- United Kingdom

- /

- Banks

- /

- LSE:HSBK

3 UK Dividend Stocks Yielding Up To 5.9%

Reviewed by Simply Wall St

As the FTSE 100 index experiences fluctuations due to weak trade data from China and a challenging global economic environment, investors are keenly observing how these conditions impact the broader UK market. In such uncertain times, dividend stocks can offer a measure of stability and income, making them an appealing choice for those seeking consistent returns amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.57% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.74% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.01% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.81% | ★★★★★☆ |

| Epwin Group (AIM:EPWN) | 5.80% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.72% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.84% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.62% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.21% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.21% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

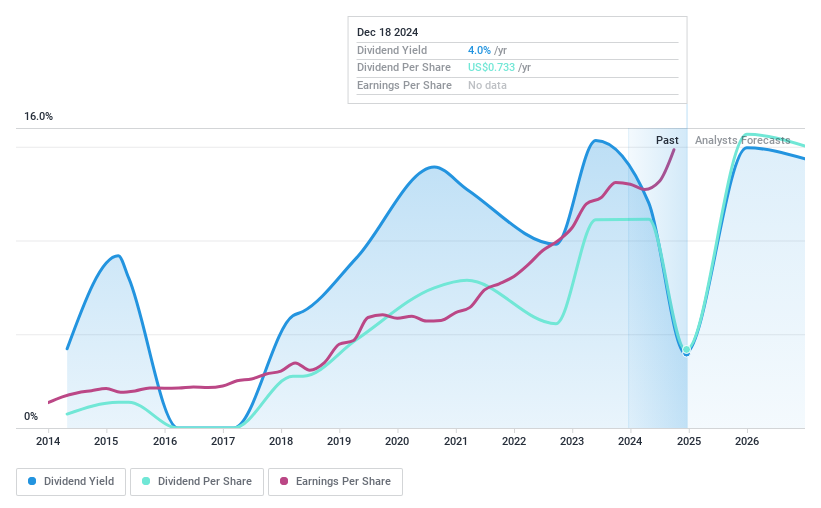

Livermore Investments Group (AIM:LIV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £106.24 million.

Operations: Livermore Investments Group Limited generates revenue from its equity and debt instruments investment activities, amounting to $23.75 million.

Dividend Yield: 5.2%

Livermore Investments Group offers dividends that are well-covered by both earnings and cash flows, with payout ratios of 25.3% and 33%, respectively. Despite a low price-to-earnings ratio of 6.9x, indicating potential value, its dividend yield of 5.21% is slightly below the UK's top quartile payers. However, the dividend history has been volatile over the past decade despite some growth, raising concerns about reliability amidst recent board changes affecting leadership dynamics.

- Navigate through the intricacies of Livermore Investments Group with our comprehensive dividend report here.

- The analysis detailed in our Livermore Investments Group valuation report hints at an inflated share price compared to its estimated value.

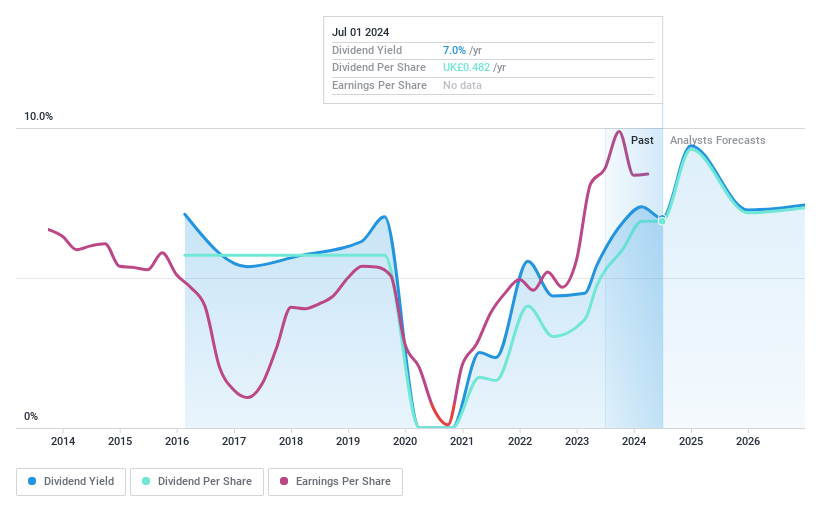

HSBC Holdings (LSE:HSBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc is a global provider of banking and financial services, with a market cap of approximately £156.44 billion.

Operations: HSBC Holdings plc generates revenue through its diverse global banking and financial services operations.

Dividend Yield: 5.9%

HSBC Holdings' dividend yield is among the UK's top 25%, and its payouts are currently sustainable with a 52.9% payout ratio, forecasted to remain covered by earnings. However, the dividend history has been volatile over nine years, raising concerns about reliability. Recent earnings reports show improved financial performance with a net income of US$351 million for Q4 2024 compared to a loss last year, potentially supporting future dividends despite high levels of bad loans at 2.2%.

- Click to explore a detailed breakdown of our findings in HSBC Holdings' dividend report.

- Upon reviewing our latest valuation report, HSBC Holdings' share price might be too optimistic.

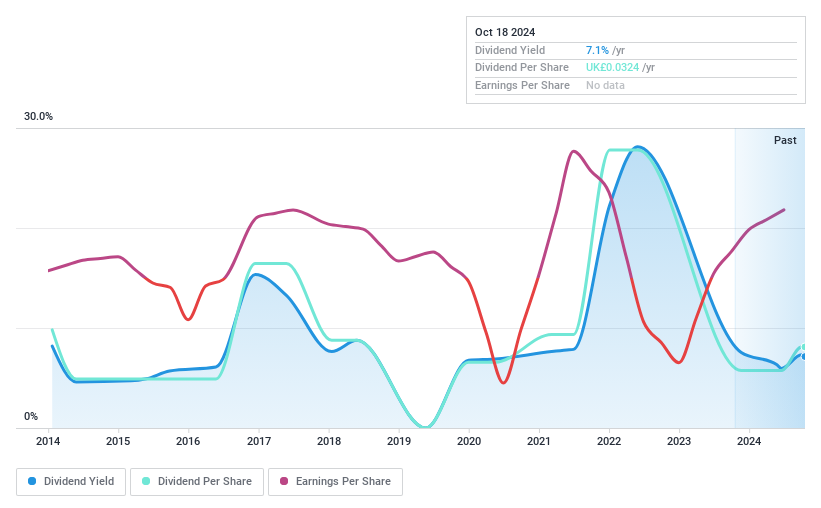

Halyk Bank of Kazakhstan (LSE:HSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Halyk Bank of Kazakhstan Joint Stock Company, along with its subsidiaries, offers corporate and retail banking services mainly in Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan and has a market cap of $5.45 billion.

Operations: Halyk Bank of Kazakhstan's revenue is primarily derived from its Corporate Banking segment, which generated KZT 483.28 billion, followed by Investment Banking at KZT 272.50 billion, Retail Banking at KZT 153.85 billion, and Small and Medium Enterprises (SME) Banking contributing KZT 152.10 billion.

Dividend Yield: 3.8%

Halyk Bank of Kazakhstan offers a mixed picture for dividend investors. Its dividends are covered by earnings with a 35% payout ratio, forecasted to remain sustainable at 48.4%. However, the dividend yield is lower than the UK's top tier, and payments have been volatile over the past decade. Despite recent dividend affirmations and increased payouts over ten years, concerns include high levels of bad loans at 6.9%, which could impact financial stability.

- Get an in-depth perspective on Halyk Bank of Kazakhstan's performance by reading our dividend report here.

- The analysis detailed in our Halyk Bank of Kazakhstan valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 59 Top UK Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halyk Bank of Kazakhstan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBK

Halyk Bank of Kazakhstan

Provides corporate and retail banking services primarily in the Republic of Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives