Emerging European Stocks With Solid Potential In December 2025

Reviewed by Simply Wall St

As European markets navigate a landscape marked by mixed returns and hopes for interest rate cuts, the pan-European STOXX Europe 600 Index has shown resilience with a modest rise, reflecting cautious optimism amid economic uncertainties. In this environment, identifying stocks with solid potential involves looking at companies that demonstrate robust fundamentals and adaptability to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

LU-VE (BIT:LUVE)

Simply Wall St Value Rating: ★★★★★☆

Overview: LU-VE S.p.A. focuses on the production and marketing of heat exchangers and air-cooled equipment, serving both domestic and international markets, with a market capitalization of approximately €872.71 million.

Operations: LU-VE S.p.A. generates revenue primarily from two segments: Components (€294.54 million) and Cooling Systems (€289.01 million). The company's financial performance is highlighted by its net profit margin, which reflects the efficiency of its operations in converting revenue into profit.

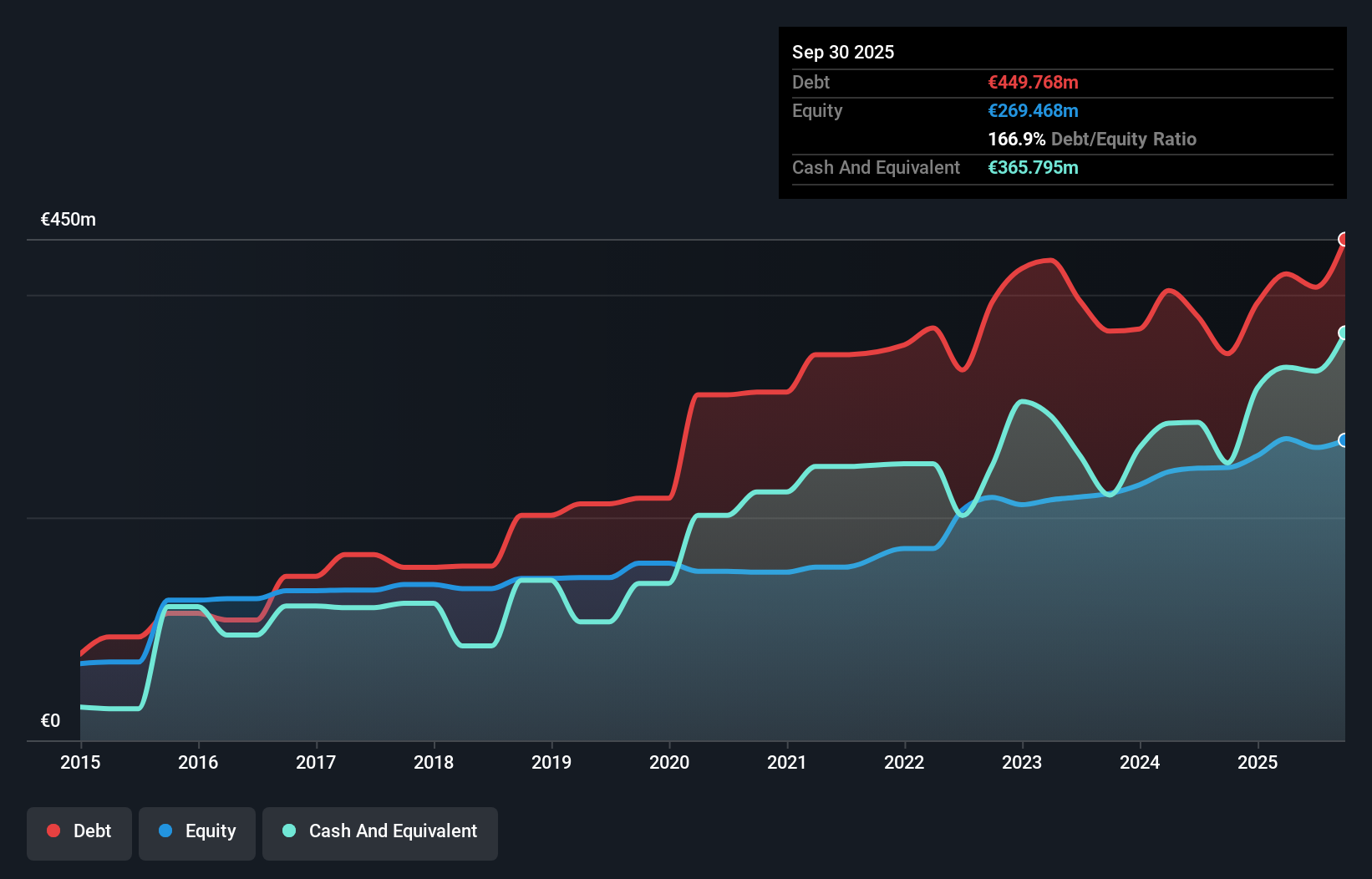

LU-VE, a notable player in the European market, reported sales of €440.21 million for the first nine months of 2025, slightly up from €438.38 million a year prior. Its net income rose to €27.1 million from €25.77 million, reflecting robust performance despite industry challenges. The company's debt to equity ratio improved significantly over five years from 207% to 167%, indicating better financial health with its net debt to equity at a satisfactory 31%. LU-VE's earnings growth of 21% outpaced the building industry's -2%, showcasing strong operational efficiency and promising future prospects with forecasted annual growth of 15%.

- Navigate through the intricacies of LU-VE with our comprehensive health report here.

Review our historical performance report to gain insights into LU-VE's's past performance.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA is a SaaS company operating in France and internationally, with a market capitalization of €365.62 million.

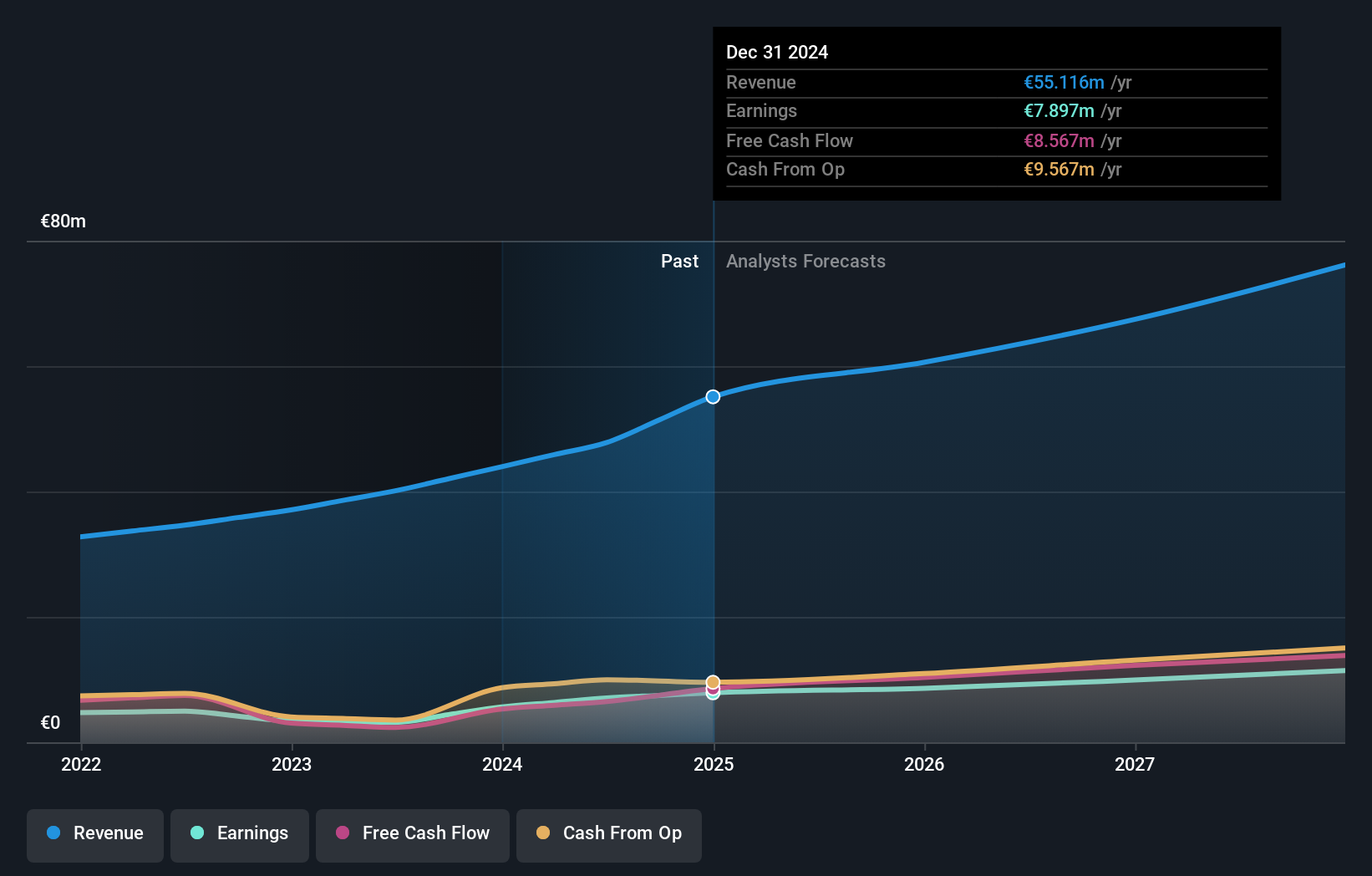

Operations: Revenue for Sidetrade SA primarily comes from its Software & Programming segment, amounting to €59.64 million.

Sidetrade's recent strategic alliance with NX Partners is set to enhance CFOs' agility across Western Europe, leveraging Sidetrade's agentic AI platform, Aimie. The company reported a revenue increase to EUR 44.4 million for the first nine months of 2025 from EUR 39.7 million in the previous year, with half-year net income rising to EUR 4.12 million from EUR 3.59 million. Sidetrade boasts high-quality earnings and its EBIT covers interest payments by an impressive 139 times, despite a rise in its debt-to-equity ratio from 1.6% to 15.7% over five years, indicating robust financial health and growth potential within the software industry context.

- Click here and access our complete health analysis report to understand the dynamics of Sidetrade.

Understand Sidetrade's track record by examining our Past report.

Caisse Régionale de Crédit Agricole du Morbihan (ENXTPA:CMO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole du Morbihan offers a range of banking products and services to diverse clients including individuals, professionals, farmers, and local authorities in France, with a market cap of €560.03 million.

