3 Noteworthy Stocks Estimated To Be Trading At A Discount Of Up To 49%

Reviewed by Simply Wall St

Amidst a mixed performance in global markets, with U.S. stocks closing a strong year despite recent volatility, investors are closely examining opportunities that may be trading below their intrinsic value. In such an environment, identifying undervalued stocks can be crucial, as they offer potential for growth when market conditions stabilize and economic indicators improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.90 | CN¥55.57 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.605 | £13.12 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.68 | CN¥43.25 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥42.00 | 49.9% |

| AeroEdge (TSE:7409) | ¥1763.00 | ¥3511.45 | 49.8% |

| Vault Minerals (ASX:VAU) | A$0.33 | A$0.66 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$94.43 | US$187.71 | 49.7% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.91 | €5.81 | 49.9% |

| Genscript Biotech (SEHK:1548) | HK$9.63 | HK$19.15 | 49.7% |

We'll examine a selection from our screener results.

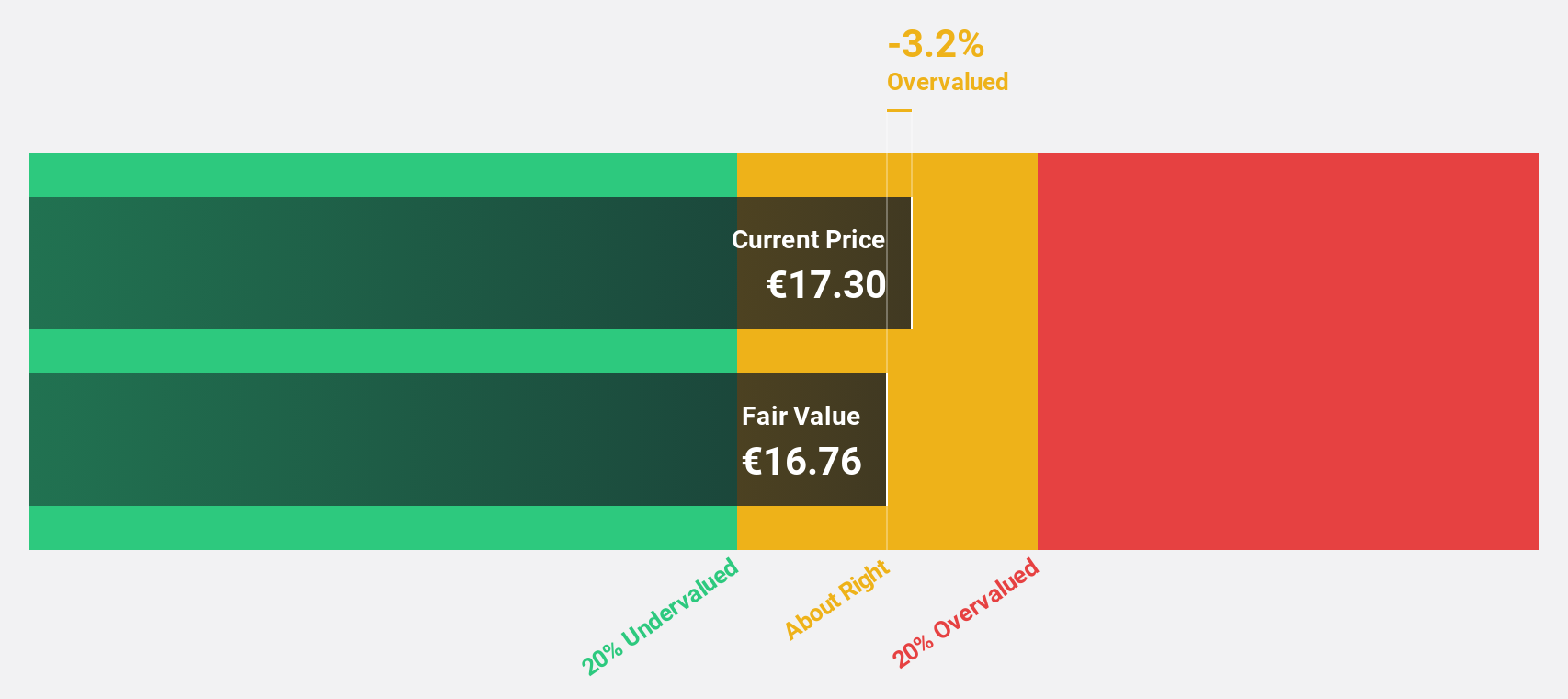

Iveco Group (BIT:IVG)

Overview: Iveco Group N.V. is involved in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses, and specialty vehicles for various applications globally with a market cap of €2.47 billion.

Operations: The company's revenue segments include Powertrain at €3.75 billion and Financial Services at €570 million.

Estimated Discount To Fair Value: 29.0%

Iveco Group appears undervalued based on cash flows, trading 29% below its estimated fair value of €13.18. Despite a high debt level, earnings are forecast to grow significantly at 36.7% annually, outpacing the Italian market's growth rate. Recent contracts, including a €755 million deal with the Italian Ministry of Defence and a €235 million agreement for electric buses in Germany, bolster future revenue streams and support its financial position amidst strategic partnerships enhancing market presence.

- The analysis detailed in our Iveco Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Iveco Group with our comprehensive financial health report here.

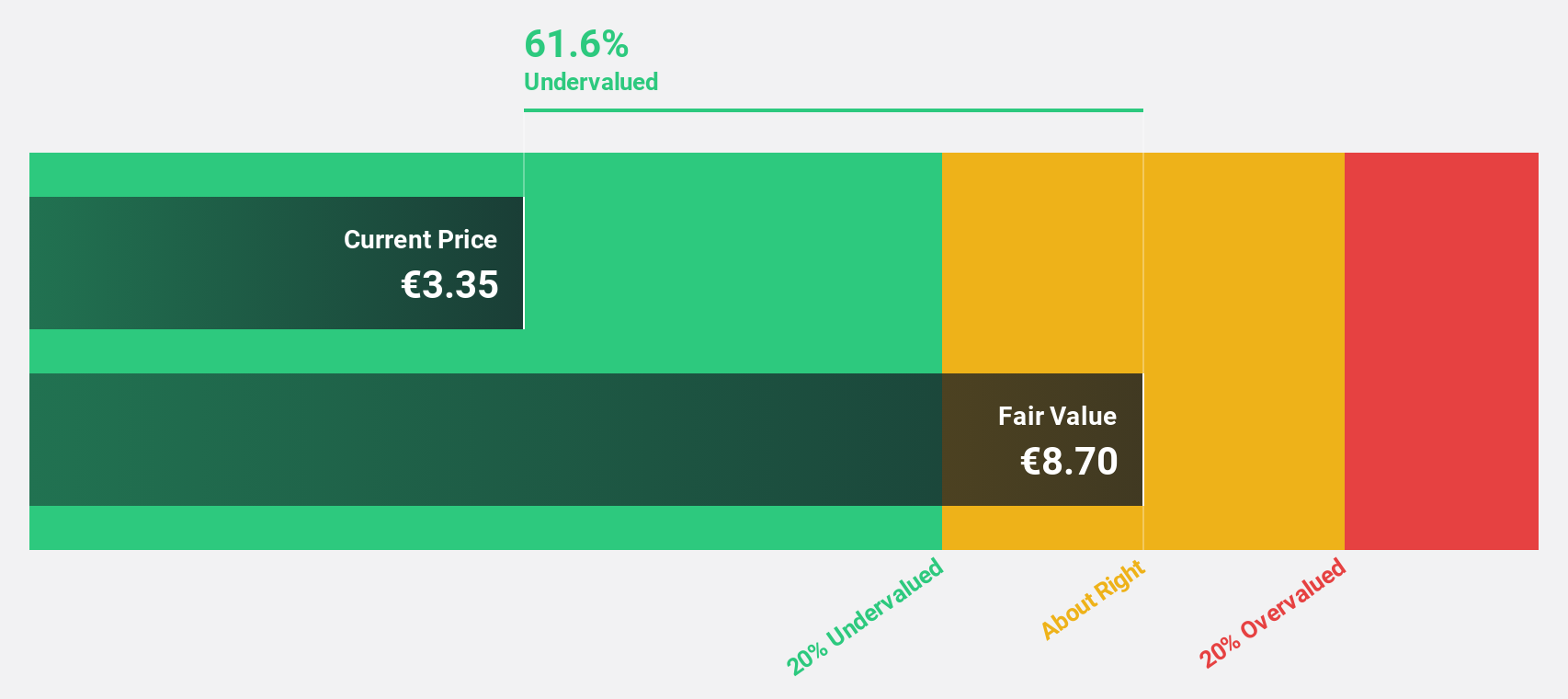

Outokumpu Oyj (HLSE:OUT1V)

Overview: Outokumpu Oyj is a company that produces and sells various stainless steel products across Finland, other European countries, North America, the Asia-Pacific, and internationally with a market cap of €1.23 billion.

Operations: The company's revenue segments are comprised of €4.21 billion from Europe (excluding Ferrochrome), €1.72 billion from the Americas, and €491 million from Ferrochrome.

Estimated Discount To Fair Value: 43.7%

Outokumpu Oyj is trading at a significant discount, 43.7% below its estimated fair value of €5.17, highlighting potential undervaluation based on cash flows. Despite a challenging revenue environment with sales declining to €4.54 billion for the first nine months of 2024, the company returned to profitability in Q3 with a net income of €20 million. However, its dividend yield remains unsustainable due to insufficient earnings coverage and low forecasted return on equity at 4.4%.

- Upon reviewing our latest growth report, Outokumpu Oyj's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Outokumpu Oyj.

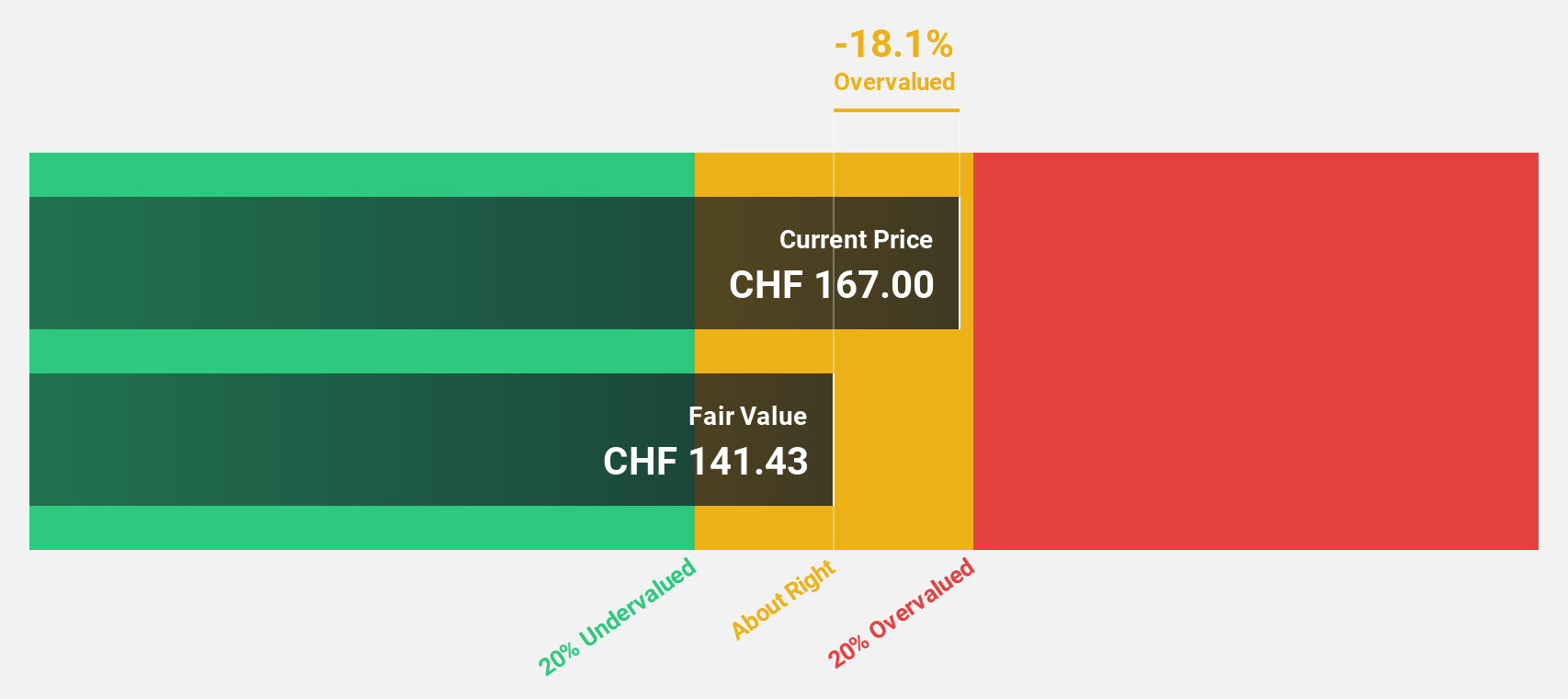

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., along with its subsidiaries, develops and manufactures electronic components, devices, and systems globally, with a market cap of CHF258.18 million.

Operations: The company's revenue is primarily derived from its Electronic Manufacturing Services (EMS) Division, which accounts for CHF377.46 million, and its Advanced Substrates (AS) Division, contributing CHF46.24 million.

Estimated Discount To Fair Value: 49%

Cicor Technologies is trading at CHF60.8, significantly below its fair value estimate of CHF119.3, suggesting it is undervalued based on cash flows. Despite a forecasted earnings growth of 28.3% annually, which outpaces the Swiss market average, the company faces challenges with high debt levels and recent sales guidance revision to CHF470-490 million for 2024. Additionally, Oep 80 B.V.'s proposed acquisition at CHF55.17 per share could impact future valuations and strategic direction.

- According our earnings growth report, there's an indication that Cicor Technologies might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Cicor Technologies.

Taking Advantage

- Unlock our comprehensive list of 893 Undervalued Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:IVG

Iveco Group

Engages in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses and specialty vehicles for firefighting, defense, and other applications worldwide.

Undervalued with reasonable growth potential.