- United Kingdom

- /

- Capital Markets

- /

- LSE:PLUS

Top 3 UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom market has remained flat over the past week but has seen a 6.1% increase over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this environment, selecting dividend stocks that offer reliable income and potential for growth can be a strategic approach for investors looking to balance stability with future earnings potential.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.21% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.14% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.55% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.11% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.23% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.26% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.92% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.04% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.57% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc is a global provider of banking and financial services, with a market cap of approximately £129.48 billion.

Operations: HSBC Holdings plc generates its revenue from several key segments, including Commercial Banking ($19.78 billion), Global Banking and Markets ($16.80 billion), Wealth and Personal Banking ($24.83 billion), and Corporate Centre ($2.82 billion).

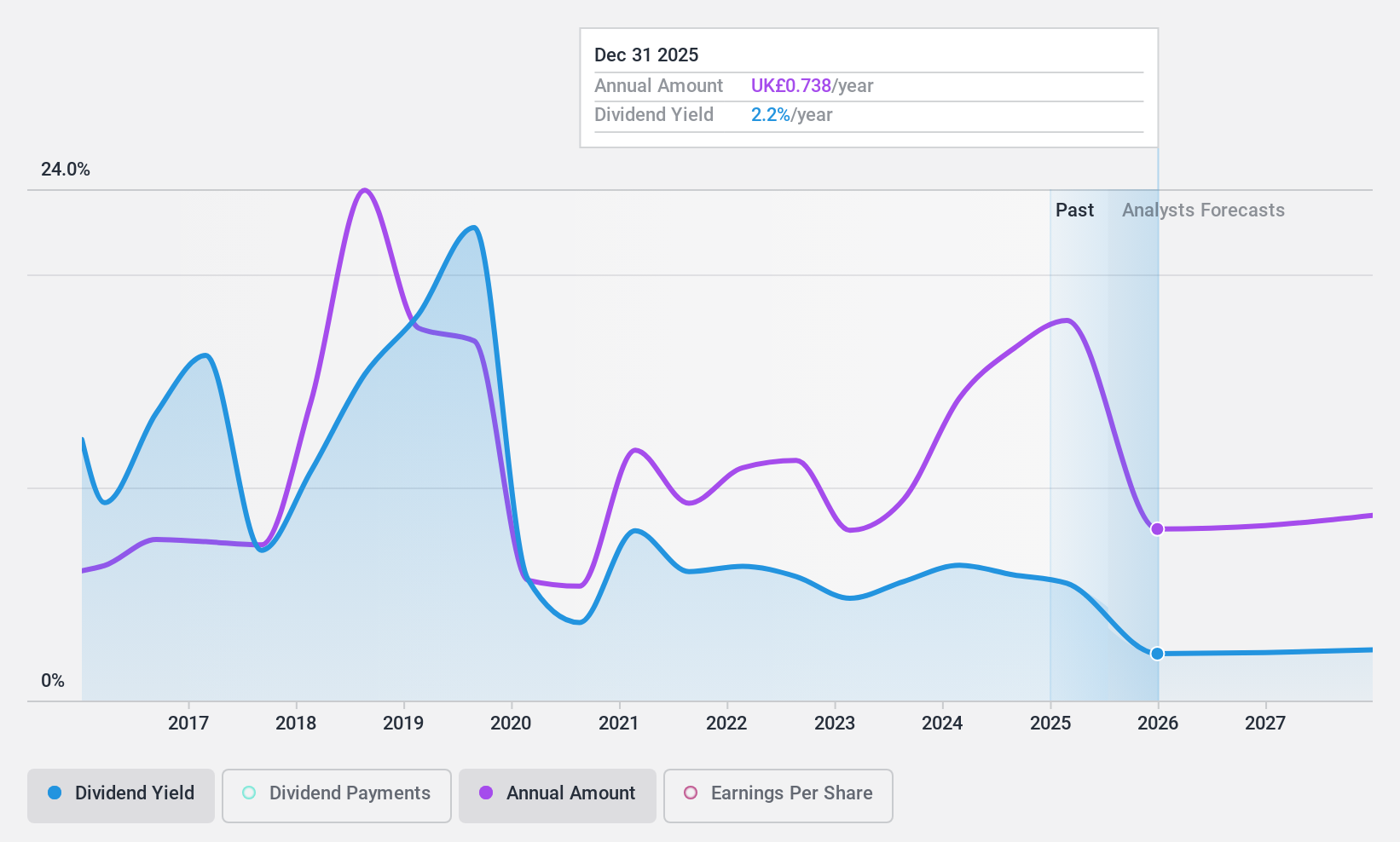

Dividend Yield: 6.6%

HSBC Holdings' dividend history shows volatility over the past nine years, with dividends being covered by earnings at a 50.4% payout ratio. The bank's high level of bad loans (2.2%) and unreliable dividend track record present concerns for stability. Despite this, its current yield is among the top 25% in the UK market. Recent fixed-income offerings and debt purchases indicate active financial management, which might support future dividend sustainability amidst forecasted earnings decline.

- Click here to discover the nuances of HSBC Holdings with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that HSBC Holdings is priced lower than what may be justified by its financials.

Plus500 (LSE:PLUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Plus500 Ltd. is a fintech company that operates technology-based trading platforms across Europe, the United Kingdom, Australia, and internationally, with a market cap of approximately £1.82 billion.

Operations: Plus500 Ltd. generates its revenue primarily from CFD Trading, amounting to $750.80 million.

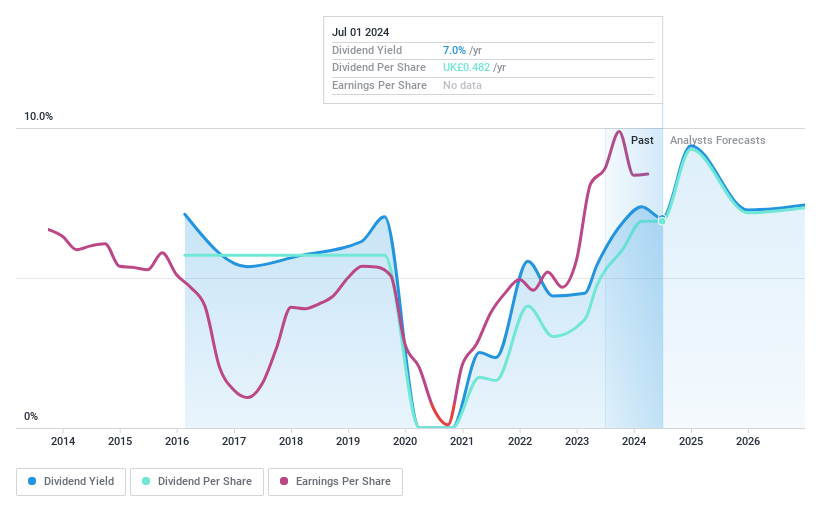

Dividend Yield: 6.3%

Plus500's dividends are well-covered by earnings and cash flows, with payout ratios of 24.9% and 36.6%, respectively, placing its yield in the top 25% in the UK market. However, its dividend history has been volatile over the past decade despite recent growth. The company’s robust financial position is underscored by a significant share buyback program totaling $100 million, reflecting confidence in future prospects despite anticipated earnings decline over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Plus500.

- In light of our recent valuation report, it seems possible that Plus500 is trading behind its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to both corporate and individual clients in Georgia, Azerbaijan, and Uzbekistan with a market capitalization of £1.79 billion.

Operations: TBC Bank Group PLC generates revenue through its diverse services, including banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

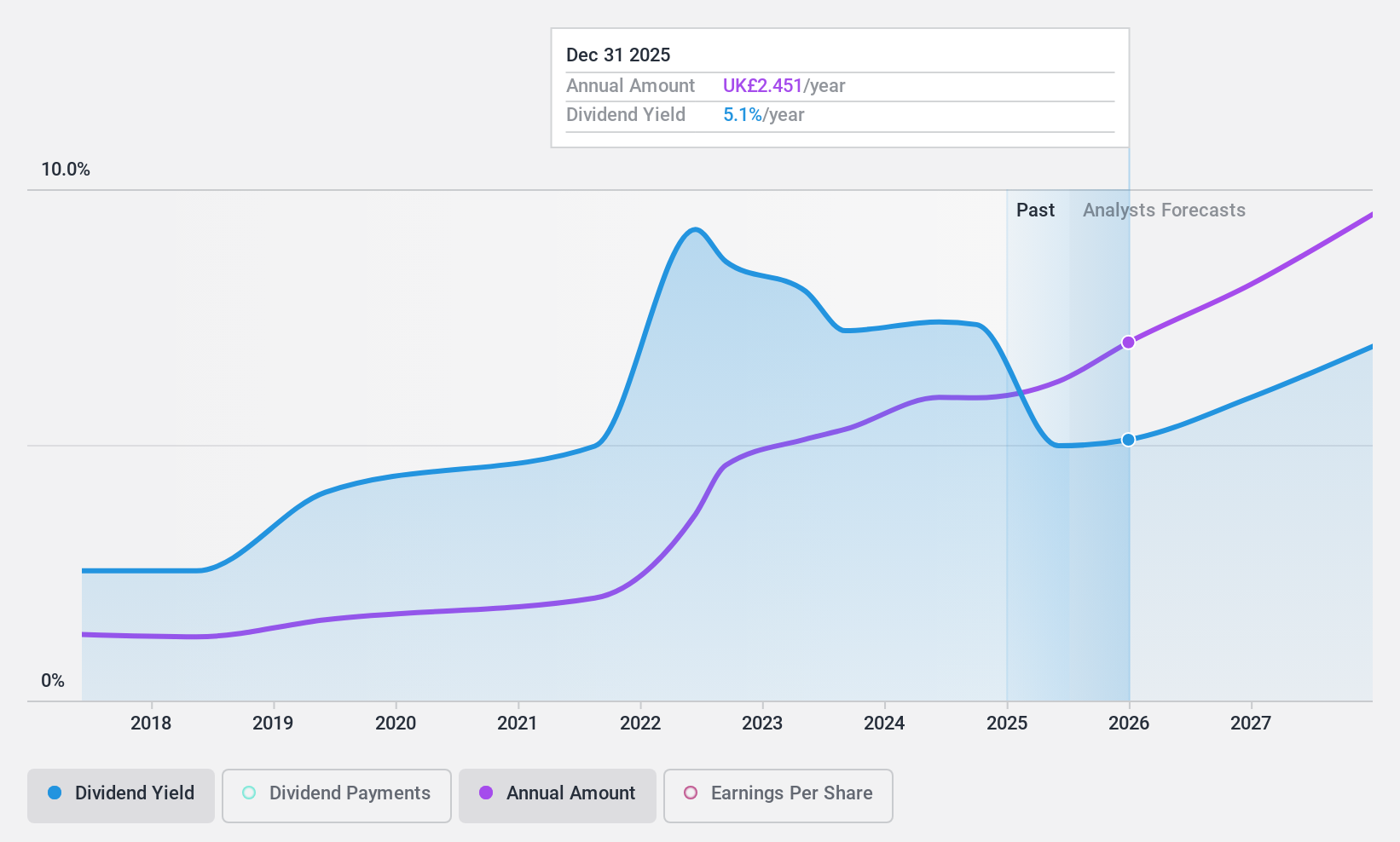

Dividend Yield: 6.2%

TBC Bank Group's dividends are well-supported by a low payout ratio of 31.6%, with coverage expected to remain strong at 32.5% in three years, suggesting sustainability. Despite only seven years of dividend history, payments have been stable and rank in the top 25% for yield in the UK market. Recent earnings growth of GEL 339.89 million indicates robust financial health, though a high bad loan ratio of 2.1% warrants attention for potential risks.

- Dive into the specifics of TBC Bank Group here with our thorough dividend report.

- The analysis detailed in our TBC Bank Group valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Dive into all 64 of the Top UK Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PLUS

Plus500

A fintech company, operates technology-based trading platforms in Europe, the United Kingdom, Australia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives