A Fresh Look at BBVA (BME:BBVA) Valuation Following Notable Stock Price Momentum

Reviewed by Kshitija Bhandaru

Banco Bilbao Vizcaya Argentaria (BME:BBVA) has been making waves with some eye-catching stock price moves lately, capturing the attention of investors who may be weighing next steps. While there has not been a single headline event driving the action, the momentum in recent weeks suggests the market is reevaluating the outlook for one of Spain’s leading banks. Whether you are holding shares or considering an entry, the latest movement prompts a closer inspection, especially for those wondering if opportunity is knocking.

Looking across the past year, BBVA’s stock has generated meaningful long-term returns, with shares up by 75% over the last twelve months and showing an impressive 266% gain over the past three years. Short-term momentum has not faded either, with a 6% rise in the past month and a huge 77% gain year to date. This comes as the bank has continued posting annual revenue and net income growth, signaling underlying business strength even as overall market risk appetite shifts.

So after such a big run, is Banco Bilbao Vizcaya Argentaria currently undervalued, or is the market already factoring in the next wave of growth?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, BBVA shares are now fairly valued, with the market reflecting consensus expectations for future performance. Analysts see no meaningful discount or premium compared to the estimated fair value, pointing to a balanced risk-reward equation at current prices.

"BBVA is well positioned to benefit from the continued expansion of the middle class and rising financial inclusion in high-growth emerging markets like Mexico and Turkey. This is expected to fuel sustained loan growth and fee-generating activity, positively impacting top-line revenue and long-term earnings potential. The bank's ongoing investment and leadership in digital transformation, including increased AI-driven productivity and cost-containment initiatives, should drive further cost efficiencies, improve customer acquisition, and enhance net margins over time."

What is the key formula behind this valuation? It hinges on forecasted growth in revenue and profit, steady profit margins, and a future multiple usually reserved for top-tier banks. Curious about the bullish financial assumptions driving BBVA’s fair price? Take a closer look into the analyst consensus and see which projections could move the needle and shape the next leg of this major bank’s story.

Result: Fair Value of €16.22 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, downside risks remain. Unexpected volatility in key emerging markets or persistent interest rate declines could quickly undermine even the most robust forecasts.

Find out about the key risks to this Banco Bilbao Vizcaya Argentaria narrative.Another View: Discounted Cash Flow Tells a Different Story

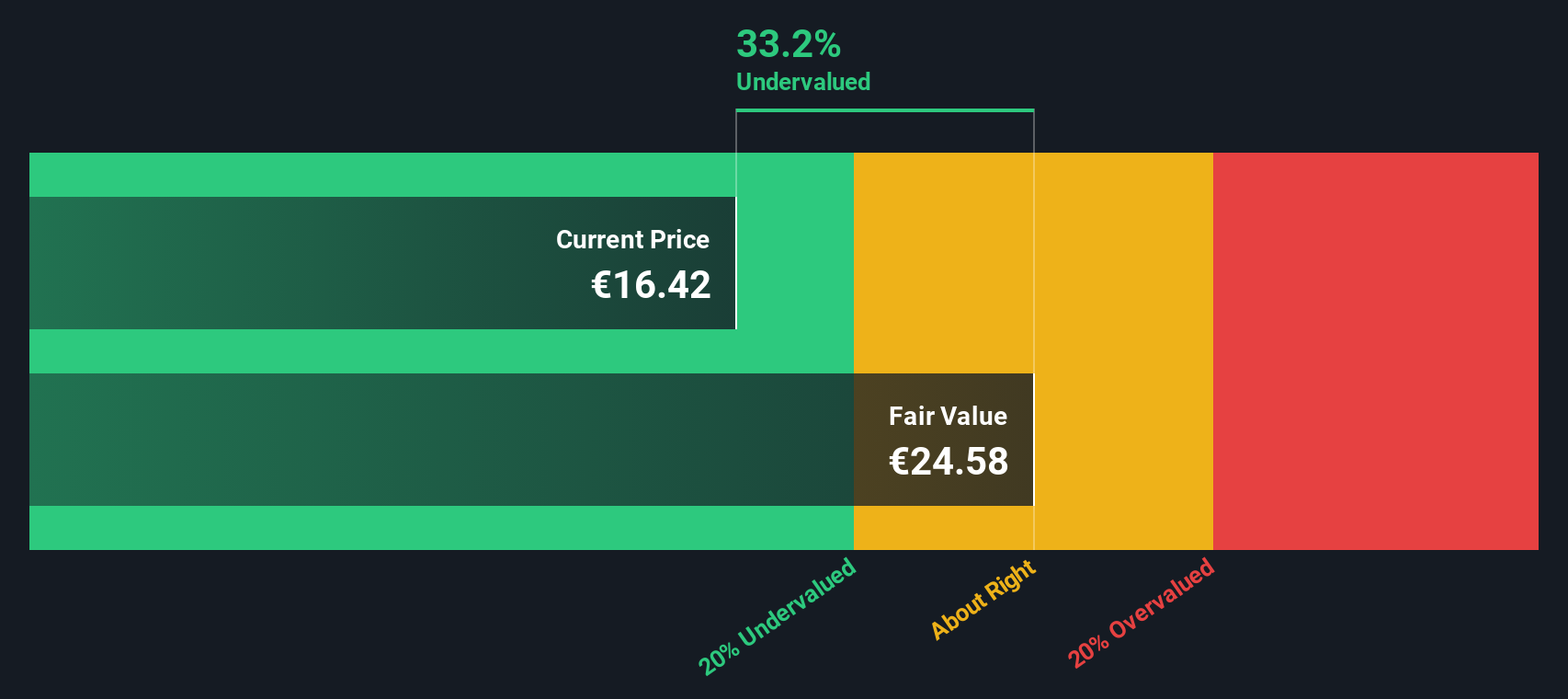

While analysts using earnings-based methods see BBVA as fairly valued, our DCF model presents a more optimistic picture and suggests shares may be trading below their intrinsic value. Could the market be overlooking future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Banco Bilbao Vizcaya Argentaria to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Banco Bilbao Vizcaya Argentaria Narrative

If you have another perspective or prefer digging into the numbers firsthand, you can quickly craft and refine your own take on BBVA’s outlook in just a few minutes. Do it your way

A great starting point for your Banco Bilbao Vizcaya Argentaria research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities slip by. Unleash your next bold move with the Simply Wall Street Screener. Hand-pick winning stocks tailored to your goals, backed by trusted insights and real-time data.

- Unlock hidden value by targeting companies trading below their intrinsic worth using our list of undervalued stocks based on cash flows.

- Secure steady potential income streams by zeroing in on stocks with robust yields and proven payouts through dividend stocks with yields > 3%.

- Catalyze your portfolio with innovation by tapping into the latest advancements in artificial intelligence via AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives