Canada, Spain, and the United Kingdom, with a market cap of £756,011.

Operations: Currently, there are no reported revenue segments for Ormonde Mining plc.

Market Cap: £756.01k

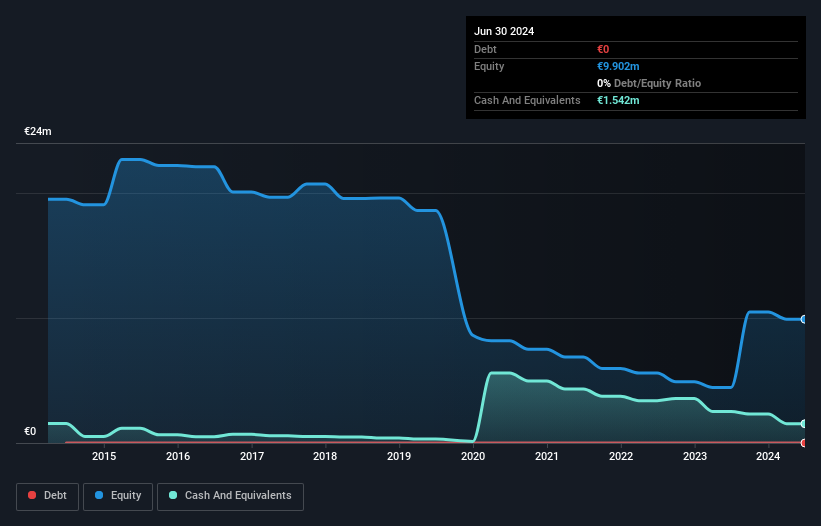

Ormonde Mining plc, with a market cap of £756,011, is pre-revenue and has recently turned profitable after years of development. The company maintains a debt-free balance sheet and its short-term assets (€2.1M) comfortably exceed short-term liabilities (€203K), indicating strong financial stability despite high share price volatility over the past three months. Its board is experienced with an average tenure of 3.3 years, although management experience remains unclear due to insufficient data. Ormonde's Price-to-Earnings ratio (4x) suggests it may be undervalued compared to the broader UK market average of 15.9x.

- Take a closer look at Ormonde Mining's potential here in our financial health report.

- Explore historical data to track Ormonde Mining's performance over time in our past results report.

Where To Now?

- Reveal the 469 hidden gems among our UK Penny Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:ORM

Ormonde Mining

A natural resource company, engages in the exploration and development of mineral resource projects in Ireland, Canada, Spain, and the United Kingdom.

Flawless balance sheet slight.

Market Insights

Community Narratives