- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Top 3 UK Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors in the UK are closely monitoring market conditions that impact companies with significant exposure to global economic shifts. In such a volatile environment, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to navigate uncertain markets while potentially benefiting from regular payouts.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.01% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.28% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.75% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.39% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.12% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.93% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.68% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.35% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.86% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.58% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc is a global provider of banking and financial services, with a market cap of approximately £133.65 billion.

Operations: HSBC Holdings plc generates revenue from several key segments, including Commercial Banking ($19.78 billion), Global Banking and Markets ($16.80 billion), Wealth and Personal Banking ($24.83 billion), and the Corporate Centre ($2.82 billion).

Dividend Yield: 6.3%

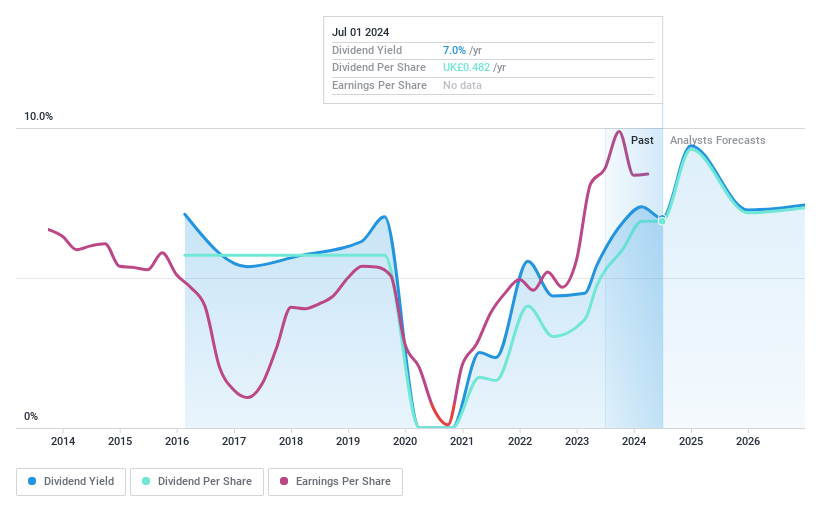

HSBC Holdings offers a dividend yield in the top 25% of UK payers, but its dividend history is less stable with volatility over the past nine years. The payout ratio of 50.4% indicates dividends are currently covered by earnings and are forecast to remain so. However, the bank faces challenges with a high level of bad loans at 2.2%. Recent executive changes aim to streamline operations and enhance decision-making efficiency amidst ongoing strategic shifts.

- Unlock comprehensive insights into our analysis of HSBC Holdings stock in this dividend report.

- Our valuation report here indicates HSBC Holdings may be undervalued.

Plus500 (LSE:PLUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Plus500 Ltd. is a fintech company that provides technology-based trading platforms across Europe, the United Kingdom, Australia, and internationally, with a market cap of approximately £1.90 billion.

Operations: Plus500 Ltd. generates revenue primarily from its CFD Trading segment, which amounts to $750.80 million.

