As global markets navigate a period of volatility, highlighted by the Federal Reserve's steady interest rates and the European Central Bank's rate cuts, small-cap stocks have faced mixed fortunes amid concerns over AI competition and geopolitical tensions. Despite these challenges, discerning investors often seek out undiscovered gems that demonstrate resilience and potential for growth in such dynamic environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market cap of €416.47 million.

Operations: EPC Groupe generates its revenue primarily from the Specialty Chemicals segment, which contributed €487.56 million. The company's net profit margin reflects its financial efficiency and profitability in managing costs relative to its revenue streams.

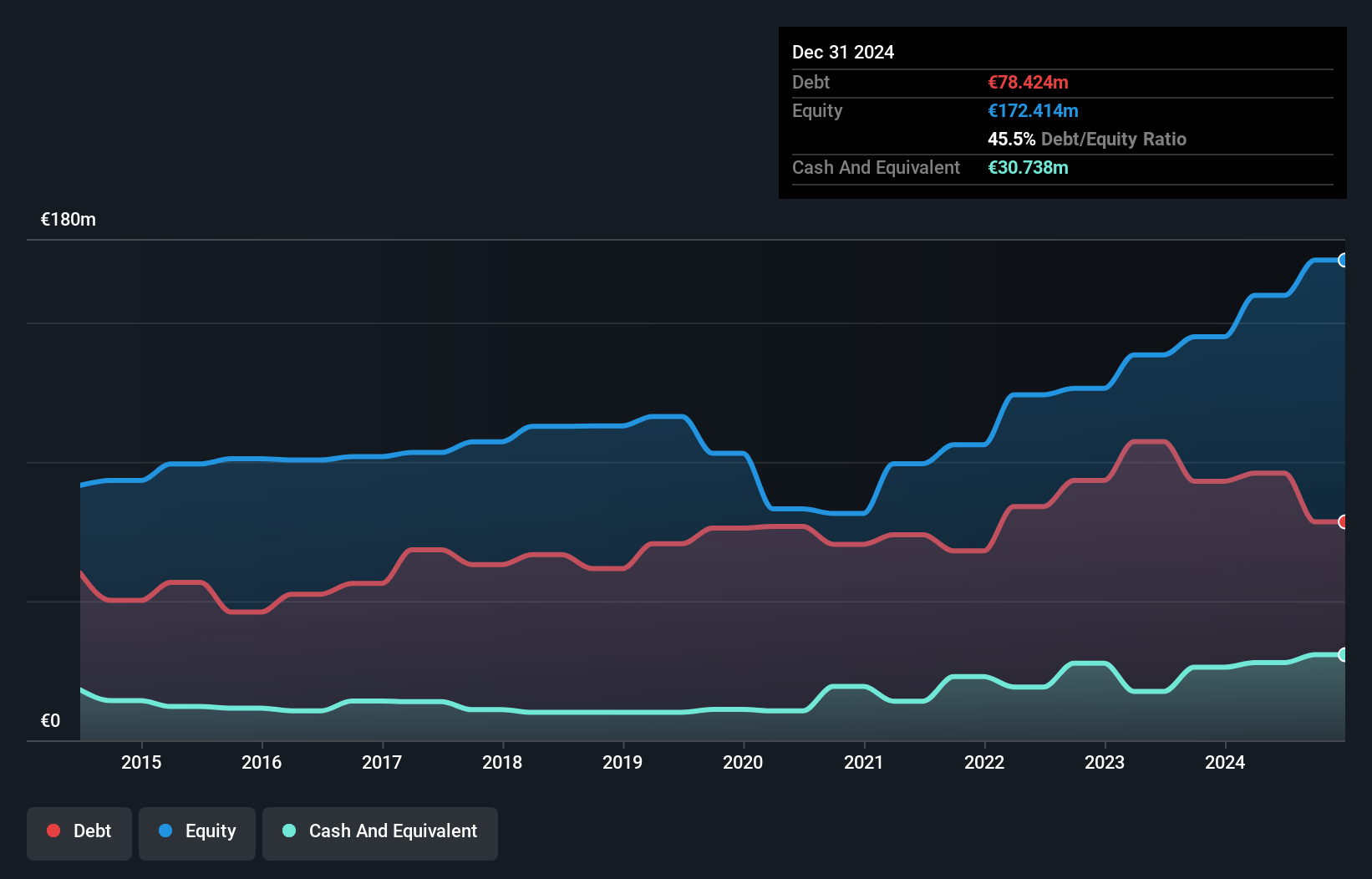

EPC Groupe, a smaller player in the chemicals sector, offers intriguing prospects with its stock trading at 46.8% below estimated fair value. The company has shown robust earnings growth of 17.4% over the past year, outpacing the industry's -8.2%. Despite this positive trajectory, EPC faces challenges with interest payments not well covered by EBIT at 2.9x coverage; ideally, this should be above 3x for comfort. On a brighter note, it boasts high-quality earnings and has managed to reduce its debt-to-equity ratio from 60.7% to 60.1% over five years while maintaining positive free cash flow status.

- Unlock comprehensive insights into our analysis of EPC Groupe stock in this health report.

Assess EPC Groupe's past performance with our detailed historical performance reports.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market capitalization of approximately €1.24 billion.

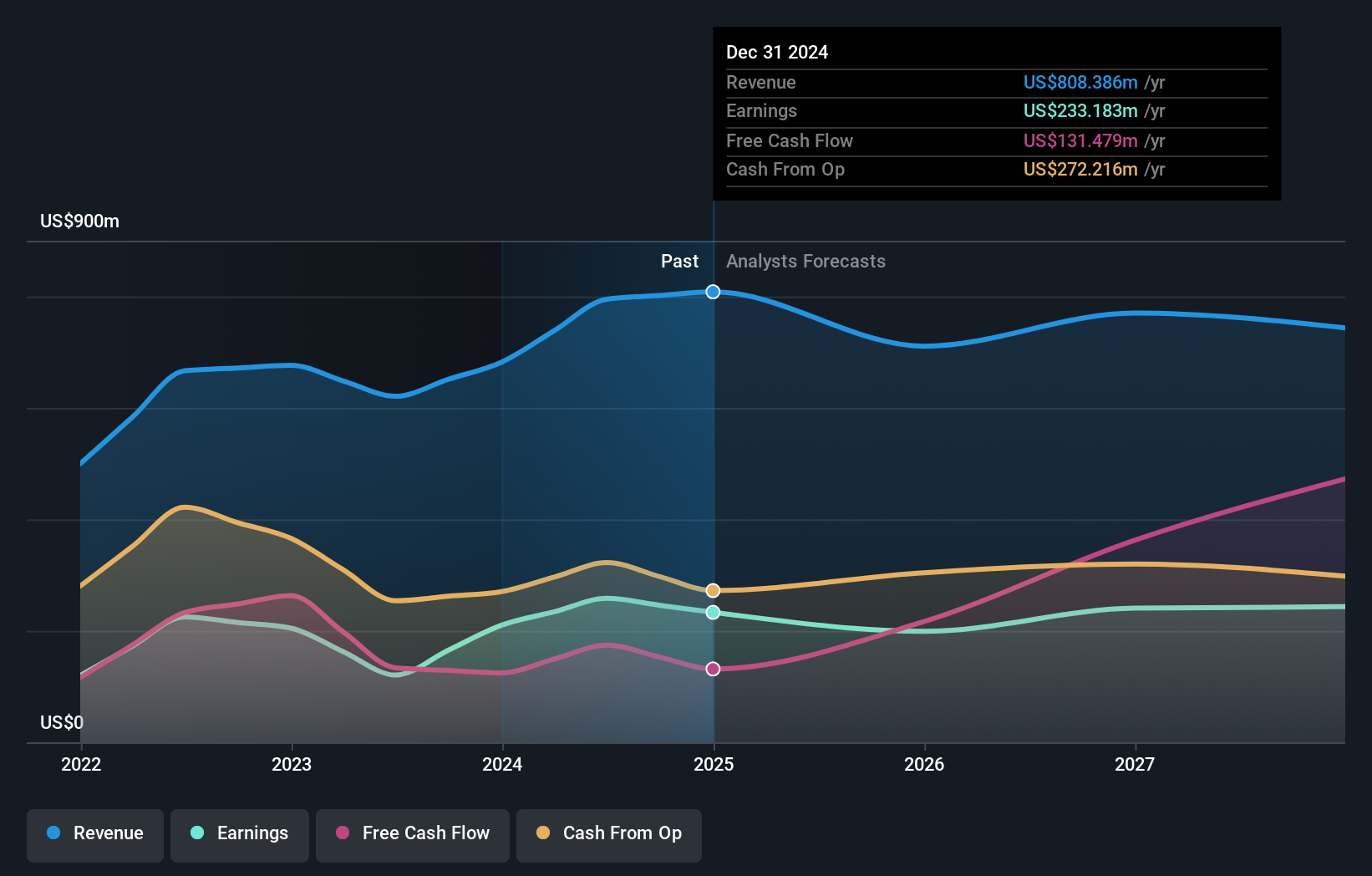

Operations: The company's revenue primarily comes from its production segment, generating $658.76 million, while its drilling segment contributes $30.57 million.

Etablissements Maurel & Prom, a nimble player in the oil and gas sector, has made significant strides with a 114% earnings growth over the past year. Their debt to equity ratio has impressively shrunk from 62.2% to 17.2% across five years, indicating robust financial management. Trading at roughly 71.6% below its estimated fair value suggests potential undervaluation compared to peers. With EBIT covering interest payments by 16 times, their financial health seems strong despite forecasts of a 10.6% yearly decline in earnings for the next three years, hinting at challenges ahead amidst high-quality past earnings performance.

Inrom Construction Industries (TASE:INRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Inrom Construction Industries Ltd, along with its subsidiaries, engages in the production, marketing, and sale of diverse products and solutions for the construction, renovation, and infrastructure sectors in Israel with a market cap of ₪2.46 billion.

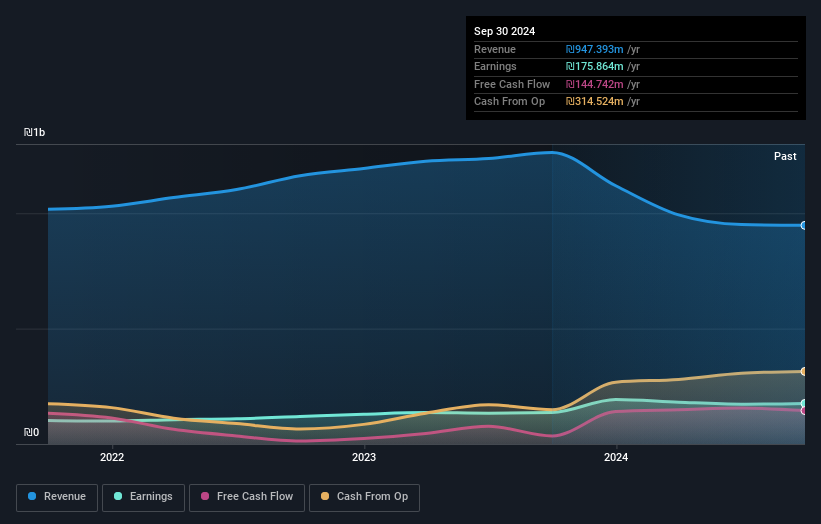

Operations: Inrom generates revenue primarily from Construction Solutions (₪359.03 million), Finishing Products for Construction (₪296.27 million), and Paint Products (₪229.00 million). The Plumbing Systems contribute ₪76.07 million to the total revenue, while consolidation adjustments account for a reduction of ₪12.98 million.

Inrom Construction Industries, a relatively small player in the building sector, showcases intriguing financial dynamics. Over the past year, earnings grew by 29%, significantly outpacing the industry's 0.1% growth rate. Despite a notable one-off gain of ₪60M impacting its recent financials, the company is trading at an attractive 92.4% below its estimated fair value. Its debt-to-equity ratio has impressively decreased from 71.3% to 16.4% over five years, and interest payments are well covered with EBIT at 22.7x coverage. However, shareholders experienced dilution last year amidst these promising indicators of potential value and growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Inrom Construction Industries.

Learn about Inrom Construction Industries' historical performance.

Where To Now?

- Click here to access our complete index of 4664 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:INRM

Inrom Construction Industries

Produces, markets, and sells various products and solutions for the construction, renovation, and infrastructure industries in Israel.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.