As European markets experience mixed performances with the pan-European STOXX Europe 600 Index slightly lower and varied results across major stock indexes, investors are closely watching central bank policies and economic indicators for guidance. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to navigate market uncertainties while potentially benefiting from steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.18% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.56% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.48% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.08% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.82% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.43% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.82% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.12% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.48% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.33% | ★★★★★★ |

Click here to see the full list of 208 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

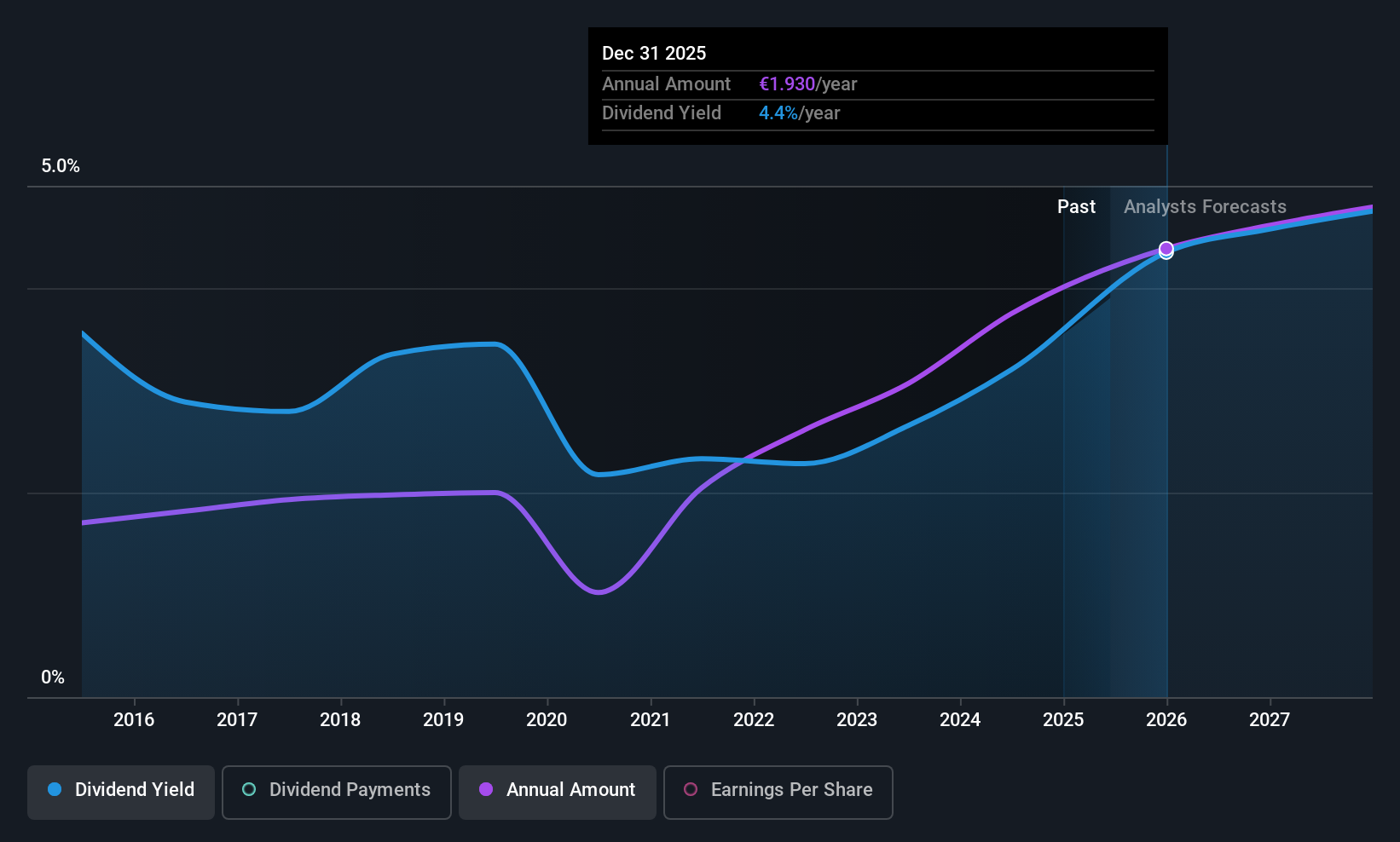

Banca Mediolanum (BIT:BMED)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banca Mediolanum S.p.A. provides a range of banking products and services in Italy, with a market capitalization of approximately €13.98 billion.

Operations: Banca Mediolanum S.p.A. generates revenue through its segments in Italy, comprising €672.30 million from banking, €468.52 million from insurance, and €357.34 million from asset management, along with contributions of €129.84 million from Spain and €2.89 million from Germany.

Dividend Yield: 4%

Banca Mediolanum's dividend of €0.60, announced for November 2025, reflects a reasonable payout ratio of 61.8%, indicating coverage by earnings despite an unstable dividend history. The company's price-to-earnings ratio of 11.9x suggests good value compared to the Italian market average of 16.3x, although its dividend yield at 3.97% is lower than top-tier payers in Italy. Recent earnings growth supports current dividends but future declines may affect sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Banca Mediolanum.

- Our expertly prepared valuation report Banca Mediolanum implies its share price may be lower than expected.

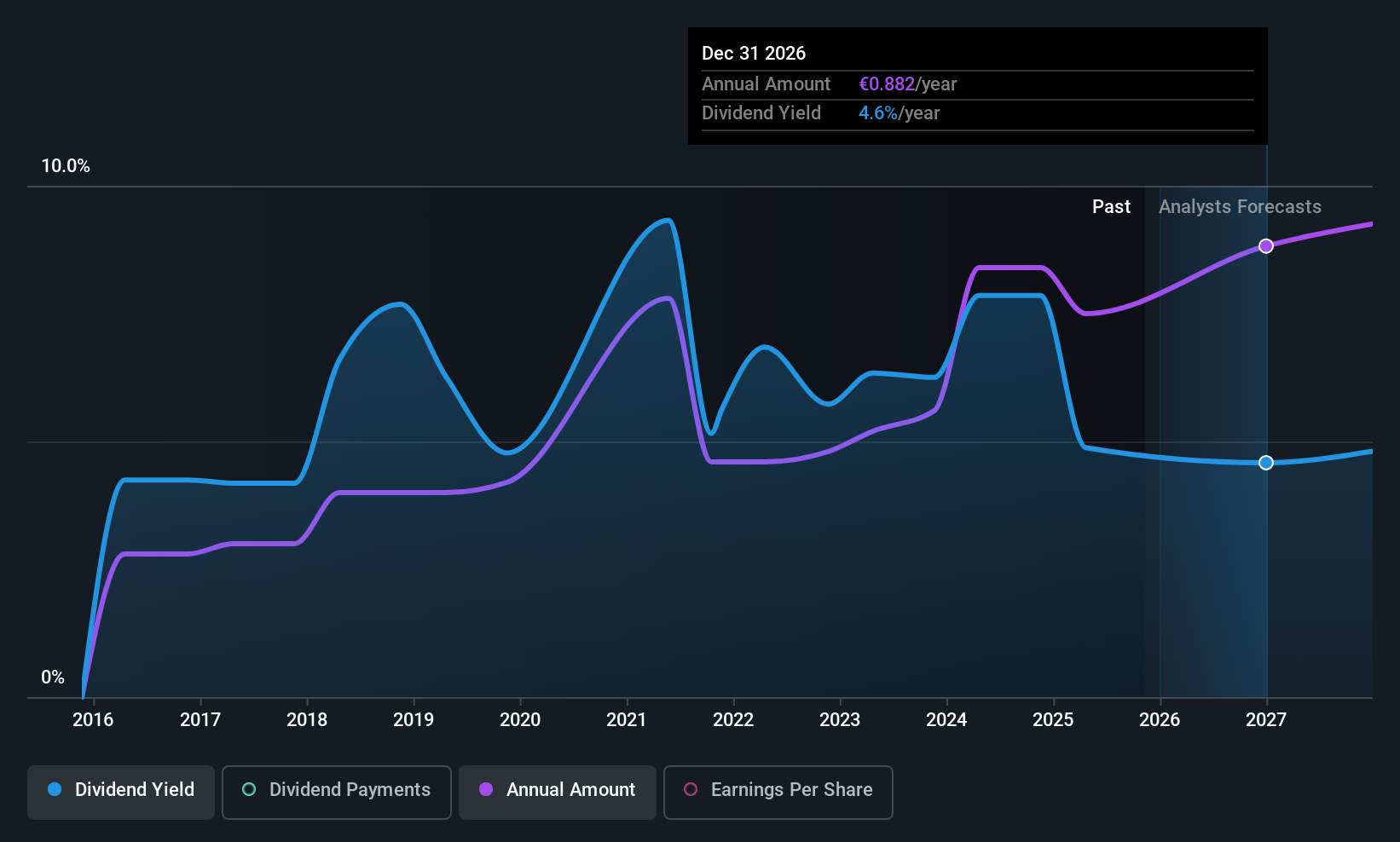

Banca Popolare di Sondrio (BIT:BPSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Popolare di Sondrio S.p.A. offers a range of banking products and services to households, SMEs, and institutions in Italy, with a market cap of €7.12 billion.

Operations: Banca Popolare di Sondrio S.p.A. generates revenue through its diverse banking products and services targeted at households, small and medium-sized enterprises, and institutions in Italy.

Dividend Yield: 5.1%

Banca Popolare di Sondrio's dividend yield of 5.05% ranks among the top 25% in Italy, supported by a reasonable payout ratio of 55.7%. However, its dividend history is marked by volatility over the past decade. Recent earnings growth, with net income rising to €512.7 million for nine months ending September 2025, supports current payouts but sustainability may be challenged as earnings are forecasted to decline. The upcoming acquisition by BPER Banca SpA could impact future dividends and strategic direction.

- Click here to discover the nuances of Banca Popolare di Sondrio with our detailed analytical dividend report.

- Our expertly prepared valuation report Banca Popolare di Sondrio implies its share price may be too high.

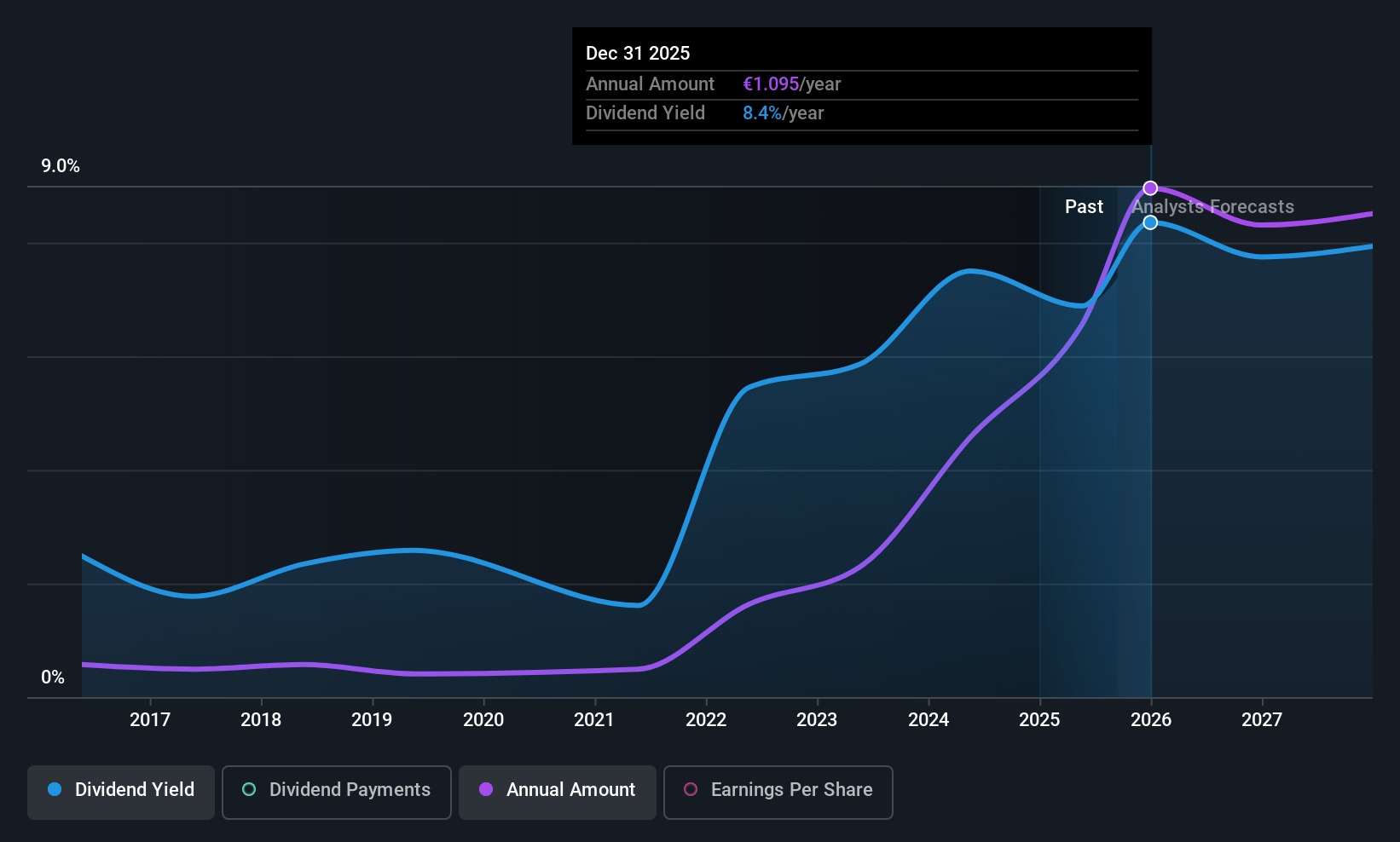

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA operates as a global market research company providing survey-based research services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific, with a market cap of approximately €1.45 billion.

Operations: Ipsos SA generates revenue of approximately €2.46 billion from its survey-based research services provided to companies and institutions across multiple regions.

Dividend Yield: 5.5%

Ipsos offers a mixed picture for dividend investors. Its dividends are well-covered by earnings and cash flows, with payout ratios of 44.3% and 35.8%, respectively, indicating sustainability. However, the dividend history has been volatile over the past decade despite recent growth in payments. Trading at a significant discount to its estimated fair value and peers, Ipsos presents potential value opportunities but is not among the top tier of French dividend payers with a yield of 5.51%. Recent executive changes may influence future financial strategies.

- Click to explore a detailed breakdown of our findings in Ipsos' dividend report.

- Our comprehensive valuation report raises the possibility that Ipsos is priced lower than what may be justified by its financials.

Summing It All Up

- Investigate our full lineup of 208 Top European Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banca Popolare di Sondrio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BPSO

Banca Popolare di Sondrio

Provides various banking products and services to households, small and medium-sized enterprises, and institutions in Italy.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)