Dividend Yield: 5.9%

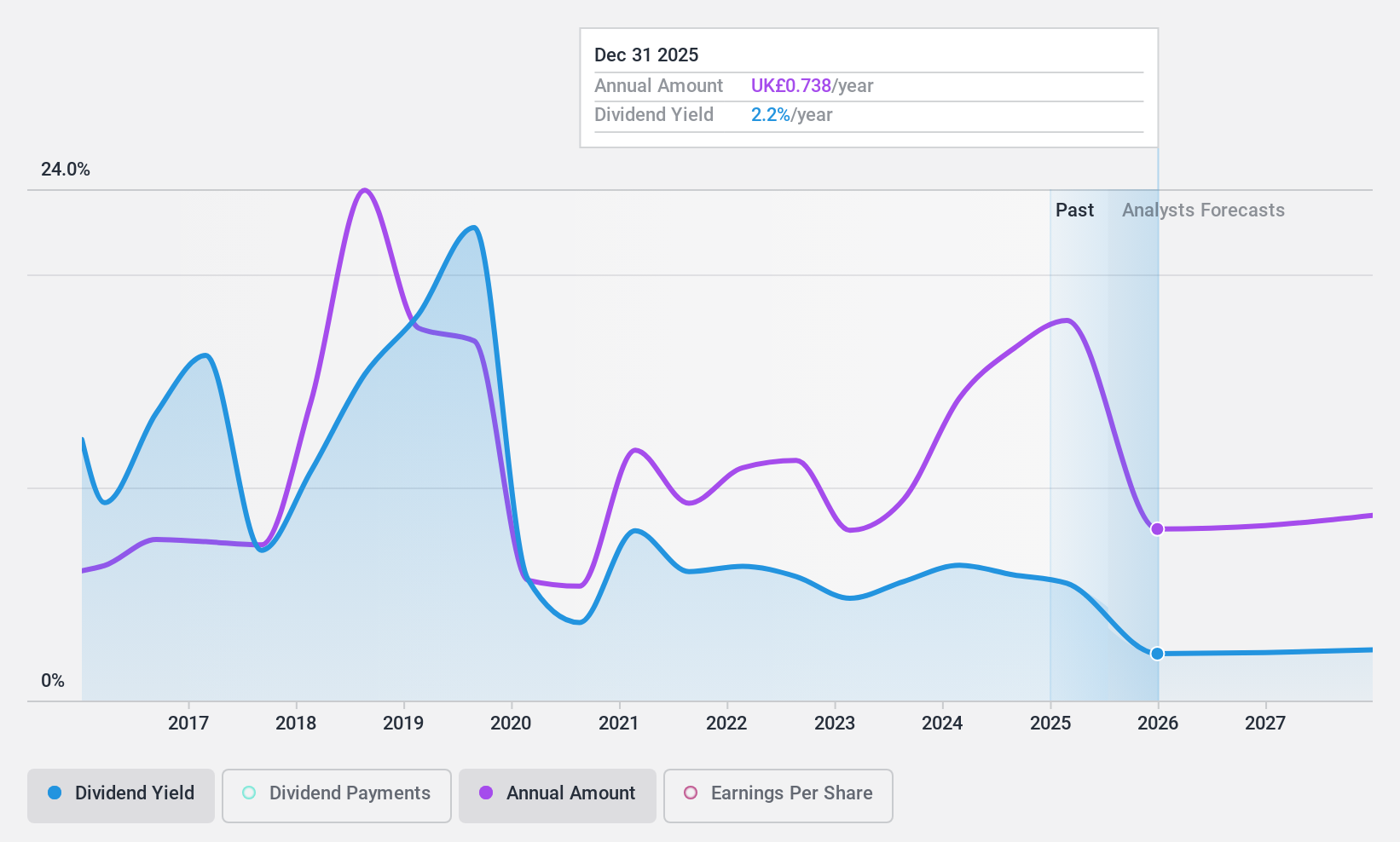

Plus500's dividend yield ranks in the top 25% of UK payers, supported by a low payout ratio of 24.9%, indicating strong coverage by earnings. The cash payout ratio of 36.4% further underscores sustainability from cash flows. Despite past volatility and an unstable track record, dividends have grown over the last decade. Currently trading at significant value below fair estimates, Plus500 presents a compelling option for investors seeking high yields amidst market uncertainties.

- Navigate through the intricacies of Plus500 with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Plus500 shares in the market.

TBC Bank Group (LSE:TBCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.71 billion, operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Operations: TBC Bank Group PLC's revenue segments include banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Dividend Yield: 6.3%

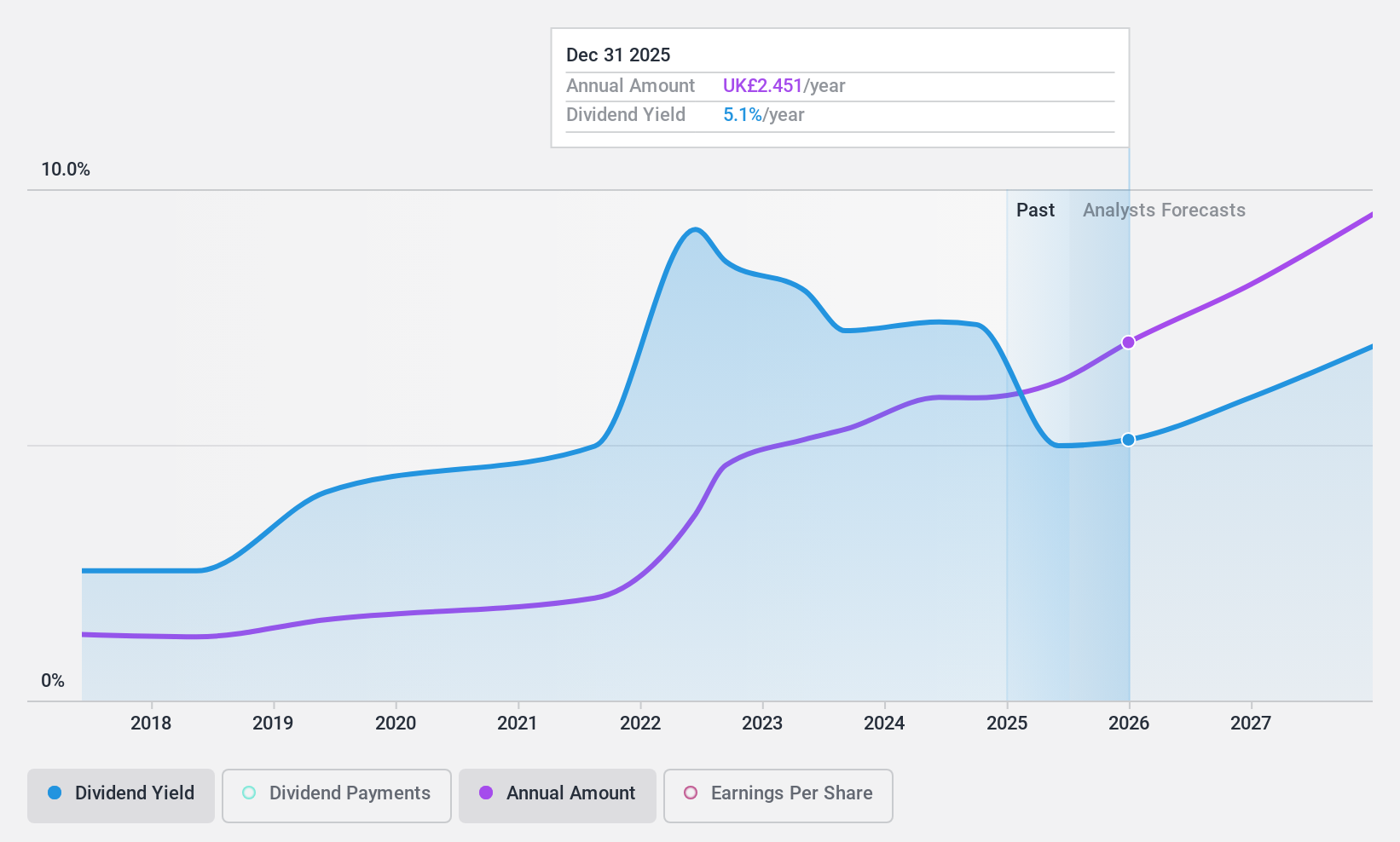

TBC Bank Group's dividend yield is among the top 25% in the UK, with a sustainable payout ratio of 31.6%, ensuring coverage by earnings. The company has maintained stable dividends for less than ten years, showing growth despite limited history. Recent earnings showed significant improvement, with net income rising to GEL 339.89 million in Q3 2024 from GEL 299.02 million a year prior. However, high bad loans (2.1%) and low allowance (76%) may pose risks to future stability.

- Click to explore a detailed breakdown of our findings in TBC Bank Group's dividend report.

- Our expertly prepared valuation report TBC Bank Group implies its share price may be lower than expected.

Taking Advantage

- Click through to start exploring the rest of the 59 Top UK Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives