- France

- /

- Auto Components

- /

- ENXTPA:ML

Is Michelin Turning into a Value Opportunity After Recent Specialty and Premium Segment Expansion?

Reviewed by Bailey Pemberton

- Investors may be wondering whether Compagnie Générale des Établissements Michelin Société en commandite par actions is quietly turning into a value opportunity, or if the market already reflects its true worth.

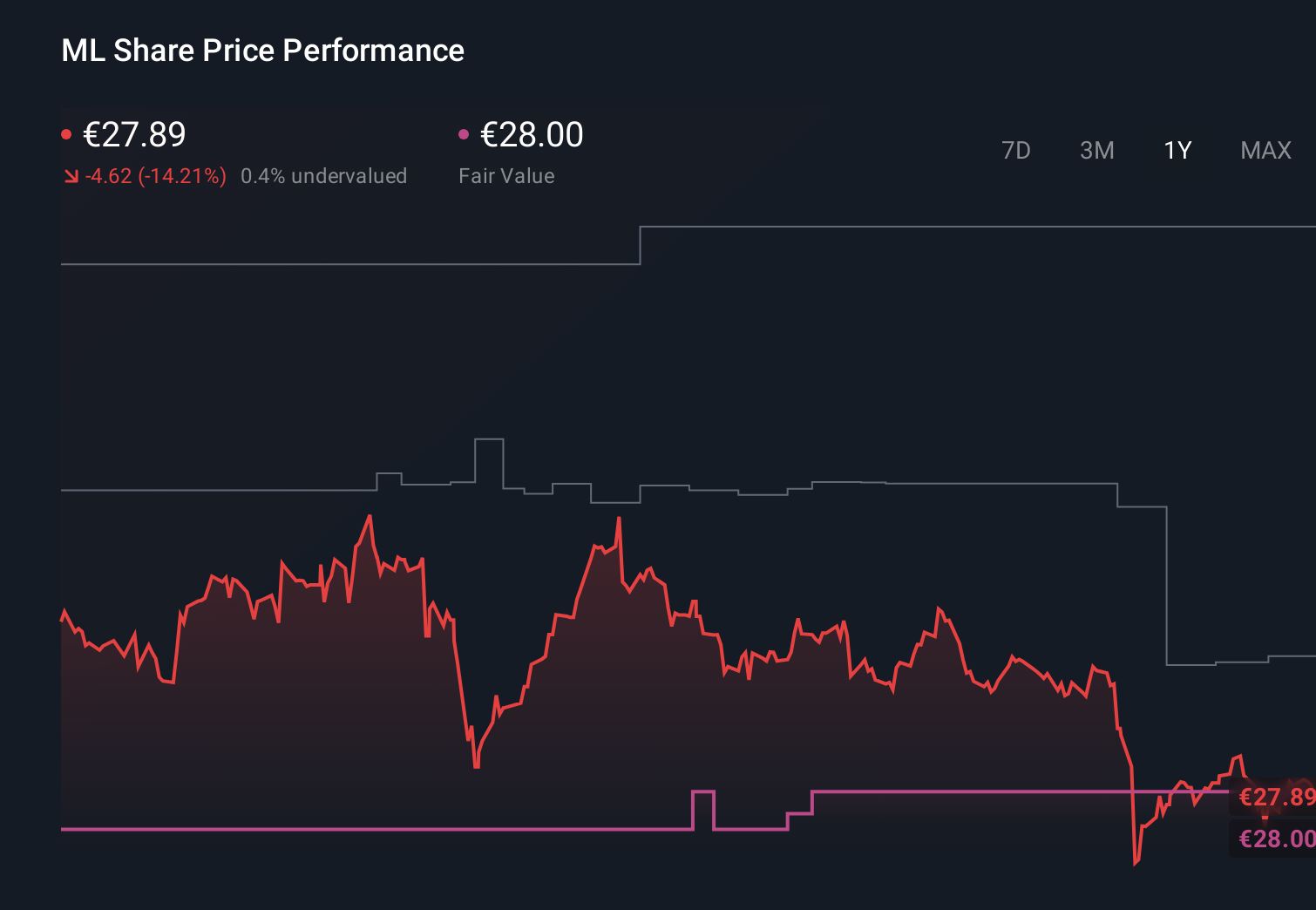

- The share price is down 0.3% over the last week, 3.4% over the past month and 13.3% year to date. However, it is still up 18.9% over three years and 22.2% over five years, which suggests a mix of recent pessimism and longer term resilience.

- Recent headlines have focused on Michelin's push into higher value specialty and premium segments, alongside continued investment in sustainable mobility and materials innovation. At the same time, the company has been in the news for portfolio streamlining and strategic partnerships designed to support margins and long term growth.

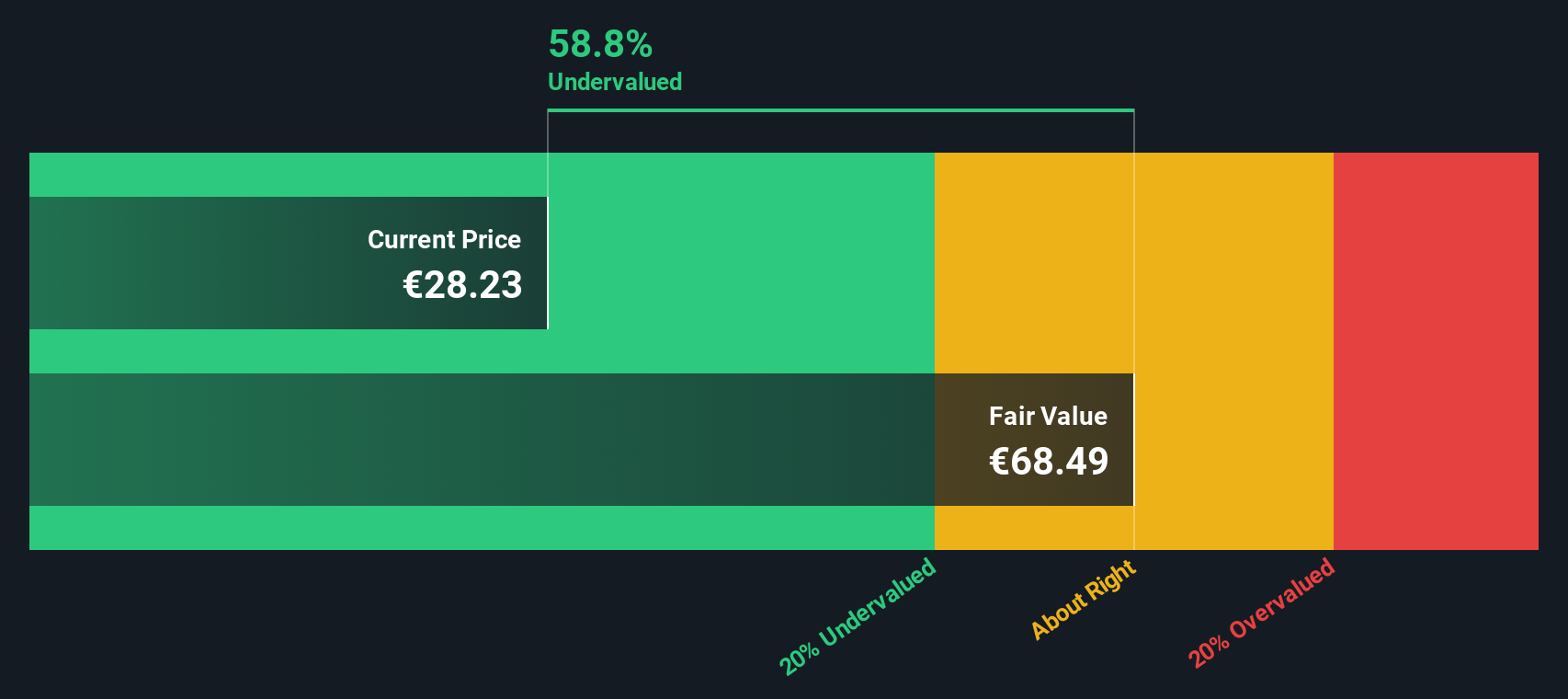

- On our valuation checks, Michelin scores a solid 5/6. Next, we will break down what different valuation methods indicate about that score, before finishing with a more holistic way to think about the stock's true value.

Approach 1: Compagnie Générale des Établissements Michelin Société en commandite par actions Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Michelin, the model used is a 2 stage Free Cash Flow to Equity approach based on cash flow projections.

The company generated trailing twelve month free cash flow of about €1.36 billion, and analysts see this rising to roughly €1.83 billion by 2027. Beyond the explicit analyst horizon, Simply Wall St extrapolates further growth, with free cash flow estimates reaching around €2.45 billion by 2035 as the business scales and margins improve.

When all of these projected cash flows are discounted back to the present, the model indicates an intrinsic value of about €44.42 per share. Compared with the current market price, this implies the stock is trading at roughly a 37.2% discount to its estimated fair value, which indicates potential undervaluation if the cash flow trajectory is achieved.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Compagnie Générale des Établissements Michelin Société en commandite par actions is undervalued by 37.2%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Compagnie Générale des Établissements Michelin Société en commandite par actions Price vs Earnings

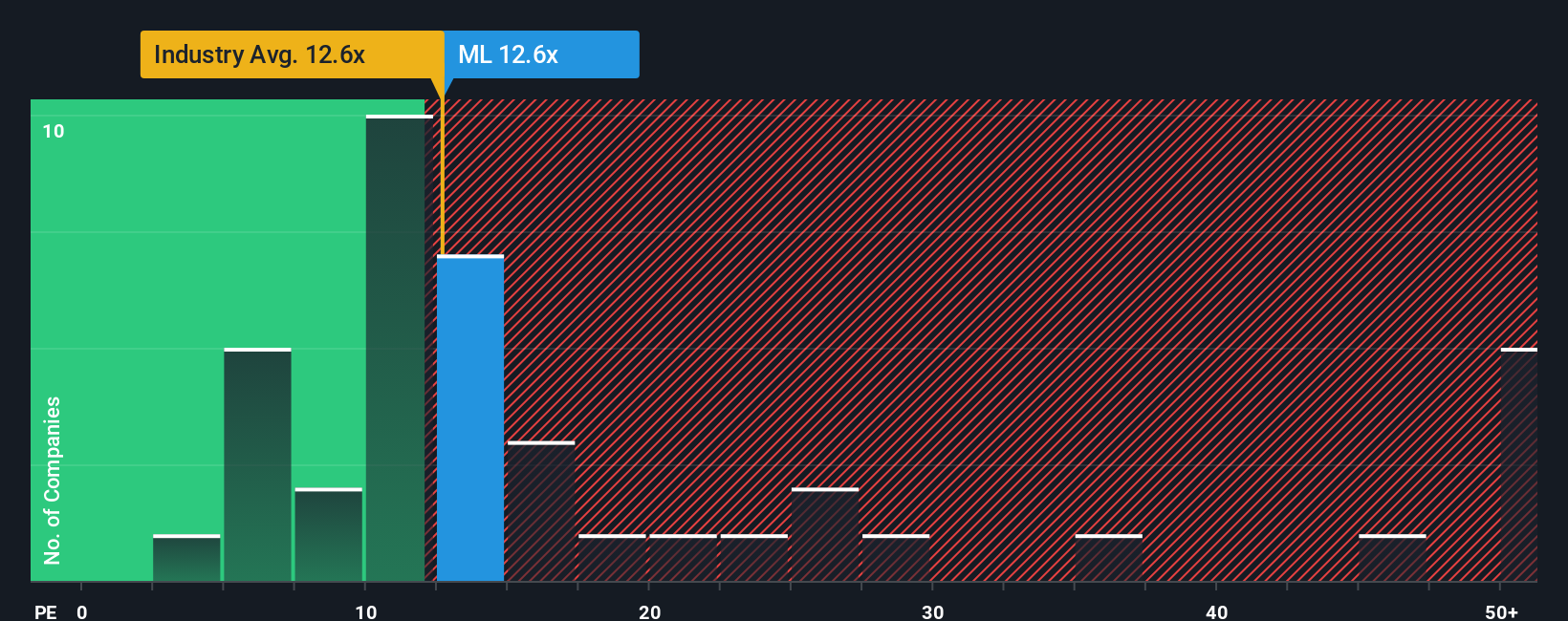

For a mature, consistently profitable business like Michelin, the price to earnings ratio is a natural way to judge value, because it links what investors pay directly to the profits the company is generating today.

In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE multiple, while slower growing or riskier firms usually trade on lower multiples. Michelin currently trades on a PE of about 12.3x, which is below both the Auto Components industry average of roughly 20.3x and the peer group average of around 17.3x. This suggests the market prices its earnings more conservatively than many competitors.

Simply Wall St also calculates a Fair Ratio of 12.7x, a proprietary estimate of what PE Michelin should trade on given its earnings growth outlook, margins, industry, market cap and risk profile. This is more tailored than a simple comparison against peers or the sector, because it adjusts for company specific strengths and vulnerabilities. With the Fair Ratio only slightly above the current PE, Michelin screens as modestly cheap rather than deeply discounted on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Compagnie Générale des Établissements Michelin Société en commandite par actions Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you attach a clear story to your numbers. You can connect your view of Michelin’s future revenues, earnings and margins to a financial forecast and, ultimately, to a fair value that you can compare with today’s share price to help you decide whether to buy, hold or sell. The platform keeps that Narrative updated as new news or earnings arrive. For example, a bullish investor might build a Narrative that leans toward the higher analyst target of €43 based on confidence in premium mix and margin expansion. A more cautious investor could anchor their Narrative closer to the lower €28 target, emphasizing regulatory and competitive risks. Both perspectives are transparently linked to their own assumptions rather than a single static model.

Do you think there's more to the story for Compagnie Générale des Établissements Michelin Société en commandite par actions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion