- France

- /

- Renewable Energy

- /

- ENXTPA:VLTSA

Voltalia SA (EPA:VLTSA) Held Back By Insufficient Growth Even After Shares Climb 38%

Despite an already strong run, Voltalia SA (EPA:VLTSA) shares have been powering on, with a gain of 38% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

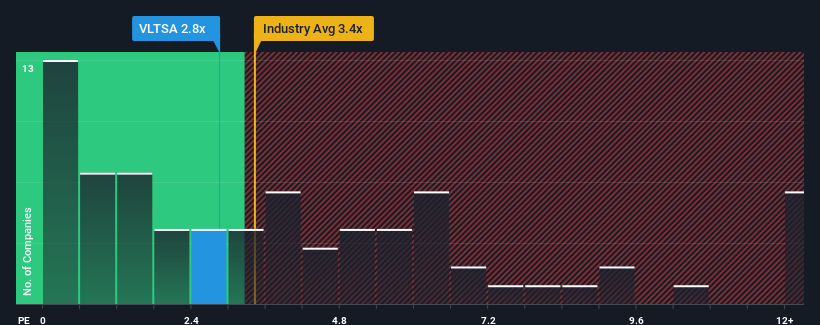

Even after such a large jump in price, Voltalia may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.8x, since almost half of all companies in the Renewable Energy industry in France have P/S ratios greater than 7.3x and even P/S higher than 13x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Voltalia

What Does Voltalia's Recent Performance Look Like?

Voltalia's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Voltalia will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Voltalia will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Voltalia?

Voltalia's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.5%. Pleasingly, revenue has also lifted 112% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 81% each year, which is noticeably more attractive.

With this information, we can see why Voltalia is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Voltalia's P/S

Shares in Voltalia have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Voltalia maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Voltalia (including 2 which are significant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VLTSA

Voltalia

Engages in the production and sale of energy generated by the wind, solar, hydropower, biomass, and storage plants.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026