- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

European Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As European markets experience a boost from robust corporate earnings and optimism surrounding geopolitical resolutions, investors are increasingly looking towards dividend stocks as a potential source of steady income amid fluctuating interest rates. In this dynamic environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for those seeking stability and income in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.68% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 3.96% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.13% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.61% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.06% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.50% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.58% | ★★★★★★ |

| Afry (OM:AFRY) | 4.04% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. is a financial institution offering a range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and globally, with a market cap of €58.99 billion.

Operations: ING Groep N.V.'s revenue is primarily derived from its Wholesale Banking segment (€6.29 billion), Retail Banking in the Netherlands (€4.83 billion), Retail Banking Other regions (€4.57 billion), Retail Banking Germany (€2.67 billion), and Retail Banking Belgium (€2.50 billion).

Dividend Yield: 5.1%

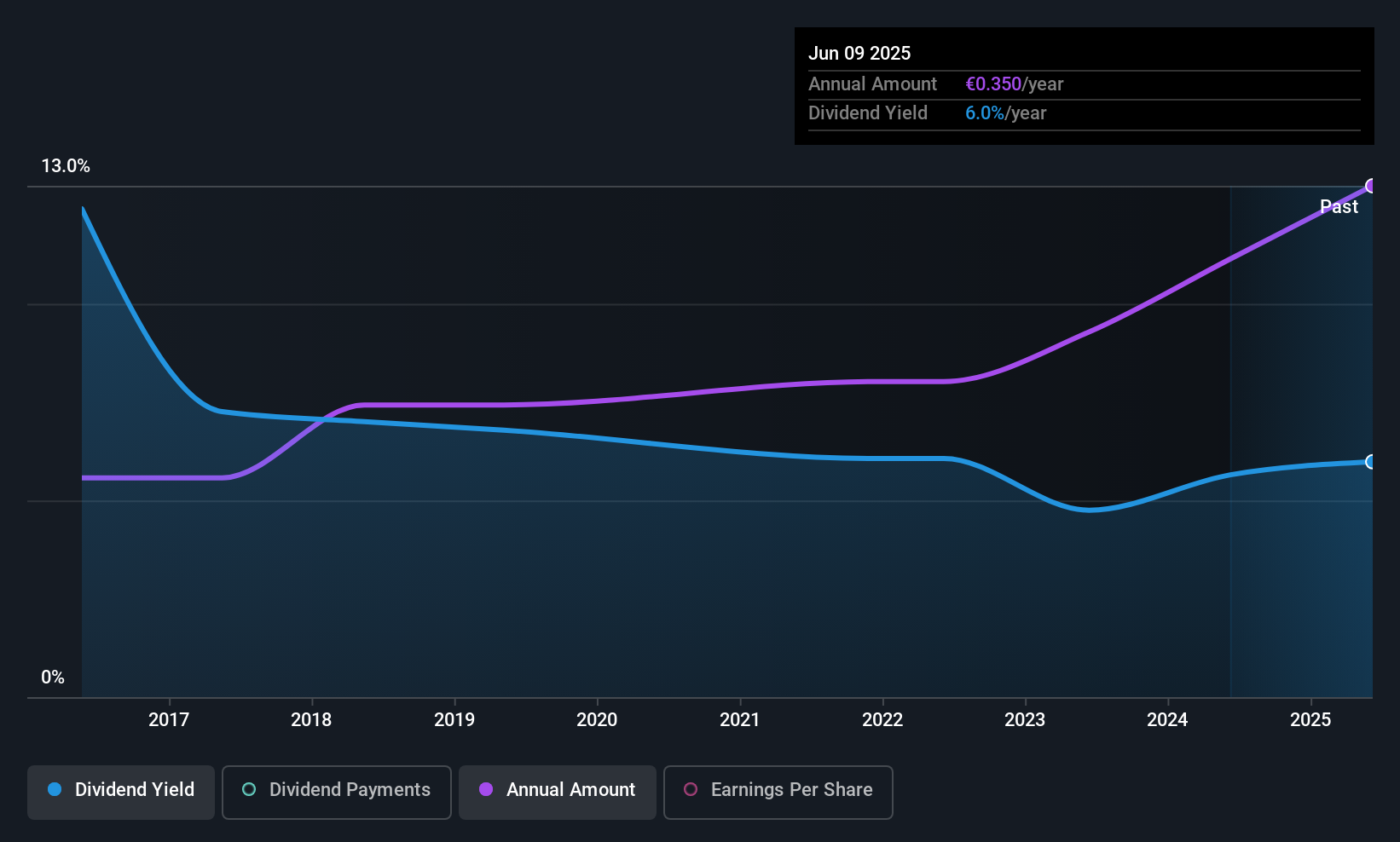

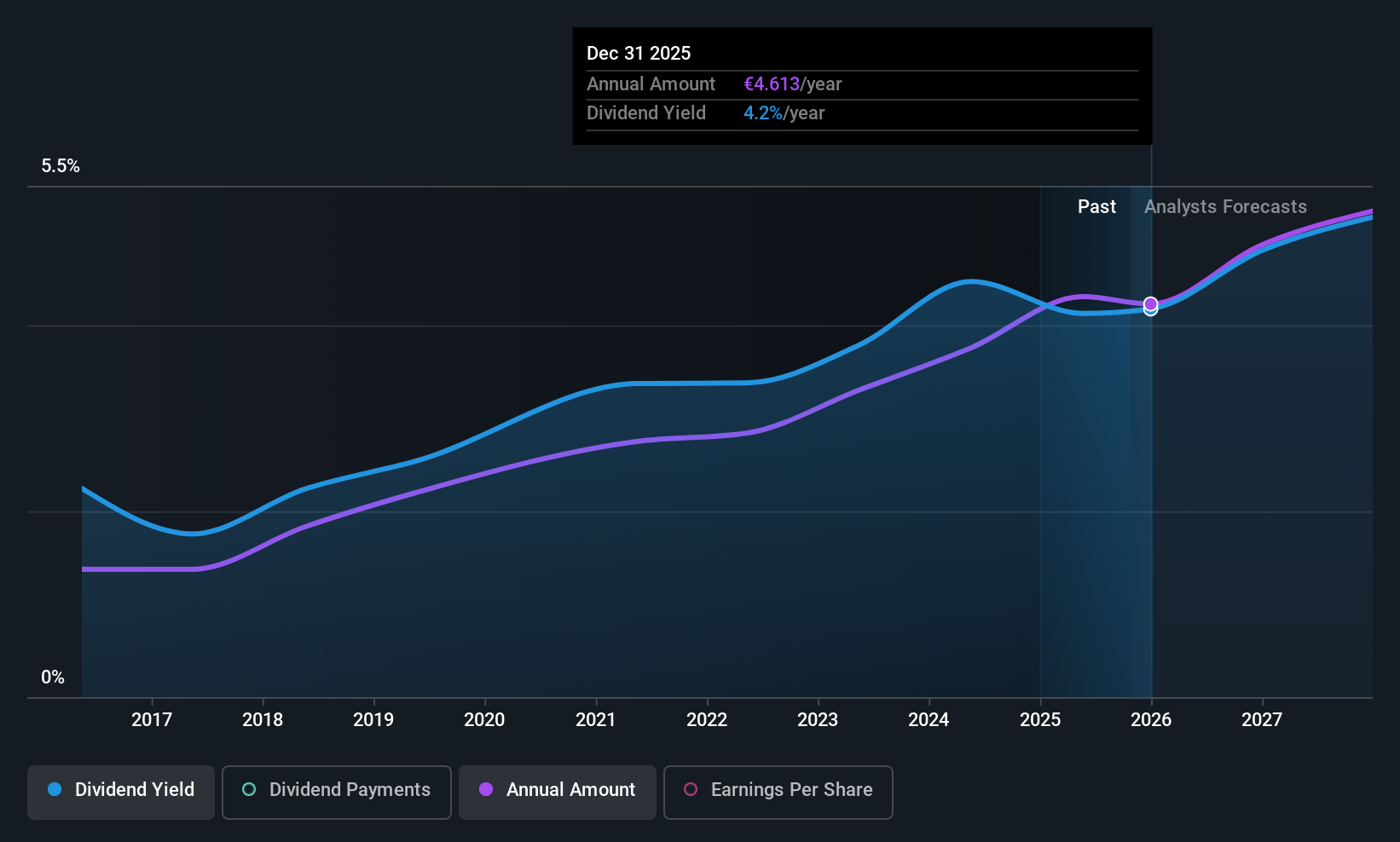

ING Groep's recent earnings report shows a decline in net interest income and net income compared to the previous year, with a current payout ratio of 68.6% indicating dividends are covered by earnings. The company has announced an interim cash dividend of €0.35 per share for the first half of 2025, despite its historically volatile dividend track record. Additionally, ING completed a share buyback worth €738 million, enhancing shareholder value amidst executive changes with the CFO set to depart in 2026.

- Get an in-depth perspective on ING Groep's performance by reading our dividend report here.

- The analysis detailed in our ING Groep valuation report hints at an inflated share price compared to its estimated value.

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €206.50 million.

Operations: Toyota Caetano Portugal, S.A. generates its revenue primarily from the domestic commercialization of motor vehicles (€824.71 million), followed by external motor vehicle industry sales (€70.01 million), domestic industrial equipment rental (€13.96 million), and various other segments including services and machine sales both domestically and abroad.

Dividend Yield: 5.9%

Toyota Caetano Portugal's dividend payments are well-supported by cash flows, reflected in a low cash payout ratio of 24%, and earnings, with a payout ratio of 44.1%. Despite being in the top 25% for yield in Portugal at 5.93%, its dividend history is marked by volatility, including drops over 20% annually. The stock trades significantly below its fair value estimate, but investors should be cautious due to its unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Toyota Caetano Portugal.

- Upon reviewing our latest valuation report, Toyota Caetano Portugal's share price might be too pessimistic.

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in the construction and concessions sectors across France, Europe, and internationally, with a market cap of €11.27 billion.

Operations: Eiffage SA's revenue segments include Concessions (€4.14 billion), Construction (€4.08 billion), Energy Systems (€7.24 billion), and Infrastructures (€8.75 billion).

Dividend Yield: 3.8%

Eiffage's dividend payments are well-supported by earnings and cash flows, with payout ratios of 42.5% and 15.6%, respectively, though its dividend history is marked by volatility. Trading at 31% below estimated fair value and offering a modest yield of 3.85%, it still falls short compared to top French payers. Recent contract wins, such as the Frontex headquarters project in Warsaw, highlight operational strength but don't directly address dividend reliability concerns due to high debt levels.

- Dive into the specifics of Eiffage here with our thorough dividend report.

- Our valuation report unveils the possibility Eiffage's shares may be trading at a discount.

Key Takeaways

- Explore the 221 names from our Top European Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives