- France

- /

- Healthcare Services

- /

- ENXTPA:LNA

Earnings Miss: LNA Santé SA Missed EPS By 48% And Analysts Are Revising Their Forecasts

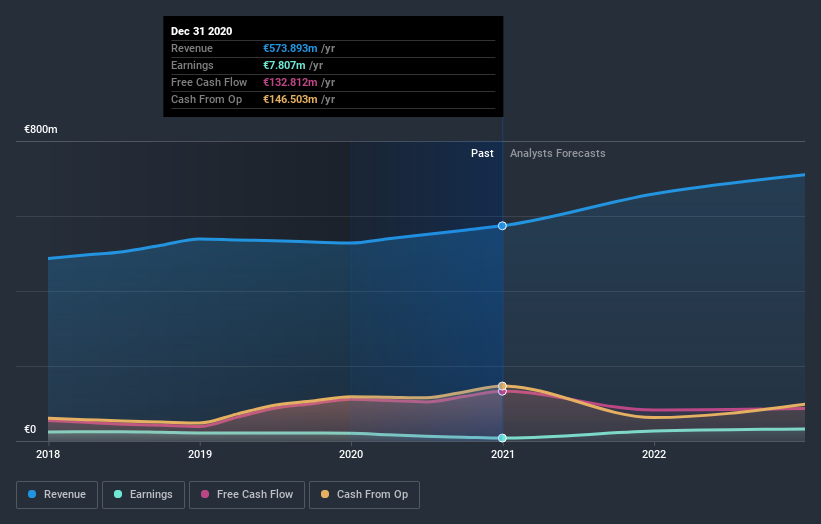

LNA Santé SA (EPA:LNA) last week reported its latest annual results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. Results overall were not great, with earnings of €0.81 per share falling drastically short of analyst expectations. Meanwhile revenues hit €574m and were slightly better than forecasts. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for LNA Santé

Taking into account the latest results, the consensus forecast from LNA Santé's five analysts is for revenues of €658.9m in 2021, which would reflect a meaningful 15% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to jump 109% to €2.72. Yet prior to the latest earnings, the analysts had been anticipated revenues of €659.3m and earnings per share (EPS) of €2.71 in 2021. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at €53.00. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic LNA Santé analyst has a price target of €63.00 per share, while the most pessimistic values it at €42.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the LNA Santé's past performance and to peers in the same industry. The analysts are definitely expecting LNA Santé's growth to accelerate, with the forecast 15% annualised growth to the end of 2021 ranking favourably alongside historical growth of 5.5% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.8% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that LNA Santé is expected to grow much faster than its industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. The consensus price target held steady at €53.00, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for LNA Santé going out to 2022, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with LNA Santé (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

When trading LNA Santé or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade LNA Santé, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:LNA

LNA Santé

Engages in the management and operation of health establishments.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives