Broker Upgrade On Turnaround Progress Could Be A Game Changer For FLSmidth (CPSE:FLS)

Reviewed by Sasha Jovanovic

- Earlier this week, Danish engineering group FLSmidth was upgraded from "hold" to "buy" by ABG Sundal Collier, with the broker citing expectations of stronger financials, margin expansion and support from higher metal prices as the company exits a major restructuring phase under departing CEO Mikko Keto.

- The upgrade underscores how FLSmidth’s completed turnaround and exposure to improving metals markets are reshaping expectations for its order pipeline and profitability profile.

- We’ll now examine how ABG Sundal Collier’s upgrade, grounded in anticipated margin expansion, may influence FLSmidth’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

FLSmidth Investment Narrative Recap

To own FLSmidth, you need to believe its mining focused strategy, higher margin service mix and completed restructuring can translate into more resilient earnings through volatile capex cycles. ABG Sundal Collier’s upgrade reinforces this thesis in the short term by highlighting margin expansion as a key catalyst, but it does not remove the core risk that lumpy Product demand and delayed mining projects could still pressure orders and profitability if the expected upturn is pushed out.

The most relevant recent announcement here is CEO Mikko Keto’s planned departure in the first half of 2026, following a multi year transformation that refocused FLSmidth on mining and tightened the cost base. With a succession process underway and new leaders already appointed for Mining Products and Mining Service, the upgrade arrives just as investors are weighing whether the next management team can sustain the shift toward a higher margin, more recurring revenue profile.

Yet investors should also be aware that if customer hesitancy keeps delaying new mining projects and large capital orders, then...

Read the full narrative on FLSmidth (it's free!)

FLSmidth's narrative projects DKK16.2 billion revenue and DKK1.6 billion earnings by 2028. This requires a 6.5% yearly revenue decline and about DKK0.3 billion earnings increase from DKK1.3 billion today.

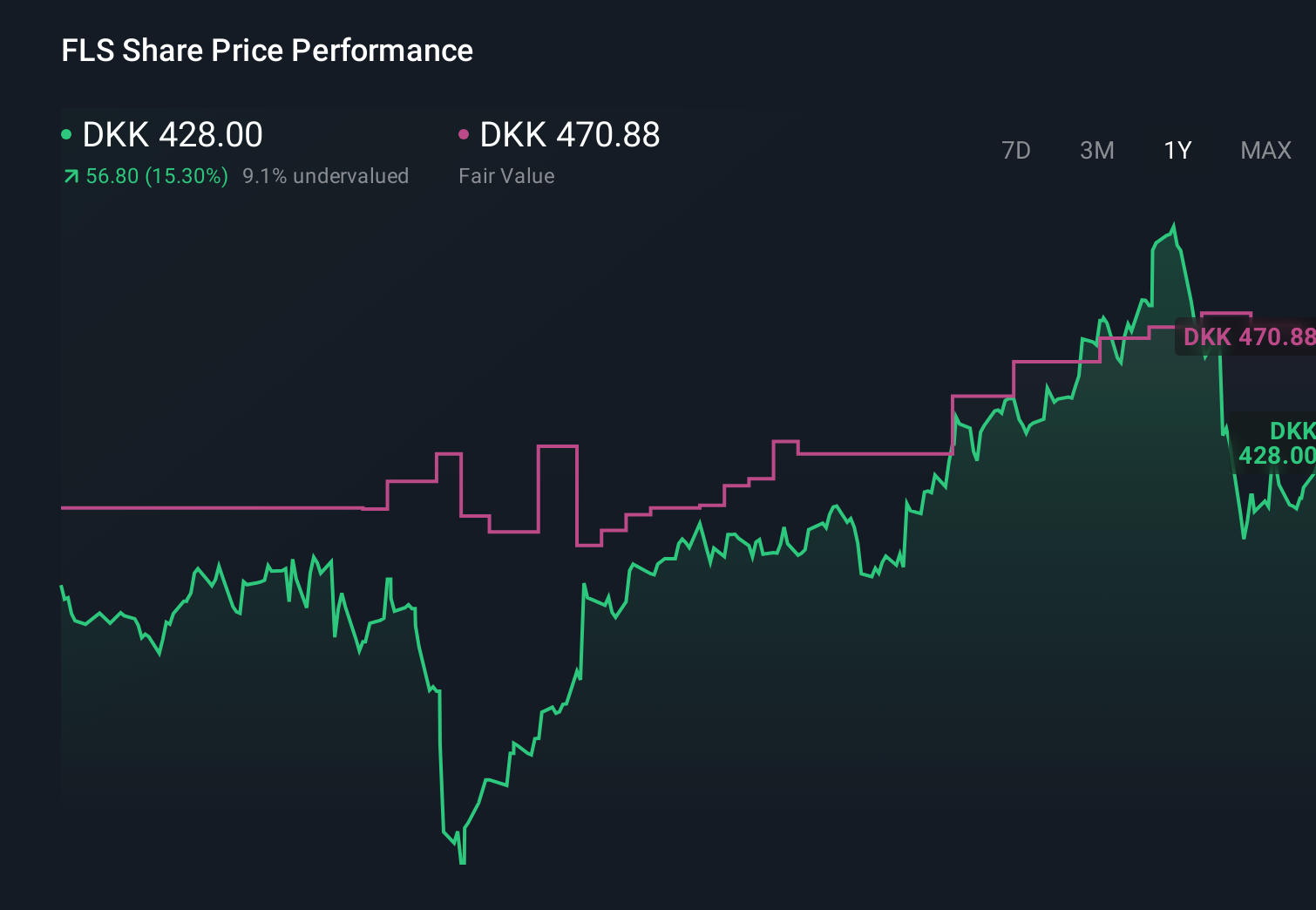

Uncover how FLSmidth's forecasts yield a DKK470.88 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly DKK470.88 to DKK686.03, showing how far apart individual expectations can be. You can weigh these views against the highlighted risk that prolonged weakness or delays in capital equipment demand could still challenge FLSmidth’s order growth and earnings profile.

Explore 3 other fair value estimates on FLSmidth - why the stock might be worth as much as 63% more than the current price!

Build Your Own FLSmidth Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FLSmidth research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FLSmidth research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FLSmidth's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:FLS

FLSmidth

Provides flowsheet technology and service solutions for the mining and cement industries in Denmark, the United States of America, Canada, Chile, Brazil, Peru, Australia, North and South America, Europe, the Middle East, Africa, and Asia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)