Is It Too Late to Invest in BNP Paribas After Its 46.9% One Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether BNP Paribas still offers good value after such a strong run, or if you might be arriving late to the opportunity, this is a good place to unpack what the current share price implies.

- The stock has climbed 3.9% over the last week, 16.5% in the past month and 32.8% year to date, adding up to a 46.9% gain over 1 year and 152.7% over 5 years. That naturally raises questions about how much upside may remain from here.

- These moves have come as European banks have experienced a more supportive rate outlook and improving sentiment toward large universal banks, which tends to favor well capitalised names like BNP Paribas. Investors are also responding to the group sharpening its strategic focus and capital returns, which has helped re rate the stock while still leaving room for a valuation discussion.

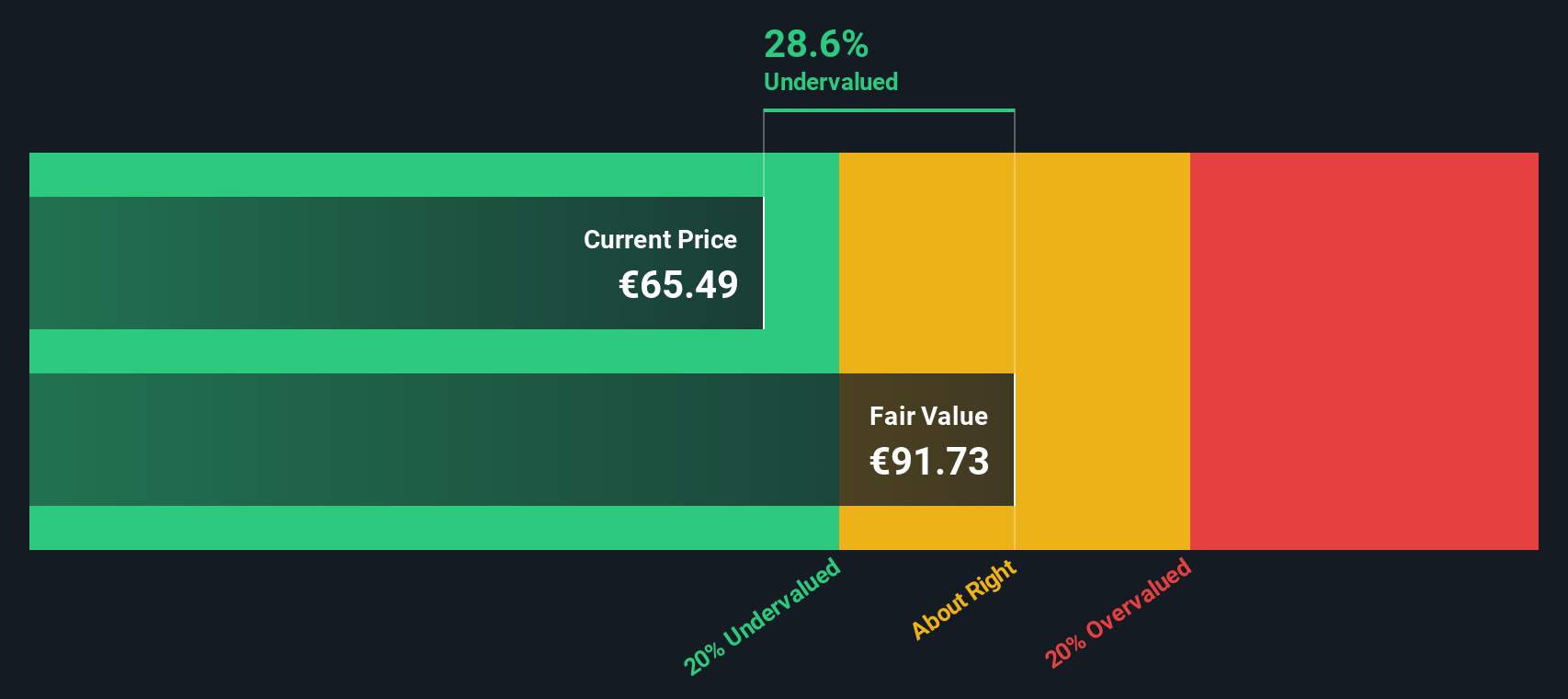

- Even after this rally, BNP Paribas scores a 4/6 valuation check, suggesting it still appears undervalued on several measures, though not all. Next we break down what that means under different valuation approaches, before circling back to a way of thinking about fair value that ties them together.

Find out why BNP Paribas's 46.9% return over the last year is lagging behind its peers.

Approach 1: BNP Paribas Excess Returns Analysis

The Excess Returns model asks whether BNP Paribas can consistently earn more on its equity than investors require as compensation for risk. Instead of focusing on headline earnings, it compares the bank's return on equity with its cost of equity and projects how this gap develops over time.

For BNP Paribas, the average return on equity is estimated at 10.30%, based on analyst forecasts. This supports a stable earnings power of about €11.82 per share, drawn from weighted future Return on Equity estimates from 14 analysts. However, the implied cost of equity is higher, at around €14.10 per share, leaving an excess return of roughly €-2.29 per share. On the balance sheet side, the current book value is €111.07 per share, expected to rise slightly to a stable book value of €114.66 per share using forecasts from 9 analysts.

Even with a negative excess return, the model still produces an intrinsic value of about €92.24 per share, implying the stock trades at roughly a 14.7% discount. On this framework, BNP Paribas appears undervalued rather than fully priced.

Result: UNDERVALUED

Our Excess Returns analysis suggests BNP Paribas is undervalued by 14.7%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: BNP Paribas Price vs Earnings

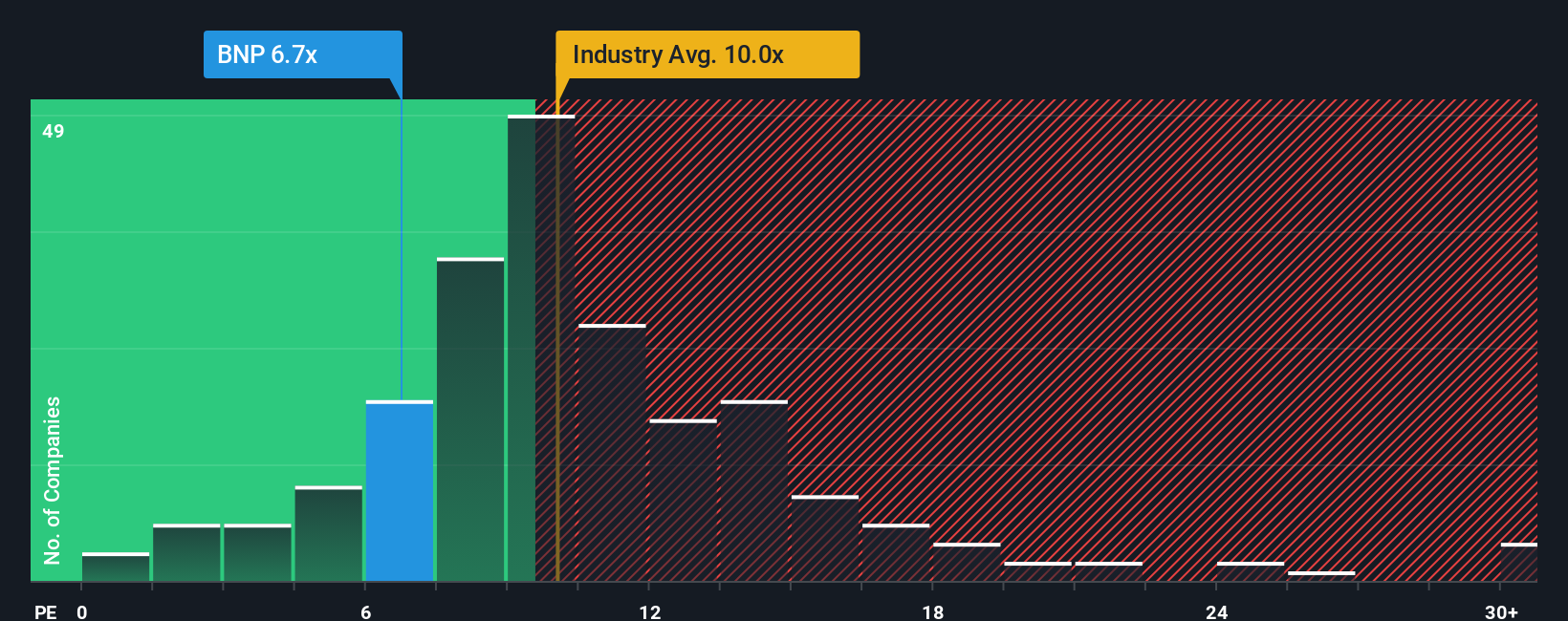

For a profitable bank like BNP Paribas, the price to earnings ratio is a practical way to gauge how much investors are paying for each euro of earnings today. It naturally captures how the market weighs current profitability against expectations for future growth and the risks attached to those earnings.

In general, stronger and more predictable earnings growth tends to justify a higher PE ratio, while higher risk or lower growth usually pulls that multiple down. BNP Paribas currently trades on about 8.0x earnings, compared with a Banks industry average of roughly 10.7x and a peer group average of around 9.1x. On those simple comparisons, the shares still look relatively modestly priced.

Simply Wall St’s Fair Ratio framework goes a step further by asking what PE multiple would make sense for BNP Paribas once you factor in its earnings growth profile, profit margins, risk indicators, industry positioning and market cap. This produces a Fair Ratio of about 8.4x, which is more tailored than a blunt peer or sector comparison. Since the current PE of 8.0x sits below this Fair Ratio, the shares look slightly undervalued rather than stretched.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BNP Paribas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St's Community page that helps you connect your view of a company with a full financial forecast and a Fair Value you can compare to today’s price, and that then keeps updating dynamically as new news or earnings arrive.

Do you think there's more to the story for BNP Paribas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BNP Paribas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BNP

BNP Paribas

Provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion