- Finland

- /

- Paper and Forestry Products

- /

- HLSE:UPM

Does UPM’s Carbon-Negative Black Pigment Redefine Its Renewable Materials Story For UPM-Kymmene Oyj (HLSE:UPM)?

Reviewed by Sasha Jovanovic

- Earlier this month, UPM introduced UPM Circular Renewable Black™, a bio-based, near-infrared detectable, carbon-negative black pigment made from certified renewable lignin for fully recyclable, premium packaging.

- This pigment directly tackles the long-standing recyclability problem of conventional carbon black in packaging, potentially giving UPM an edge in sustainable materials for brand owners under growing environmental scrutiny.

- We’ll now examine how this breakthrough carbon-negative pigment could influence UPM’s investment narrative around renewable fibers and advanced materials.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

UPM-Kymmene Oyj Investment Narrative Recap

To own UPM today, you need to believe in its shift from legacy communication papers toward renewable fibers, advanced materials and decarbonization solutions, while it manages a heavy investment phase and modest recent profitability. The new Circular Renewable Black pigment reinforces the near term catalyst around Leuna’s biochemicals ramp up, but it does not materially change the biggest current risk, which is execution and cash flow strain during this capital intensive transition.

The announcement that UPM and Sappi intend to form a graphic paper joint venture is especially relevant here, because it aims to ring fence structurally declining communication paper exposure while UPM develops innovations like Circular Renewable Black at Leuna. Together, these moves frame a clearer story of UPM using new bio based products to grow in packaging and chemicals, while gradually reducing the drag from traditional graphic papers.

Yet while the pigment launch sounds exciting, investors should still pay close attention to the cash demands and timing risks around Leuna and the wider biorefinery program...

Read the full narrative on UPM-Kymmene Oyj (it's free!)

UPM-Kymmene Oyj's narrative projects €11.2 billion revenue and €1.3 billion earnings by 2028. This requires 3.0% yearly revenue growth and an earnings increase of about €955 million from €345.0 million today.

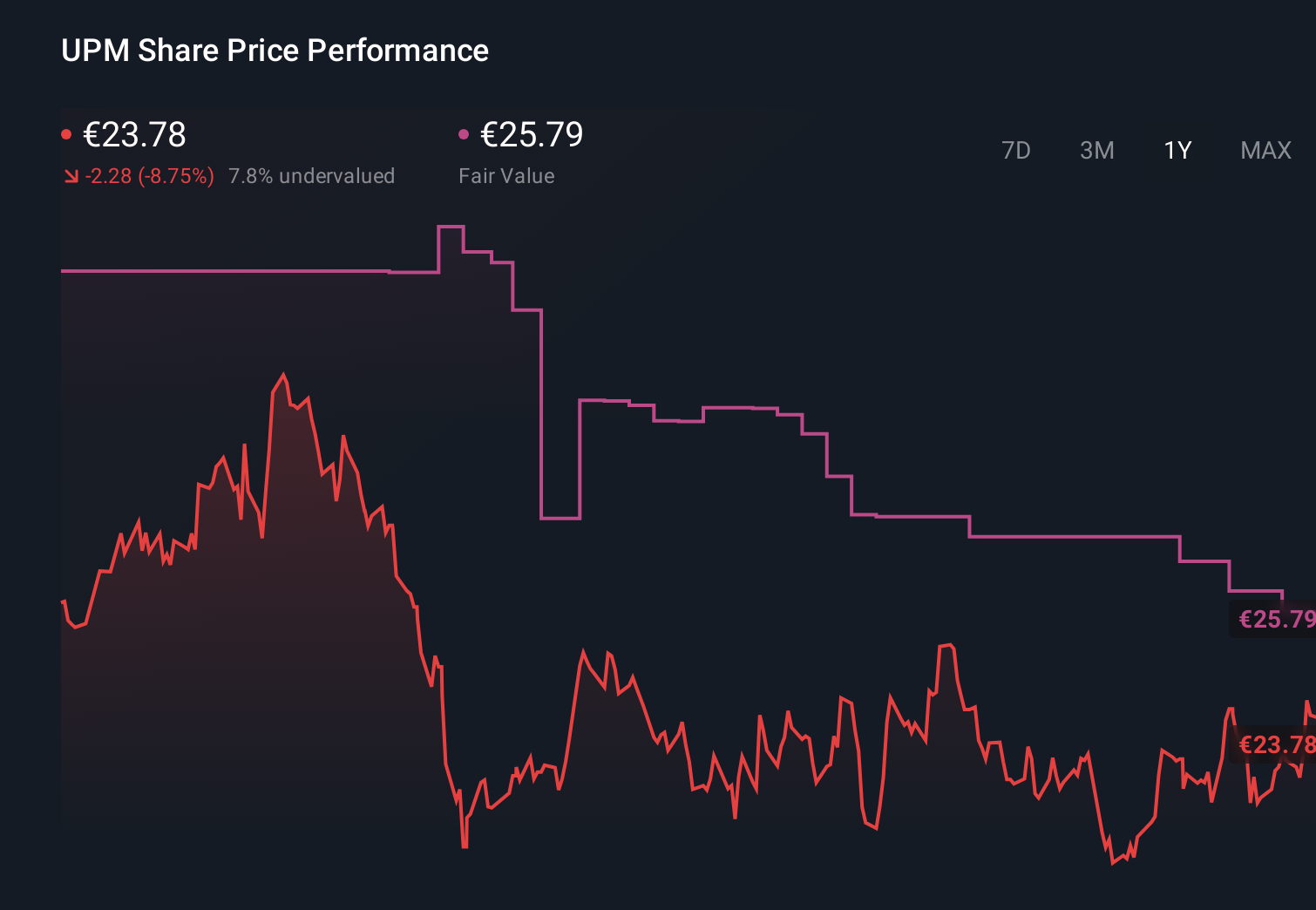

Uncover how UPM-Kymmene Oyj's forecasts yield a €25.79 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see UPM’s fair value between €18.20 and €44.33, highlighting very different expectations around upside. Against that spread, the company’s long investment cycle in projects like the €1.3B Leuna biorefinery raises real questions about how quickly any future earnings growth might flow through, so it is worth comparing several viewpoints before making up your mind.

Explore 4 other fair value estimates on UPM-Kymmene Oyj - why the stock might be worth 23% less than the current price!

Build Your Own UPM-Kymmene Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UPM-Kymmene Oyj research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UPM-Kymmene Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UPM-Kymmene Oyj's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:UPM

UPM-Kymmene Oyj

Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)