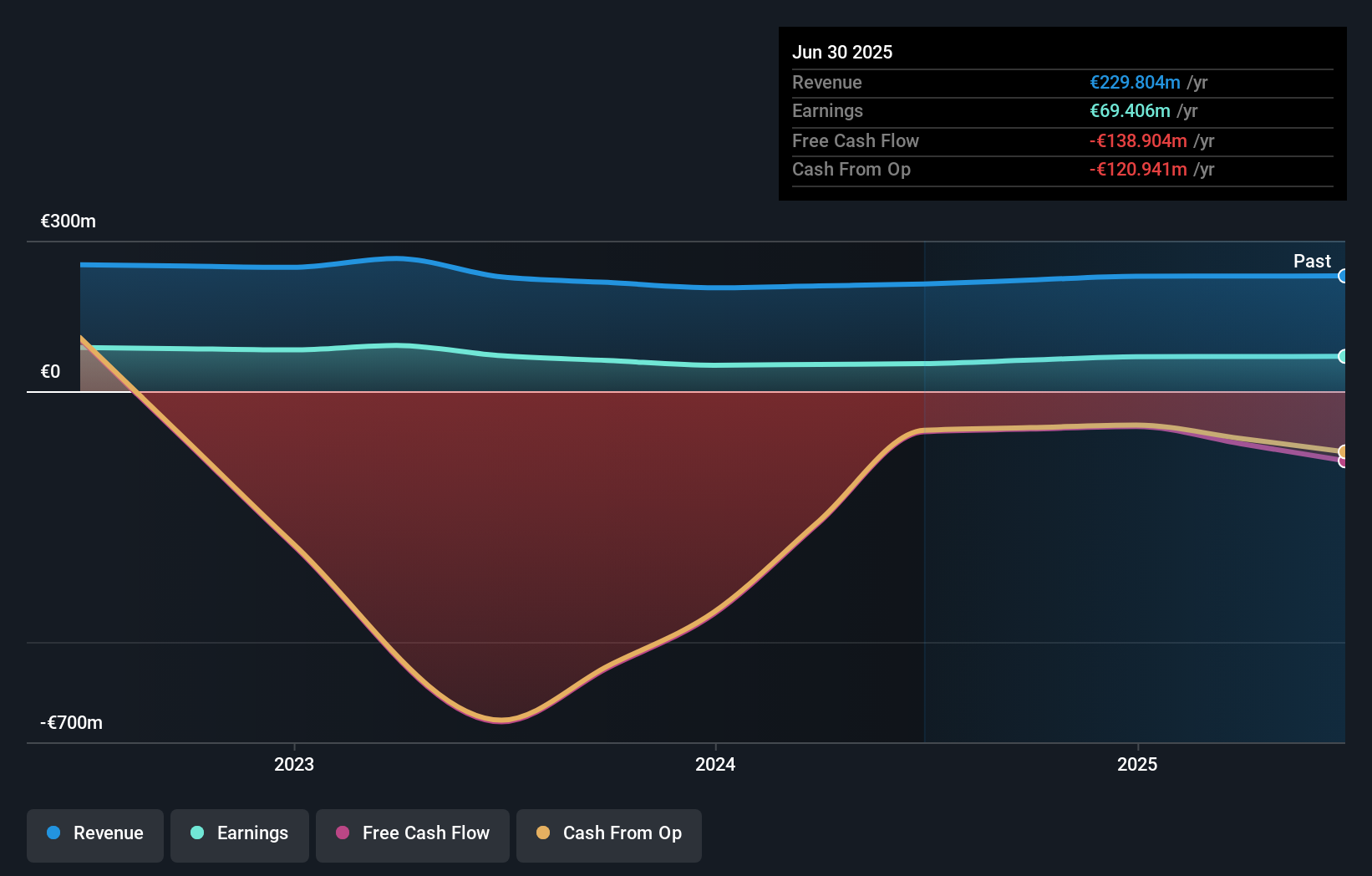

Operations: The primary revenue stream for Caisse Régionale de Crédit Agricole du Morbihan is its retail banking segment, generating €229.80 million.

Crédit Agricole du Morbihan, a smaller financial entity in Europe, showcases strong fundamentals with total assets of €13.8 billion and equity at €2.2 billion. Its liabilities are primarily low-risk, with 96% coming from customer deposits. The bank's earnings have surged by 26%, outpacing the industry average of -0.3%. With total deposits amounting to €11.1 billion and loans at €11.4 billion, it maintains an appropriate level of bad loans at 1.8%, supported by a sufficient allowance for bad loans (105%). Despite its volatile share price recently, the P/E ratio stands attractively at 8x against the French market's 16x.

- Click to explore a detailed breakdown of our findings in Caisse Régionale de Crédit Agricole du Morbihan's health report.

Learn about Caisse Régionale de Crédit Agricole du Morbihan's historical performance.

Turning Ideas Into Actions

- Investigate our full lineup of 311 European Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:LUVE

LU-VE

Engages in the production and marketing of heat exchangers and air cooled equipment in Italy and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion