- Denmark

- /

- Transportation

- /

- CPSE:NTG

Do NTG Nordic Transport Group's (CPH:NTG) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like NTG Nordic Transport Group (CPH:NTG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Our analysis indicates that NTG is potentially undervalued!

NTG Nordic Transport Group's Improving Profits

Over the last three years, NTG Nordic Transport Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, NTG Nordic Transport Group's EPS catapulted from kr.9.81 to kr.19.80, over the last year. Year on year growth of 102% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

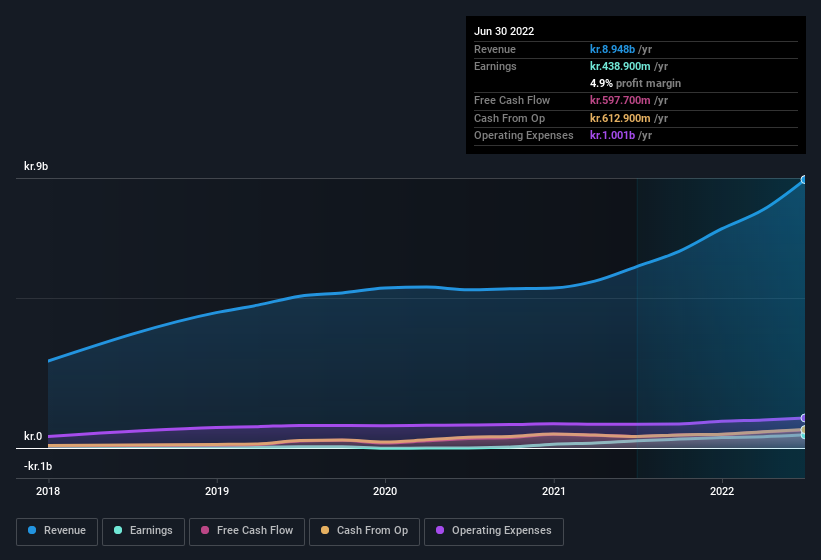

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note NTG Nordic Transport Group achieved similar EBIT margins to last year, revenue grew by a solid 48% to kr.8.9b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for NTG Nordic Transport Group.

Are NTG Nordic Transport Group Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own NTG Nordic Transport Group shares worth a considerable sum. Notably, they have an enviable stake in the company, worth kr.1.5b. This totals to 28% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Is NTG Nordic Transport Group Worth Keeping An Eye On?

NTG Nordic Transport Group's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering NTG Nordic Transport Group for a spot on your watchlist. It is worth noting though that we have found 1 warning sign for NTG Nordic Transport Group that you need to take into consideration.

Although NTG Nordic Transport Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if NTG Nordic Transport Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NTG

NTG Nordic Transport Group

Provides asset-light freight forwarding services through road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.