WithSecure Oyj's (HEL:WITH) Share Price Boosted 25% But Its Business Prospects Need A Lift Too

WithSecure Oyj (HEL:WITH) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

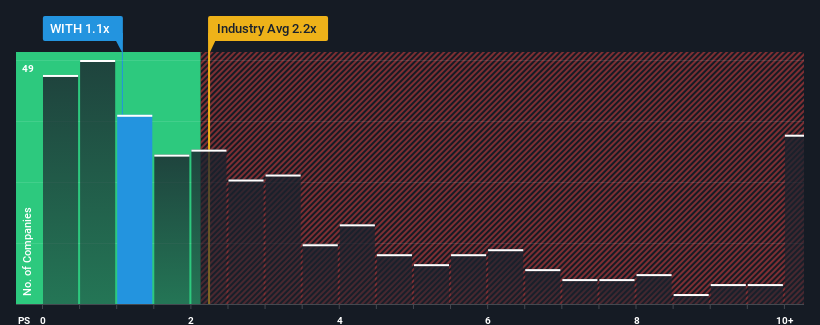

Although its price has surged higher, it would still be understandable if you think WithSecure Oyj is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.1x, considering almost half the companies in Finland's Software industry have P/S ratios above 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for WithSecure Oyj

How WithSecure Oyj Has Been Performing

WithSecure Oyj could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on WithSecure Oyj.Do Revenue Forecasts Match The Low P/S Ratio?

WithSecure Oyj's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.2%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 4.0% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.4% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15% each year, which is noticeably more attractive.

With this information, we can see why WithSecure Oyj is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From WithSecure Oyj's P/S?

WithSecure Oyj's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of WithSecure Oyj's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for WithSecure Oyj with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on WithSecure Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WithSecure Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:WITH

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)