- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

Figeac Aero (ENXTPA:FGA) Returns to Profit in H2 2025, Testing Turnaround Optimism

Reviewed by Simply Wall St

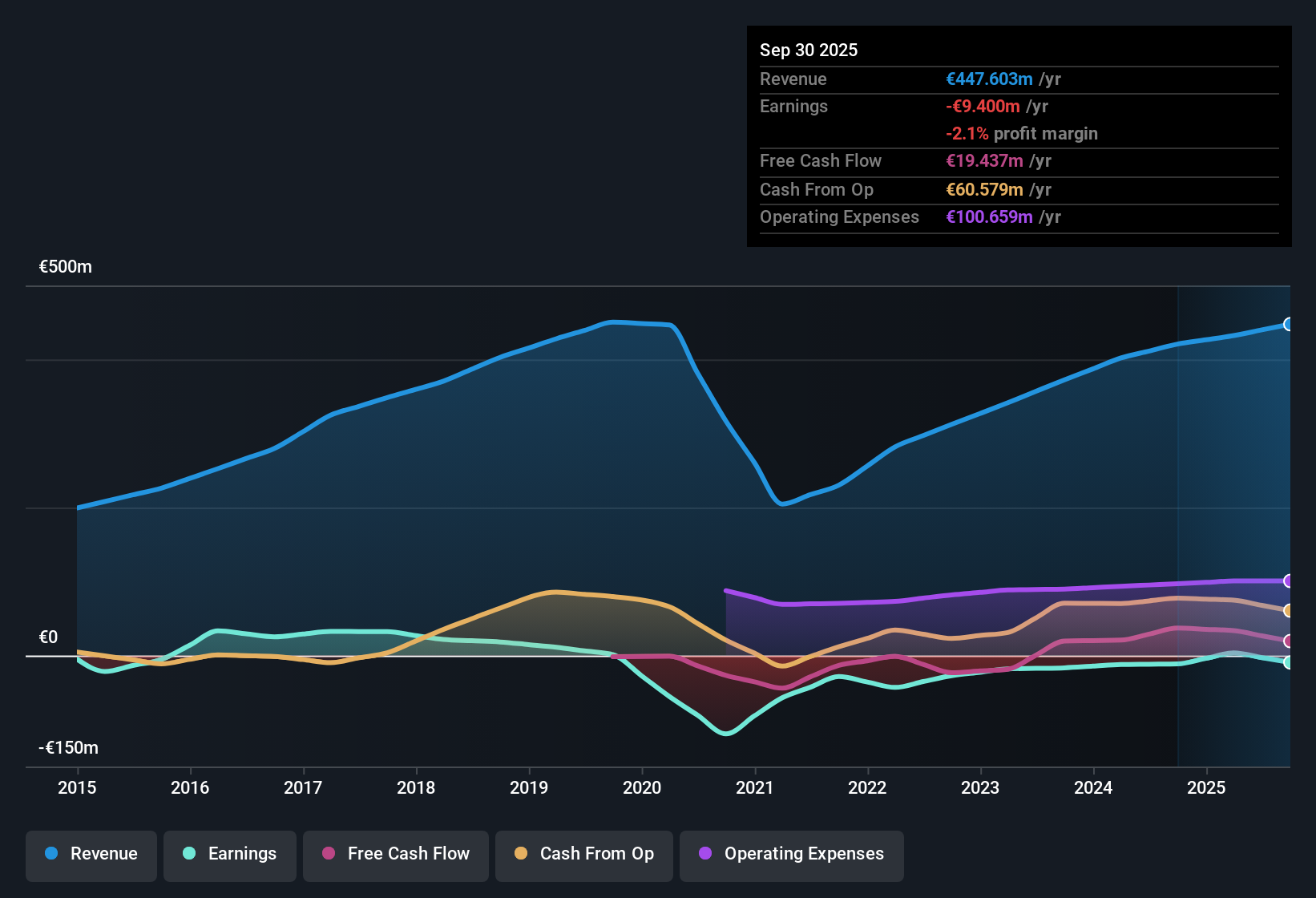

Figeac Aero Société Anonyme (ENXTPA:FGA) has kicked off H1 2026 earnings season with a fresh look at its turnaround story, coming off H2 2025 revenue of about €232 million and net income of roughly €8 million, translating into EPS of €0.19. The company has seen revenue move from about €221 million in H2 2024 to €200 million in H1 2025 and then €232 million in H2 2025, while EPS has tracked from a loss of €0.17 in H2 2024 to a loss of €0.11 in H1 2025 before swinging to a €0.19 profit in H2 2025. This sets the stage for investors to weigh a still fragile margin profile against a backdrop of rapid forecast growth.

See our full analysis for Figeac Aero Société Anonyme.With the latest numbers on the table, the next step is to see how this evolving profitability picture lines up with the prevailing narratives about Figeac Aero's growth prospects and earnings trajectory.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow, But Trailing 12-Month Net Still Negative

- On a trailing 12 month basis Figeac Aero generated about €447.6 million in revenue but still posted a net loss of roughly €9.4 million, showing that higher sales have not yet translated into consistent profitability.

- What stands out against a cautiously bullish view is that recent semi annual profits are not enough to offset longer term losses, even though:

- Net income improved from about negative €11.3 million to positive €3.6 million on a trailing basis between early and late 2025, yet the latest trailing period has swung back to a €9.4 million loss.

- Despite this, bulls point to earnings having grown about 52 percent per year over the last five years and being forecast to grow 86.62 percent per year, which depends on the company turning these improving spots into durable profitability.

Revenue Growth Outpaces French Market

- Revenue is forecast to grow around 11.6 percent per year, more than double the 5.4 percent per year expected for the French market, suggesting the business is projected to expand faster than many domestic peers.

- This faster top line profile strongly backs a bullish narrative that sees Figeac Aero as a growth name. Yet the numbers also underline execution risk:

- Bulls highlight that losses have been shrinking by about 52 percent per year over the past five years, which pairs with the 11.6 percent annual revenue growth forecast as a case for operating leverage over time.

- At the same time, the fact that the latest trailing 12 month period still shows a €9.4 million loss means that the expected move to profitability within three years requires the company to keep meeting or beating these growth assumptions.

Valuation Sits Well Below DCF Fair Value

- The shares trade around €10.60 with a price to sales ratio near 1x, versus an industry average of 2.2x and peer levels near 6.1x, while a DCF fair value of about €28.88 implies a large valuation gap.

- That discount gives bulls and bears very different talking points around the same figures:

- Supporters argue that trading roughly 63.3 percent below the DCF fair value leaves room for re rating if the company delivers on its forecast 86.62 percent annual earnings growth and reaches profitability within three years.

- More cautious investors point out that the trailing 12 month net loss of about €9.4 million shows the business is still in the red today, so the low 1x sales multiple may simply reflect the work left to turn forecast growth into steady profits.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Figeac Aero Société Anonyme's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Figeac Aero still carries a trailing net loss and fragile margins. This means its recovery relies heavily on optimistic growth forecasts and flawless execution.

If you would rather not hinge your portfolio on an unproven turnaround, use our stable growth stocks screener (2089 results) to focus on companies already delivering consistent, dependable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026