- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

Discovering Hidden Opportunities In These 3 Undiscovered Gems

Reviewed by Simply Wall St

As we approach the end of the year, global markets have shown mixed signals with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains, largely driven by large-cap growth stocks. Amidst these fluctuations, the small-cap sector presents intriguing opportunities for investors seeking hidden gems that may be overlooked in broader market trends. Identifying a good stock often involves looking beyond current headlines to find companies with strong fundamentals and potential for growth even in uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market capitalization of approximately €1.13 billion.

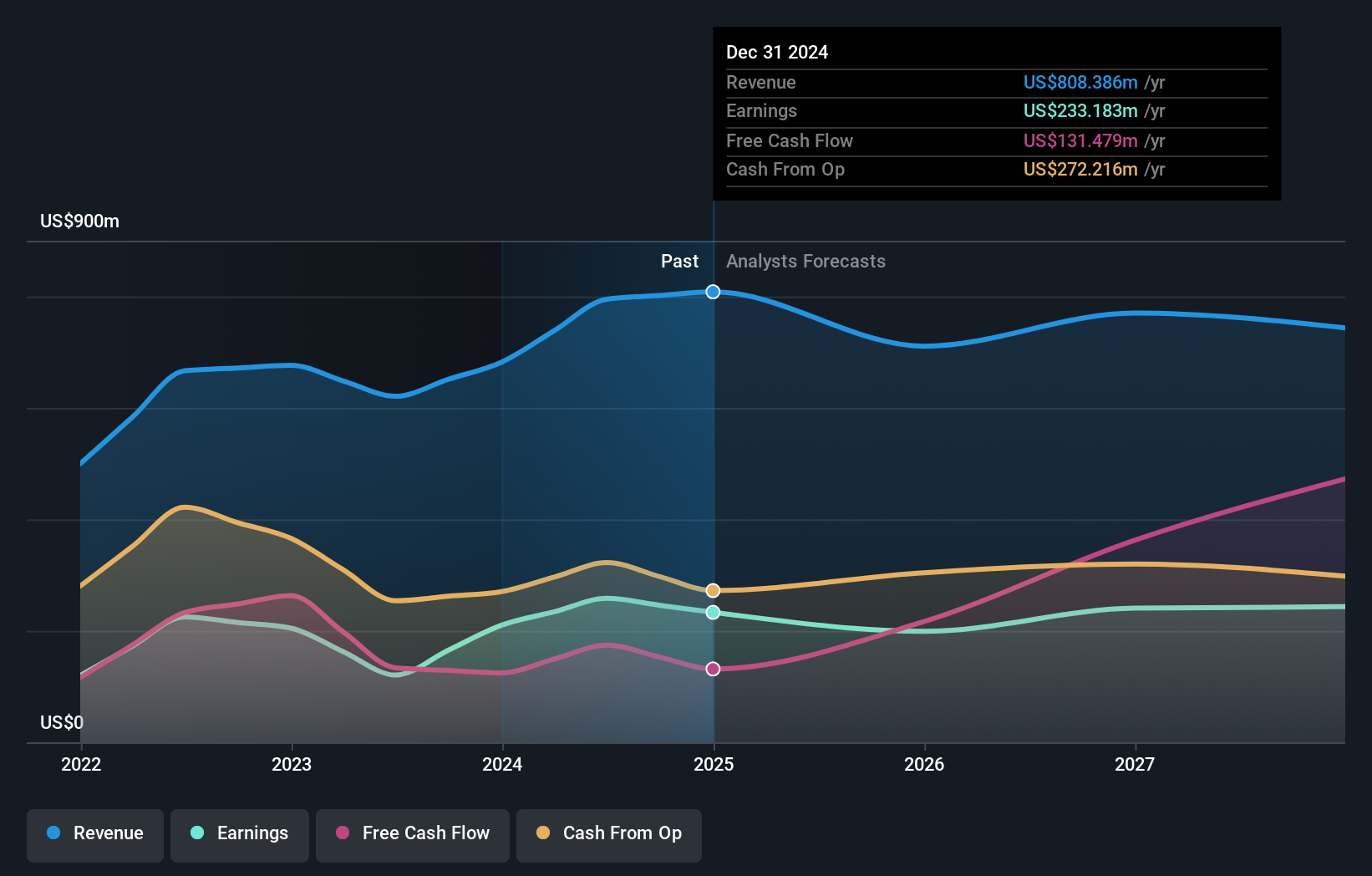

Operations: The company's revenue primarily comes from its production segment, generating $658.76 million, while the drilling segment contributes $30.57 million.

Etablissements Maurel & Prom, a nimble player in the oil and gas sector, has seen its earnings skyrocket by 114% over the past year, outpacing an industry that saw a -13.9% shift. The company reported consolidated sales of US$559 million for nine months ending September 2024, up from US$495 million the previous year. With production hitting 36,288 boepd compared to last year's 27,944 boepd and debt levels well-managed at a reduced debt-to-equity ratio of 17.2%, it seems poised for stability despite forecasts suggesting earnings may slide by an average of 10.8% annually over three years.

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems business in China and has a market capitalization of CN¥14.16 billion.

Operations: Broad-Ocean Motor generates revenue primarily from its motor systems business in China. The company's financial performance includes a net profit margin that has shown variability over recent periods, reflecting changes in cost structure and market conditions.

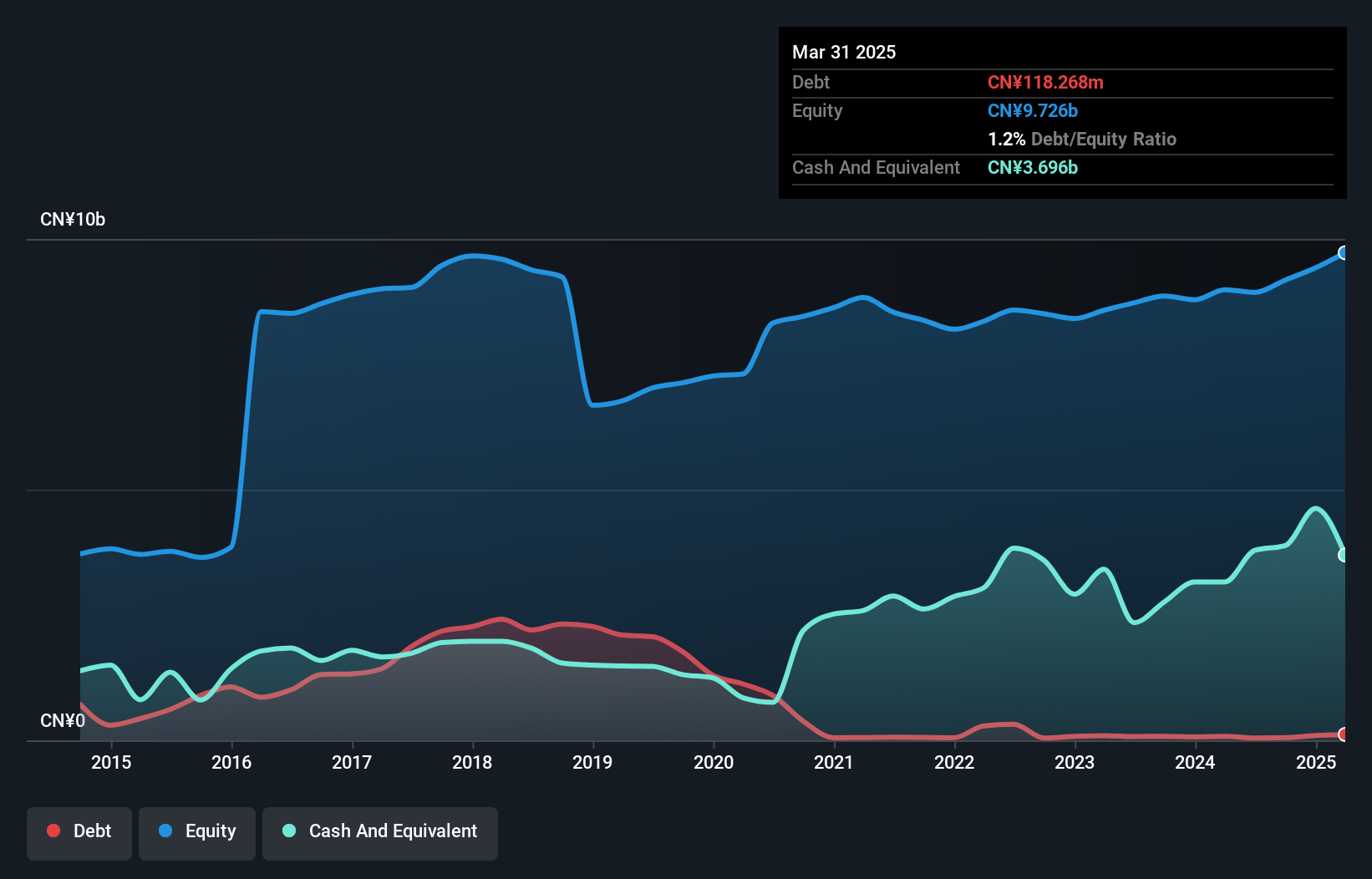

Zhongshan Broad-Ocean Motor, a notable player in the electrical industry, has shown impressive earnings growth of 50.4% over the past year, outpacing its industry peers. The company's debt-to-equity ratio has significantly improved from 24.8% to just 0.6% over five years, highlighting effective financial management. Recent earnings reported a net income of CNY 670 million for nine months ended September 2024, up from CNY 532 million the previous year. Additionally, it announced a share repurchase program worth up to CNY 200 million to support employee stock plans and equity incentives, reflecting confidence in its financial position and future prospects.

- Navigate through the intricacies of Zhongshan Broad-Ocean Motor with our comprehensive health report here.

Understand Zhongshan Broad-Ocean Motor's track record by examining our Past report.

Migdal Insurance and Financial Holdings (TASE:MGDL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Migdal Insurance and Financial Holdings Ltd., along with its subsidiaries, offers insurance, pension, and financial services to both private and corporate clients in Israel, with a market capitalization of ₪7.23 billion.

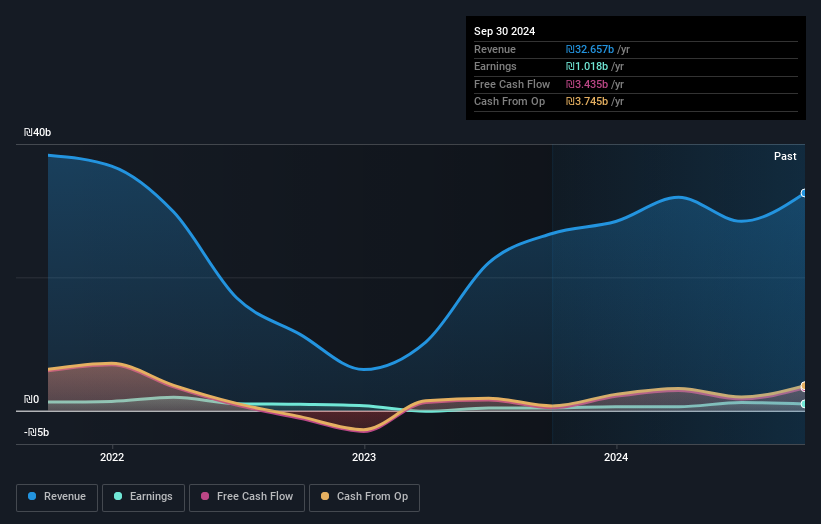

Operations: Migdal generates significant revenue from its life insurance and long-term savings segment, particularly life insurance, which contributes ₪26.70 billion. The general insurance sector also plays a substantial role, with automobile property insurance adding ₪904.37 million. Net profit margin trends are noteworthy in assessing the company's financial health over time.

Migdal Insurance and Financial Holdings, a relatively small player in the insurance sector, shows intriguing potential with its earnings growing at 26.9% annually over the past five years. Despite not outpacing the industry’s recent growth of 186.8%, Migdal's earnings have been robust, supported by high-quality past results and a solid interest coverage ratio of 7x EBIT to interest payments. The company trades significantly below its estimated fair value by about 60%, suggesting potential undervaluation in the market. Additionally, Migdal has successfully reduced its debt-to-equity ratio from 84% to 82% over five years, indicating prudent financial management.

Where To Now?

- Explore the 4636 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, Colombia, and France.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives