- Finland

- /

- Paper and Forestry Products

- /

- HLSE:UPM

UPM (HLSE:UPM) Valuation After Launching Its Circular Renewable Black Carbon-Negative Packaging Pigment

Reviewed by Simply Wall St

UPM Kymmene Oyj (HLSE:UPM) just launched Circular Renewable Black, a carbon negative, NIR detectable pigment that finally makes deep black packaging fully recyclable, and it fits neatly with the group’s long term bio-based growth story.

See our latest analysis for UPM-Kymmene Oyj.

Despite this flurry of strategic moves, including the planned graphic paper joint venture with Sappi and ongoing portfolio reshaping, UPM Kymmene Oyj’s year to date share price return of minus 12.4 percent and three year total shareholder return of minus 20.86 percent suggest momentum has been weak. However, a modest 90 day share price return of 1.15 percent hints that sentiment may slowly be stabilising as investors reassess its long term bio-based growth story.

If this kind of circular, low carbon innovation has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With earnings now rebounding and the shares trading at a hefty discount to some intrinsic value estimates, the real question is whether UPM is still overlooked value or if the market already reflects its bio-based growth ambitions.

Most Popular Narrative: 7.7% Undervalued

Compared with the last close of €23.81, the most popular narrative sees modest upside based on a higher long term fair value and ambitious earnings recovery.

The analysts have a consensus price target of €27.127 for UPM-Kymmene Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €32.0, and the most bearish reporting a price target of just €21.0.

Want to know what kind of revenue path, margin rebuild, and future earnings multiple have to line up to make that upside stick? The full narrative spells out the bold assumptions that turn today’s modest discount into tomorrow’s potential rerating.

Result: Fair Value of €25.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural decline in communication papers and persistently high Finnish wood costs could squeeze margins and delay the earnings recovery that underpins that upside case.

Find out about the key risks to this UPM-Kymmene Oyj narrative.

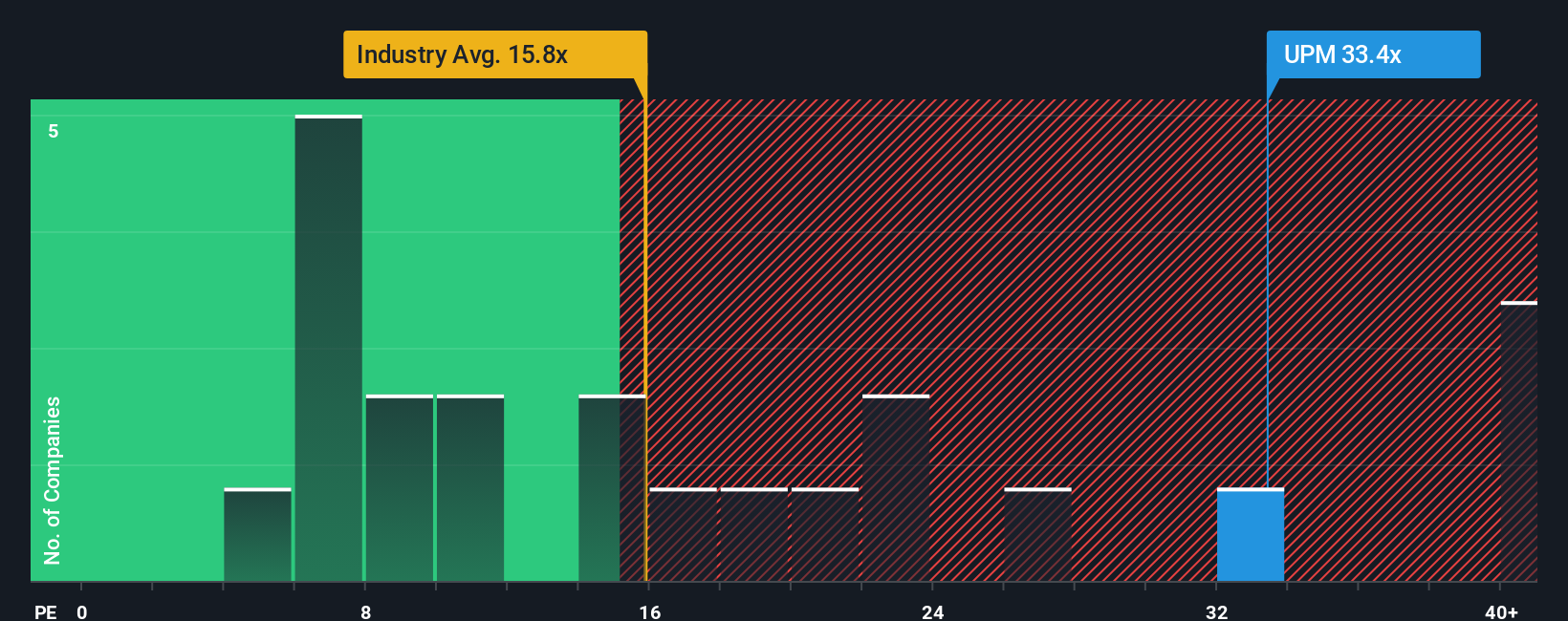

Another View: Multiples Paint a Tougher Picture

On earnings based valuation, UPM looks far less forgiving. Its price to earnings ratio of about 101 times dwarfs both the European forestry average of roughly 21 times and a fair ratio near 48 times, implying meaningful downside if sentiment normalises or earnings disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UPM-Kymmene Oyj Narrative

If this outlook does not quite fit your view or you prefer to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your UPM-Kymmene Oyj research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh prospects using our screeners, so you are not relying on just one stock to shape your returns.

- Capitalize on mispriced quality by targeting these 911 undervalued stocks based on cash flows that balance solid fundamentals with attractive entry points.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks blending medical innovation with intelligent automation.

- Amplify income potential by zeroing in on these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:UPM

UPM-Kymmene Oyj

Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)