- Poland

- /

- Entertainment

- /

- WSE:CDR

European Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

Amidst concerns about global growth and a stronger euro, the European markets have shown mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower. In this environment, stocks with high insider ownership often attract attention as they suggest confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's explore several standout options from the results in the screener.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WithSecure Oyj operates in the corporate security business globally, with a market cap of €297.89 million.

Operations: The company's revenue segments include Elements Company at €105.12 million and Cloud Protection for Salesforce at €12.01 million.

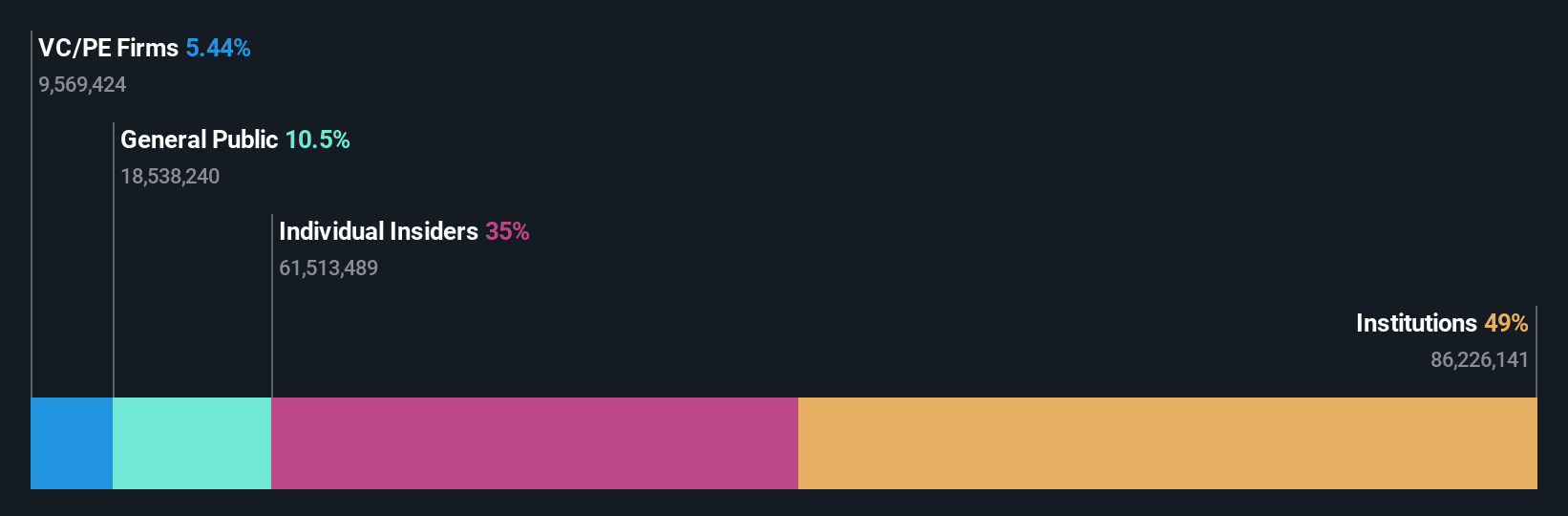

Insider Ownership: 35.1%

WithSecure Oyj, a company experiencing insider buying without substantial selling, is undergoing significant restructuring to enhance its Managed Services business. Recent changes are expected to save €6.5 million annually despite incurring €2.8 million in one-off expenses. WithSecure's earnings show improvement potential with forecasted revenue growth of 5.7% annually, surpassing the Finnish market average of 4%. Additionally, a tender offer led by CVC Capital Partners values WithSecure at approximately €300 million, indicating strategic interest and potential for future growth.

- Click here to discover the nuances of WithSecure Oyj with our detailed analytical future growth report.

- Our valuation report unveils the possibility WithSecure Oyj's shares may be trading at a premium.

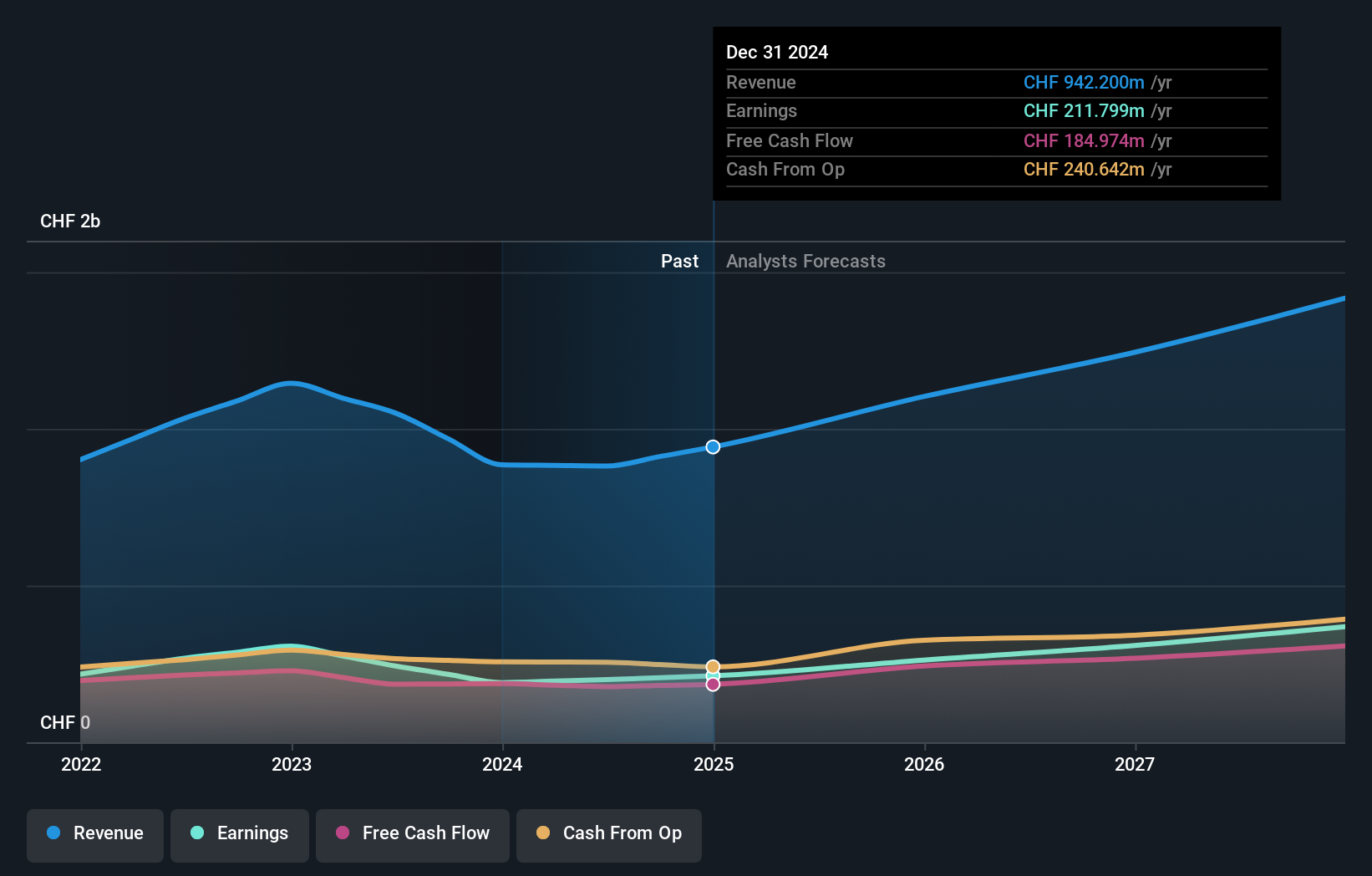

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VAT Group AG, along with its subsidiaries, specializes in the development, manufacturing, and sale of vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows with a market capitalization of CHF8.61 billion.

Operations: The company's revenue is primarily derived from its Valves segment at CHF946.68 million and Global Service segment at CHF172.14 million.

Insider Ownership: 10.2%

VAT Group is experiencing steady growth with earnings projected to increase by 16.64% annually, outpacing the Swiss market's forecast. Despite no recent insider trading activity, the company's revenue is expected to grow at 10.7% per year, surpassing market averages. Recent executive changes saw Finn Felsberg depart as EVP of Semiconductor Solutions, succeeded temporarily by CEO Urs Gantner. VAT reported a rise in half-year sales and net income, reflecting its strong market position and strategic business expansion efforts.

- Unlock comprehensive insights into our analysis of VAT Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that VAT Group is priced higher than what may be justified by its financials.

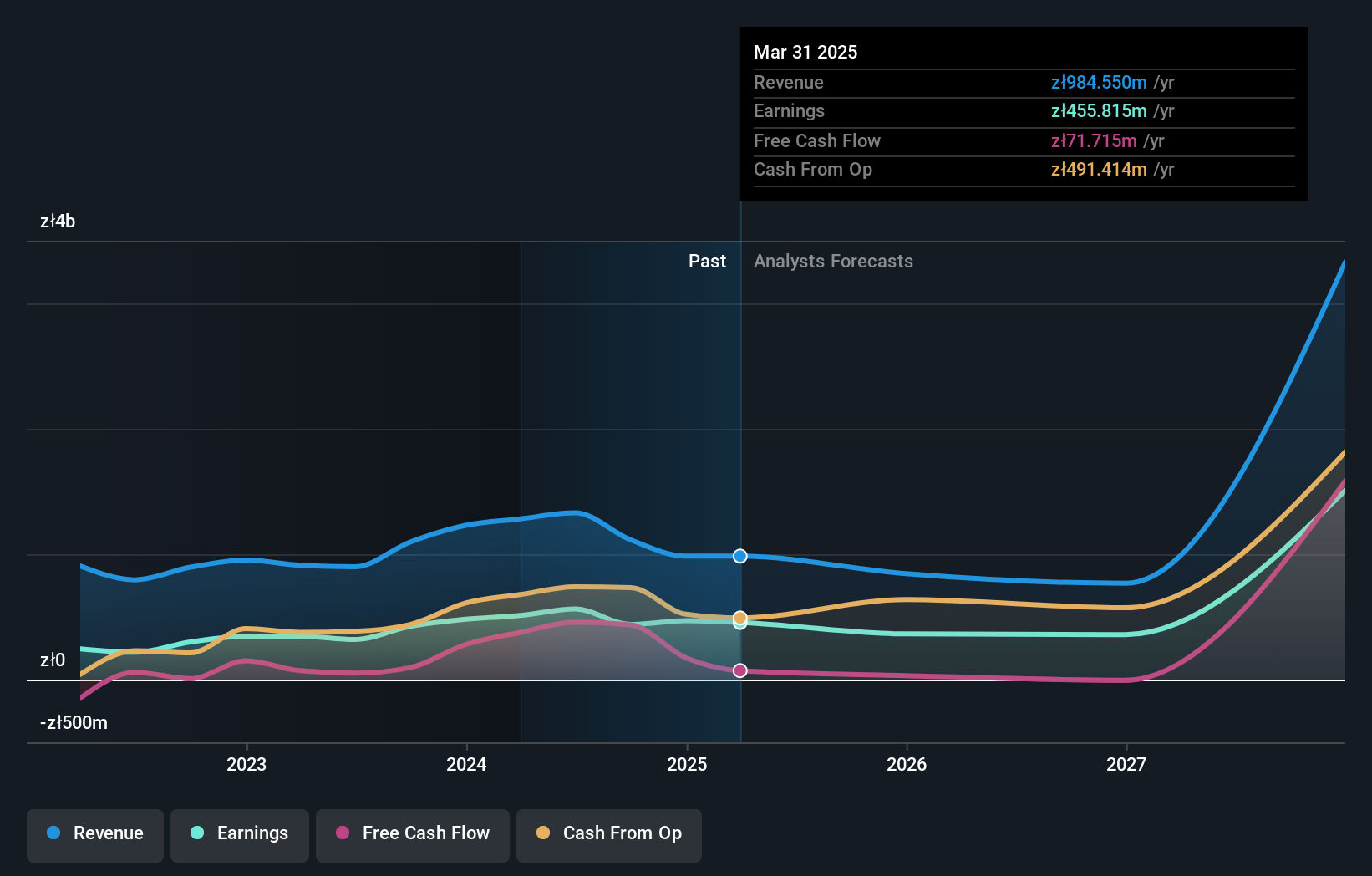

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and distributing video games for PCs and consoles in Poland, with a market cap of PLN25.48 billion.

Operations: The company's revenue is primarily derived from its segments CD PROJEKT RED, which contributes PLN812.26 million, and GOG.Com, which adds PLN205.97 million.

Insider Ownership: 29.7%

CD Projekt's revenue is forecast to grow at 35.1% annually, significantly outpacing the Polish market's 4.6% growth rate, while earnings are expected to rise by 42.7% per year. Despite a decline in half-year net income from PLN 170.01 million to PLN 154.96 million, the company remains undervalued at nearly 60% below its estimated fair value and boasts high-quality earnings with no recent insider trading activity reported over three months.

- Delve into the full analysis future growth report here for a deeper understanding of CD Projekt.

- Our expertly prepared valuation report CD Projekt implies its share price may be too high.

Turning Ideas Into Actions

- Discover the full array of 213 Fast Growing European Companies With High Insider Ownership right here.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives