Don't Race Out To Buy FORTEC Elektronik AG (ETR:FEV) Just Because It's Going Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that FORTEC Elektronik AG (ETR:FEV) is about to go ex-dividend in just 2 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase FORTEC Elektronik's shares before the 14th of February in order to be eligible for the dividend, which will be paid on the 18th of February.

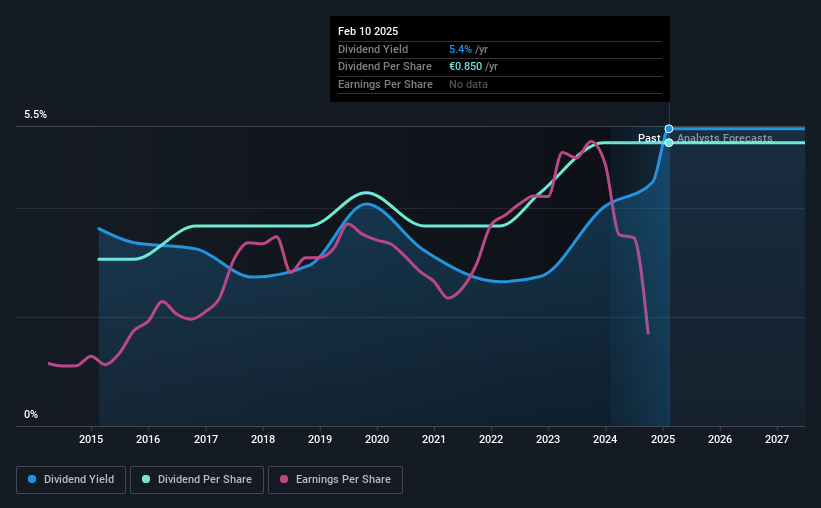

The company's next dividend payment will be €0.85 per share, on the back of last year when the company paid a total of €0.85 to shareholders. Based on the last year's worth of payments, FORTEC Elektronik stock has a trailing yield of around 5.4% on the current share price of €15.60. If you buy this business for its dividend, you should have an idea of whether FORTEC Elektronik's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for FORTEC Elektronik

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year FORTEC Elektronik paid out 105% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 21% of its free cash flow last year.

It's good to see that while FORTEC Elektronik's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit FORTEC Elektronik paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. FORTEC Elektronik's earnings per share have fallen at approximately 14% a year over the previous five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, FORTEC Elektronik has increased its dividend at approximately 5.4% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. FORTEC Elektronik is already paying out 105% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

To Sum It Up

From a dividend perspective, should investors buy or avoid FORTEC Elektronik? It's never great to see earnings per share declining, especially when a company is paying out 105% of its profit as dividends, which we feel is uncomfortably high. Yet cashflow was much stronger, which makes us wonder if there are some large timing issues in FORTEC Elektronik's cash flows, or perhaps the company has written down some assets aggressively, reducing its income. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that in mind though, if the poor dividend characteristics of FORTEC Elektronik don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 4 warning signs for FORTEC Elektronik that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:FEV

FORTEC Elektronik

Manufactures and sells components and systems in the areas of display and embedded computer technology, and power supplies in Germany and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)