- United Kingdom

- /

- Insurance

- /

- AIM:HUW

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting global economic uncertainties. Amid these fluctuations, investors often look for stocks that combine affordability with growth potential. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies with strong financials and the potential for significant returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.20 | £295.18M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £509.93M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.15 | £334.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.396 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.25 | £53.29M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.05 | £313.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.255 | £195.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.31 | £70.75M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.17 | £827.08M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Helios Underwriting (AIM:HUW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Helios Underwriting plc, along with its subsidiaries, offers limited liability investment opportunities for shareholders in the Lloyd’s insurance market in the UK and has a market cap of £157.38 million.

Operations: The company's revenue segment is derived entirely from the United Kingdom, totaling £36.00 million.

Market Cap: £157.38M

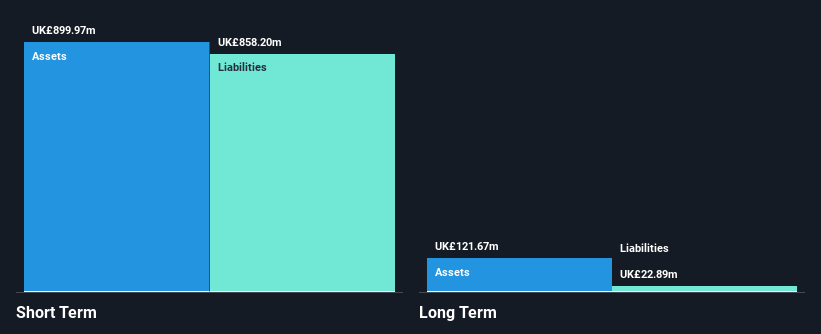

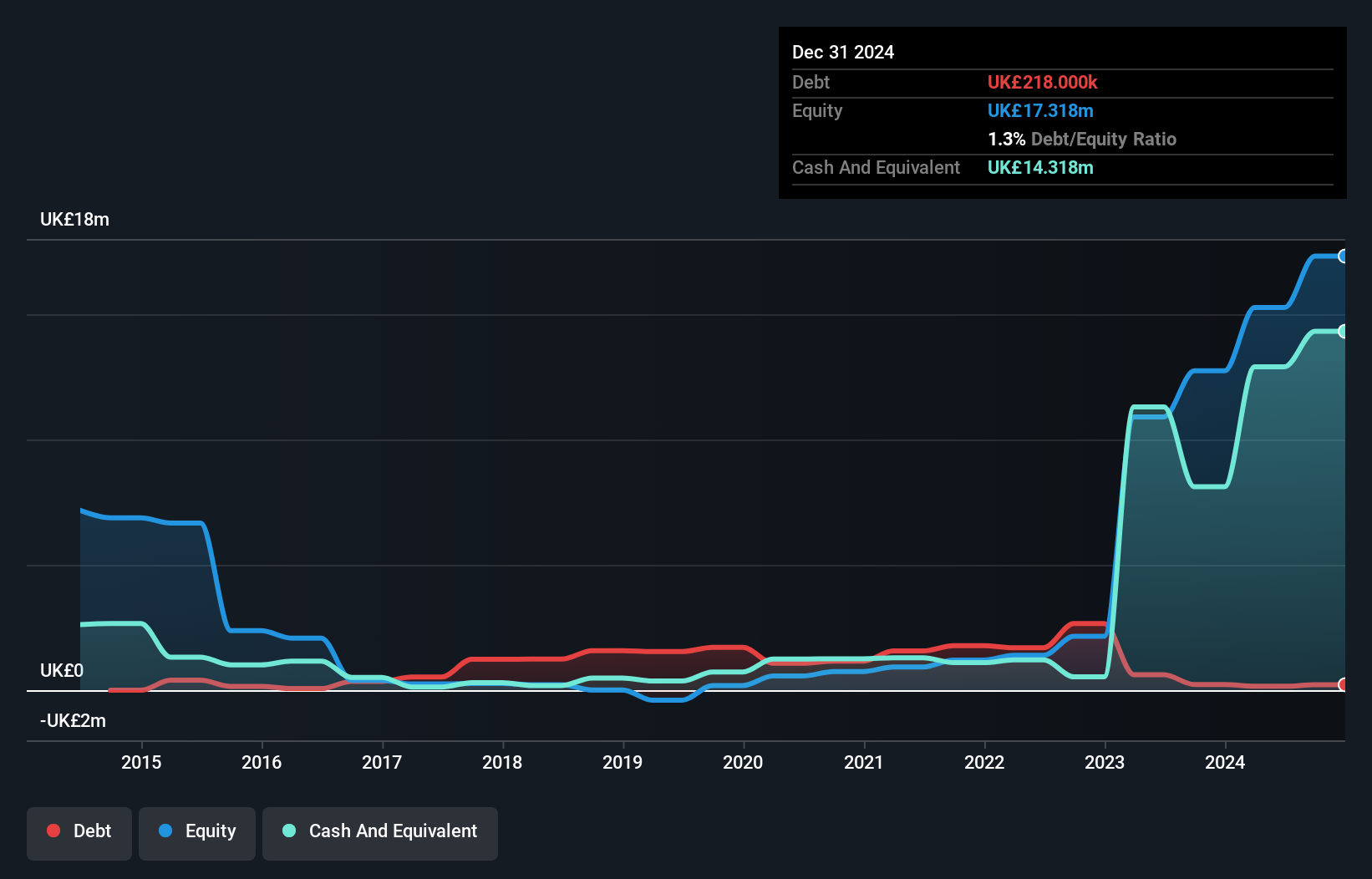

Helios Underwriting plc, with a market cap of £157.38 million, is trading at a price-to-earnings ratio of 8.5x, which is below the UK market average, indicating potential value for investors. Despite recent negative earnings growth and declining profit margins from 86.9% to 51.6%, the company maintains satisfactory debt levels with a net debt to equity ratio of 17.1%. The board and management team are relatively new, suggesting ongoing strategic shifts as evidenced by recent executive changes and restructuring efforts aimed at reducing underwriting risk and costs for 2025.

- Take a closer look at Helios Underwriting's potential here in our financial health report.

- Assess Helios Underwriting's future earnings estimates with our detailed growth reports.

Journeo (AIM:JNEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Journeo plc offers solutions for the transport sector by capturing, processing, and displaying critical information to improve travel experiences in the UK and internationally, with a market cap of £73.65 million.

Operations: The company's revenue is generated through its segments: Infotec (£12.42 million), Journeo A/S (£4.03 million), Fleet Systems (£23.69 million), and Passenger Systems (£9.50 million).

Market Cap: £73.65M

Journeo plc, with a market cap of £73.65 million, demonstrates financial stability as its short-term assets (£33.7M) exceed both short-term (£17.1M) and long-term liabilities (£7.7M). The company's high Return on Equity (26.1%) and quality earnings reflect strong operational performance, while recent contracts bolster its growth prospects. Notably, Journeo secured a minimum £1.2 million contract with Umove in Denmark for Intelligent Transport Systems and a €4.2 million order from Alstom SA for CCTV systems on CrossCountry's Voyager fleets in the UK, enhancing its revenue pipeline through significant SaaS opportunities over coming years.

- Unlock comprehensive insights into our analysis of Journeo stock in this financial health report.

- Evaluate Journeo's historical performance by accessing our past performance report.

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zotefoams plc, along with its subsidiaries, manufactures, distributes, and sells polyolefin foams across the United Kingdom, Europe, North America, and internationally; it has a market cap of £156.41 million.

Operations: The company's revenue is primarily derived from High-Performance Products (£79.64 million), Polyolefin Foams (£66.93 million), and Mucell Extrusion LLC (£1.22 million).

Market Cap: £156.41M

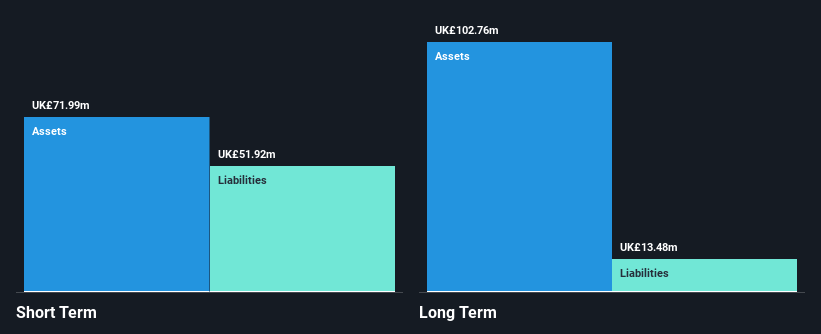

Zotefoams plc, with a market cap of £156.41 million, is currently unprofitable but maintains financial stability as its short-term assets (£72.0M) exceed both short-term (£51.9M) and long-term liabilities (£13.5M). The company's debt is well covered by operating cash flow (72.3%), and it has not meaningfully diluted shareholders recently. While the dividend yield of 2.33% isn't fully supported by earnings, Zotefoams' recent executive changes, including appointing Nick Wright as Group CFO, signal a strategic focus on financial management and growth potential in high-performance products and polyolefin foams sectors internationally.

- Jump into the full analysis health report here for a deeper understanding of Zotefoams.

- Understand Zotefoams' earnings outlook by examining our growth report.

Seize The Opportunity

- Reveal the 301 hidden gems among our UK Penny Stocks screener with a single click here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Underwriting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HUW

Helios Underwriting

Provides a limited liability investment for its shareholders in the Lloyd’s insurance market in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives