European markets have recently shown resilience, with the STOXX Europe 600 Index climbing 2.77% amid easing trade tensions between the U.S. and China, providing a positive backdrop for investors. In such a climate, penny stocks—though an older term—remain relevant as they often represent smaller or less-established companies that can offer substantial value when backed by solid financials. By identifying those with strong balance sheets and clear growth potential, investors may uncover opportunities in this niche segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.16 | SEK2.07B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.60 | SEK237.06M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Tesgas (WSE:TSG) | PLN2.59 | PLN29.4M | ✅ 2 ⚠️ 3 View Analysis > |

| IMS (WSE:IMS) | PLN3.65 | PLN123.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.60 | €54.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.48M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €3.955 | €22.9M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.21 | €305.12M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 431 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Innate Pharma (ENXTPA:IPH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innate Pharma S.A. is a biotechnology company focused on developing immunotherapies for cancer patients both in France and internationally, with a market cap of €153.21 million.

Operations: The company generates revenue from its biotechnology segment, amounting to €20.12 million.

Market Cap: €153.21M

Innate Pharma's recent financial performance highlights challenges typical of penny stocks, with a significant net loss of €49.47 million for 2024 and declining revenue from €61.64 million to €20.12 million year-over-year, indicating volatility in its earnings stream. Despite being unprofitable, the company maintains a strong cash position exceeding its total debt and has a cash runway exceeding three years based on current free cash flow. The recent completion of a €15 million equity offering suggests efforts to bolster financial stability amid ongoing development activities, including the FDA Breakthrough Therapy Designation for lacutamab targeting Sézary Syndrome, potentially enhancing future prospects.

- Unlock comprehensive insights into our analysis of Innate Pharma stock in this financial health report.

- Learn about Innate Pharma's future growth trajectory here.

Nurminen Logistics Oyj (HLSE:NLG1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nurminen Logistics Oyj offers logistics services across Finland, Russia, Sweden, and the Baltic countries with a market cap of €87.40 million.

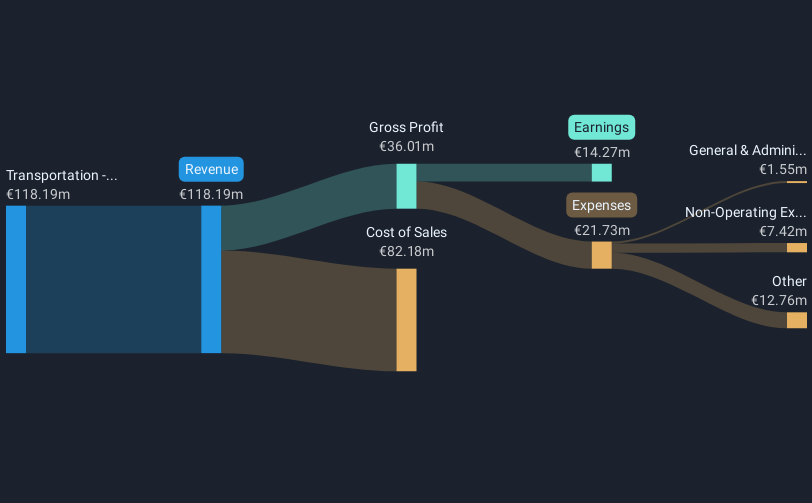

Operations: The company generates revenue primarily from its Transportation - Trucking segment, which amounts to €102.01 million.

Market Cap: €87.4M

Nurminen Logistics Oyj's recent performance reflects the complexities often seen in penny stocks, with first-quarter sales decreasing to €32.42 million from €35.17 million year-over-year and net income dropping to €1.69 million from €2.44 million. Despite this, the company maintains a satisfactory net debt to equity ratio of 22.3%, and its interest payments are well-covered by EBIT at 4.8 times coverage, indicating financial resilience amid challenges. The board's recent appointments aim to strengthen governance as the company forecasts growth in revenue and operating profit driven by expanding railway operations in its market areas for 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Nurminen Logistics Oyj.

- Evaluate Nurminen Logistics Oyj's prospects by accessing our earnings growth report.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Financial Health Rating: ★★★★★☆

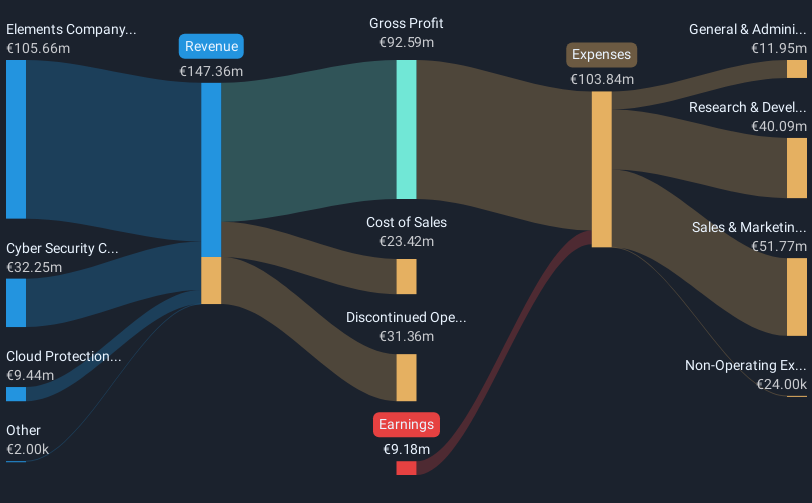

Overview: WithSecure Oyj operates globally in the corporate security sector and has a market cap of €161.96 million.

Operations: Revenue segments for WithSecure Oyj are not reported.

Market Cap: €161.96M

WithSecure Oyj, while navigating the challenges typical of penny stocks, showcases a strategic focus on enhancing its cybersecurity offerings through partnerships like the one with Stellar Cyber. Despite reporting a net loss of €3.58 million in Q1 2025, sales increased to €30.09 million from €28.82 million year-over-year, indicating potential revenue growth amid ongoing losses. The company maintains financial stability with short-term assets exceeding liabilities and a cash runway sufficient for over three years. Additionally, WithSecure's recent share repurchase program underscores confidence in its market valuation and commitment to shareholder value enhancement despite current unprofitability.

- Click to explore a detailed breakdown of our findings in WithSecure Oyj's financial health report.

- Assess WithSecure Oyj's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click here to access our complete index of 431 European Penny Stocks.

- Looking For Alternative Opportunities? We've found 23 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPH

Innate Pharma

Operates as a biotechnology company that develops immunotherapies for cancer patients in France and internationally.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives