- France

- /

- Capital Markets

- /

- ENXTPA:TKO

Tikehau Capital And 2 More Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by political developments and economic shifts, U.S. stocks have surged to record highs, fueled by optimism over trade policies and advancements in artificial intelligence. Amidst this buoyant market environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.72 | 49.8% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.80 | CN¥37.54 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| Fudo Tetra (TSE:1813) | ¥2153.00 | ¥4301.30 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.95 | CN¥27.81 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5854.00 | ¥11678.68 | 49.9% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.10 | CN¥18.19 | 50% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

Tikehau Capital (ENXTPA:TKO)

Overview: Tikehau Capital is an alternative asset management group with €46.1 billion in assets under management and a market capitalization of approximately €3.72 billion.

Operations: The company's revenue segments include €173.11 million from investment activities and €322.94 million from asset management activities.

Estimated Discount To Fair Value: 42.4%

Tikehau Capital is trading at €21.65, significantly below its estimated fair value of €37.59, highlighting potential undervaluation based on cash flows. Despite a dividend yield of 3.46% not being well covered by free cash flows, the company shows strong growth prospects with earnings expected to rise by 35.9% annually, outpacing the French market's forecasted growth rate of 12%. However, debt coverage by operating cash flow remains a concern for investors.

- The analysis detailed in our Tikehau Capital growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Tikehau Capital's balance sheet health report.

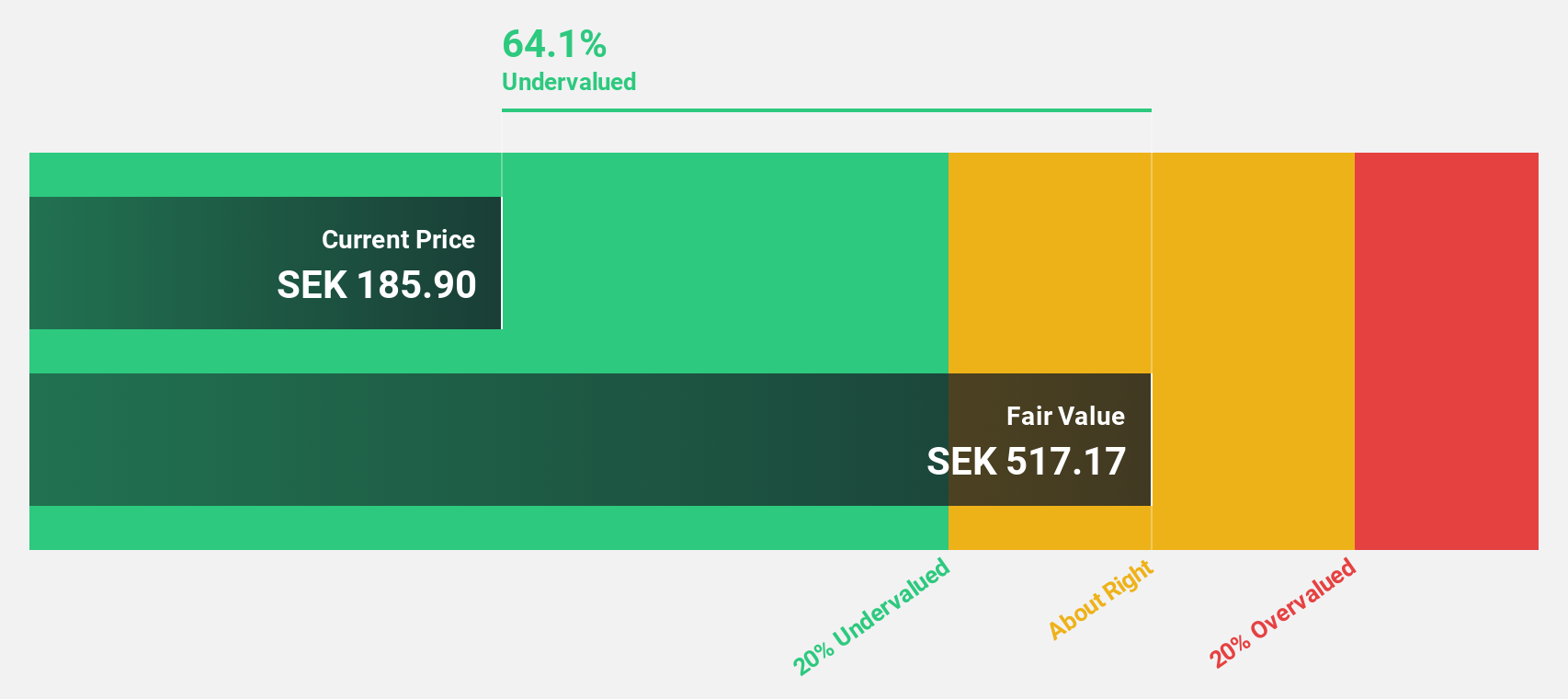

BioArctic (OM:BIOA B)

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK19.23 billion.

Operations: The company's revenue primarily comes from its biotechnology segment, amounting to SEK167.14 million.

Estimated Discount To Fair Value: 37.5%

BioArctic is trading at SEK 217.6, significantly below its estimated fair value of SEK 348.11, suggesting potential undervaluation based on cash flows. The company recently secured a US$100 million upfront payment and up to US$1.25 billion in milestone payments from a licensing agreement with Bristol Myers Squibb, enhancing its cash flow prospects. Despite recent losses, BioArctic's revenue is forecasted to grow at 41.4% annually, surpassing market expectations and supporting future profitability projections within three years.

- The growth report we've compiled suggests that BioArctic's future prospects could be on the up.

- Get an in-depth perspective on BioArctic's balance sheet by reading our health report here.

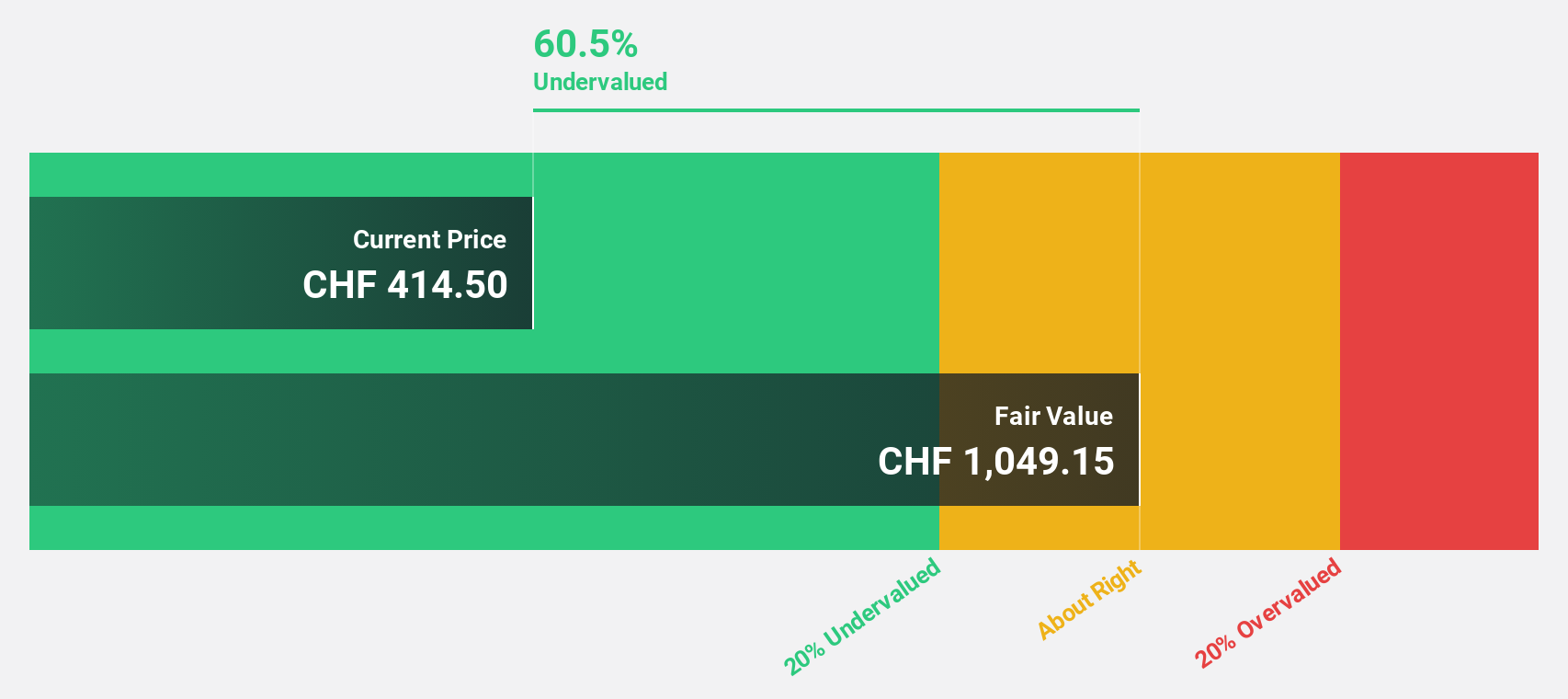

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF4.87 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies.

Operations: Ypsomed Holding generates revenue primarily from two segments: Ypsomed Diabetes Care, contributing CHF176.61 million, and Ypsomed Delivery Systems, accounting for CHF428.94 million.

Estimated Discount To Fair Value: 30.7%

Ypsomed Holding, trading at CHF 357, appears undervalued relative to its estimated fair value of CHF 515.29. Despite recent earnings challenges with net income dropping to CHF 0.0326 million for the half year ending September 2024, the company's earnings are forecasted to grow significantly at over 40% annually. This growth trajectory surpasses Swiss market expectations and is supported by innovative product approvals like the mylife YpsoPump in Canada, enhancing future revenue potential despite high debt levels.

- Insights from our recent growth report point to a promising forecast for Ypsomed Holding's business outlook.

- Click here to discover the nuances of Ypsomed Holding with our detailed financial health report.

Summing It All Up

- Click this link to deep-dive into the 887 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tikehau Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKO

Tikehau Capital

An alternative asset management group with €46.1 billion of assets under management (as of 30 June 2024).

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives