- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

Engie (ENXTPA:ENGI): Reassessing Valuation After a Strong 3-Month and 1-Year Share Price Rally

Reviewed by Simply Wall St

Engie (ENXTPA:ENGI) has quietly turned into one of the stronger performers in European utilities, with the stock up almost 19% over the past 3 months and more than 53% over the past year.

See our latest analysis for Engie.

That momentum has been building rather than fading, with a 90 day share price return of 18.6% and a five year total shareholder return of around 150%, signalling that investors are steadily repricing Engie’s growth and risk profile.

If Engie’s run has you rethinking your utility exposure, it might be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With Engie now trading close to analyst targets but showing modest recent earnings growth, the key question is whether today’s price still leaves a margin of safety, or if the market is already banking on stronger future gains.

Most Popular Narrative: 5.4% Undervalued

With Engie closing at €21.46 against a narrative fair value of about €22.68, the story assumes only modest upside yet rests on specific long term drivers.

Large scale and timely commissioning of new renewable/battery assets (including marquee projects in Africa and the Middle East) is accelerating revenue contribution and margin expansion, while performance improvement initiatives and contract optimization are structurally boosting EBIT and net margins.

Curious how modest revenue expectations still back a richer earnings multiple and higher margin profile? Want to see which long term assumptions really power that valuation?

Result: Fair Value of $22.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth execution, as project delays, regulatory shifts, or weaker power prices could easily chip away at those margin and valuation assumptions.

Find out about the key risks to this Engie narrative.

Another View: Market Multiple Signals More Upside

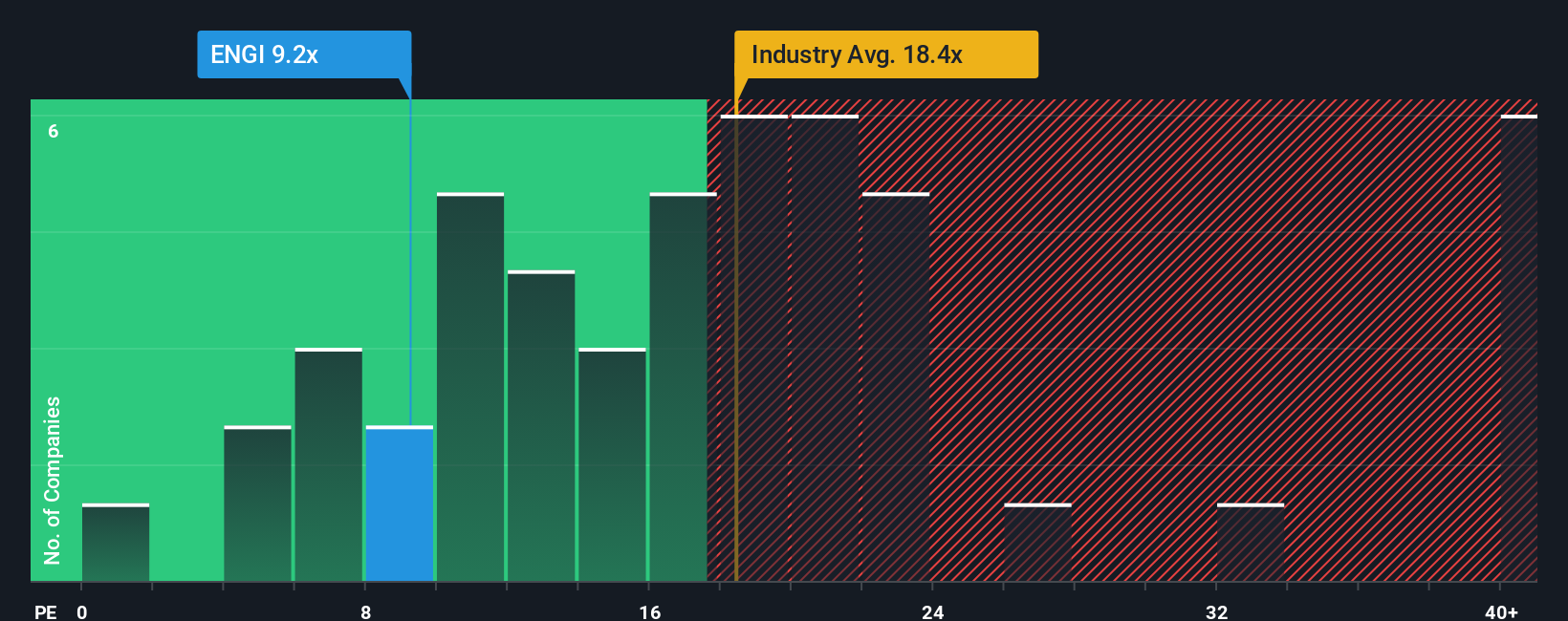

While the narrative fair value points to only modest undervaluation, Engie’s current price to earnings ratio of 10.5x sits well below the global integrated utilities average of 17.8x and a fair ratio of 15.2x, suggesting the market may still be underpricing its earnings power and rerating potential.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Engie for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Engie Narrative

If you would rather examine the numbers yourself and question these assumptions, you can build a customized view of Engie’s prospects in minutes: Do it your way.

A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready For Your Next Investment Move?

Set yourself up for the next opportunity by using the Simply Wall St Screener to uncover focused stock ideas before the wider market catches on.

- Capture early-stage momentum by scanning these 3602 penny stocks with strong financials that pair smaller market caps with surprisingly resilient financials.

- Position for the next wave of automation by reviewing these 30 healthcare AI stocks blending medical innovation with powerful data intelligence.

- Strengthen your income stream by targeting these 12 dividend stocks with yields > 3% offering reliable yields above 3% without ignoring fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion