- United Kingdom

- /

- Banks

- /

- LSE:MTRO

Pulling back 9.8% this week, Metro Bank Holdings' LON:MTRO) one-year decline in earnings may be coming into investors focus

It hasn't been the best quarter for Metro Bank Holdings PLC (LON:MTRO) shareholders, since the share price has fallen 14% in that time. But that doesn't change the fact that the returns over the last year have been very strong. During that period, the share price soared a full 157%. So we think most shareholders won't be too upset about the recent fall. Only time will tell if there is still too much optimism currently reflected in the share price.

Although Metro Bank Holdings has shed UK£66m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Metro Bank Holdings

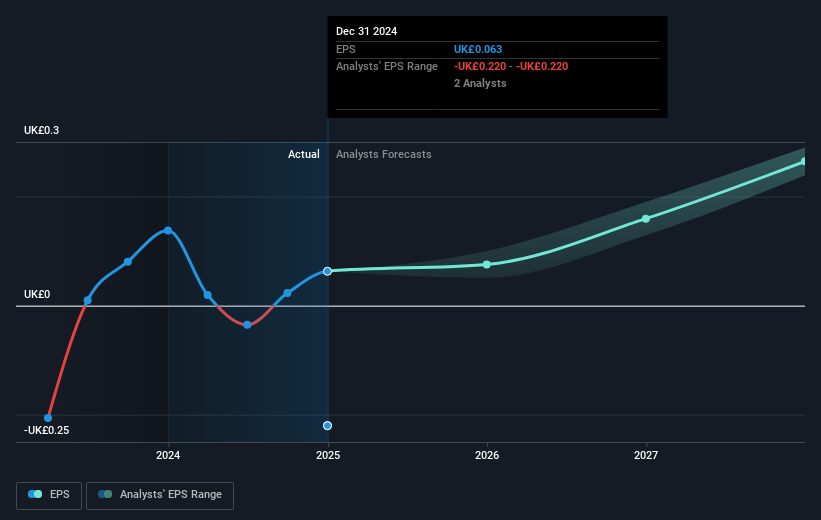

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Metro Bank Holdings went from making a loss to reporting a profit, in the last year.

We think the growth looks very prospective, so we're not surprised the market liked it too. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Metro Bank Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Metro Bank Holdings shareholders have received a total shareholder return of 157% over the last year. That certainly beats the loss of about 6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Metro Bank Holdings better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Metro Bank Holdings you should be aware of.

Metro Bank Holdings is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MTRO

Metro Bank Holdings

Operates as the bank holding company for Metro Bank PLC that provides various banking products and services in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives