As European markets navigate the complexities of U.S. trade policy uncertainty and fluctuating economic indicators, the STOXX Europe 600 Index recently snapped a 10-week streak of gains, reflecting broader investor caution despite positive developments in Germany's defense and infrastructure spending. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and adaptability to shifting market dynamics while capitalizing on technological advancements and strategic opportunities within the sector.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

We'll examine a selection from our screener results.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

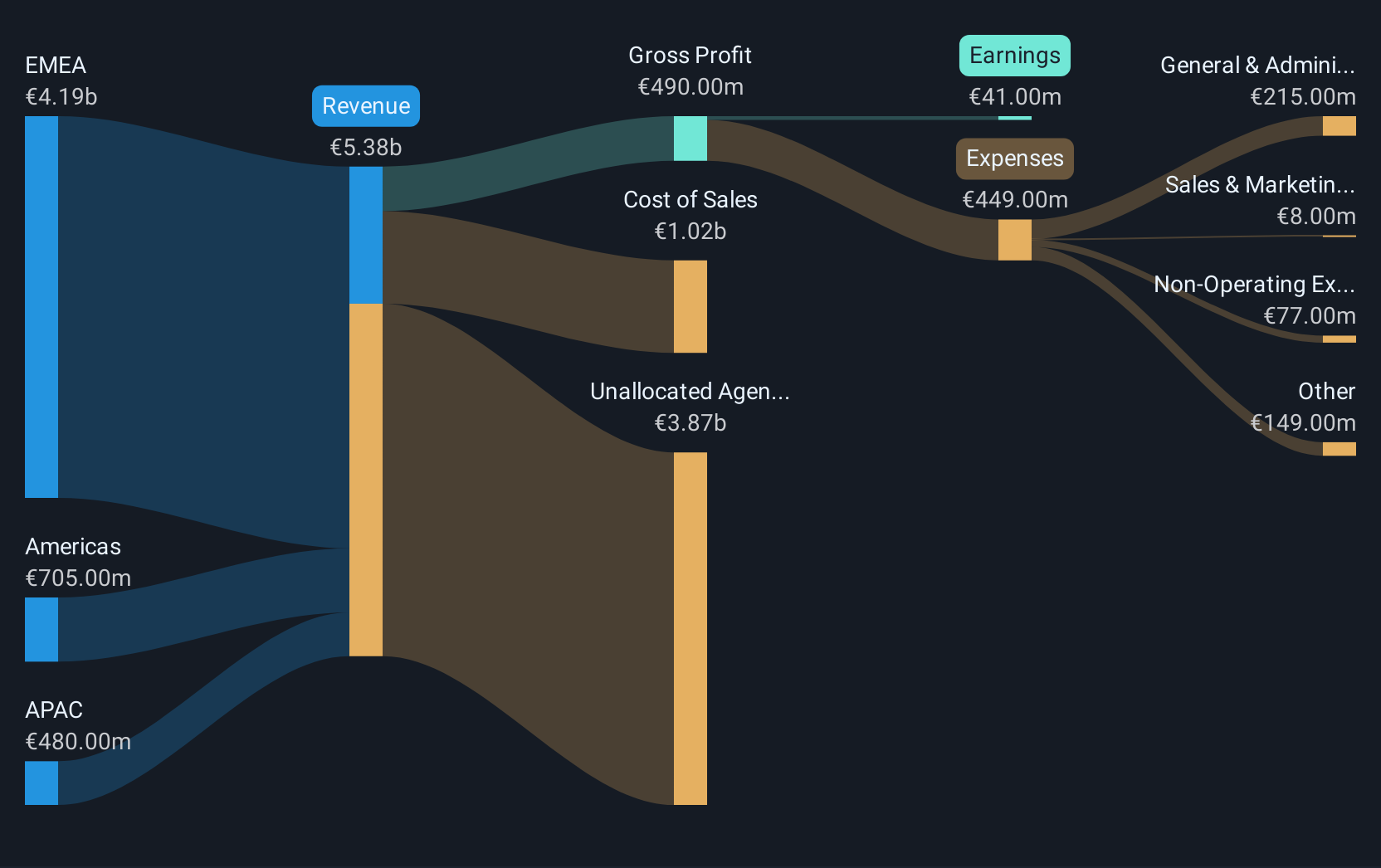

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure across Europe, the Middle East, Africa, the United States, and the Asia Pacific with a market cap of €1.72 billion.

Operations: Exclusive Networks SA generates revenue primarily from its operations in EMEA (€4.19 billion), APAC (€480 million), and the Americas (€705 million). The company specializes in cybersecurity solutions, focusing on digital infrastructure across various regions.

Exclusive Networks, a key player in the European tech landscape, has demonstrated robust growth with an annualized revenue increase of 14.2% and earnings forecast to surge by 34.5% annually. Despite recent challenges, including being dropped from the S&P Global BMI Index, the company's strategic partnership with FireMon underscores its commitment to expanding its cybersecurity solutions globally. This collaboration is poised to enhance network security management for clients worldwide, leveraging Exclusive Networks' extensive distribution network across over 170 countries. Additionally, the recent acquisition by a consortium led by CD&R and Permira not only reshapes its board but also strategically positions Exclusive Networks for future growth within the tech sector.

- Unlock comprehensive insights into our analysis of Exclusive Networks stock in this health report.

Evaluate Exclusive Networks' historical performance by accessing our past performance report.

Valneva (ENXTPA:VLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Valneva SE is a specialty vaccine company that focuses on developing, manufacturing, and commercializing vaccines for infectious diseases with unmet needs, and it has a market capitalization of €542.31 million.

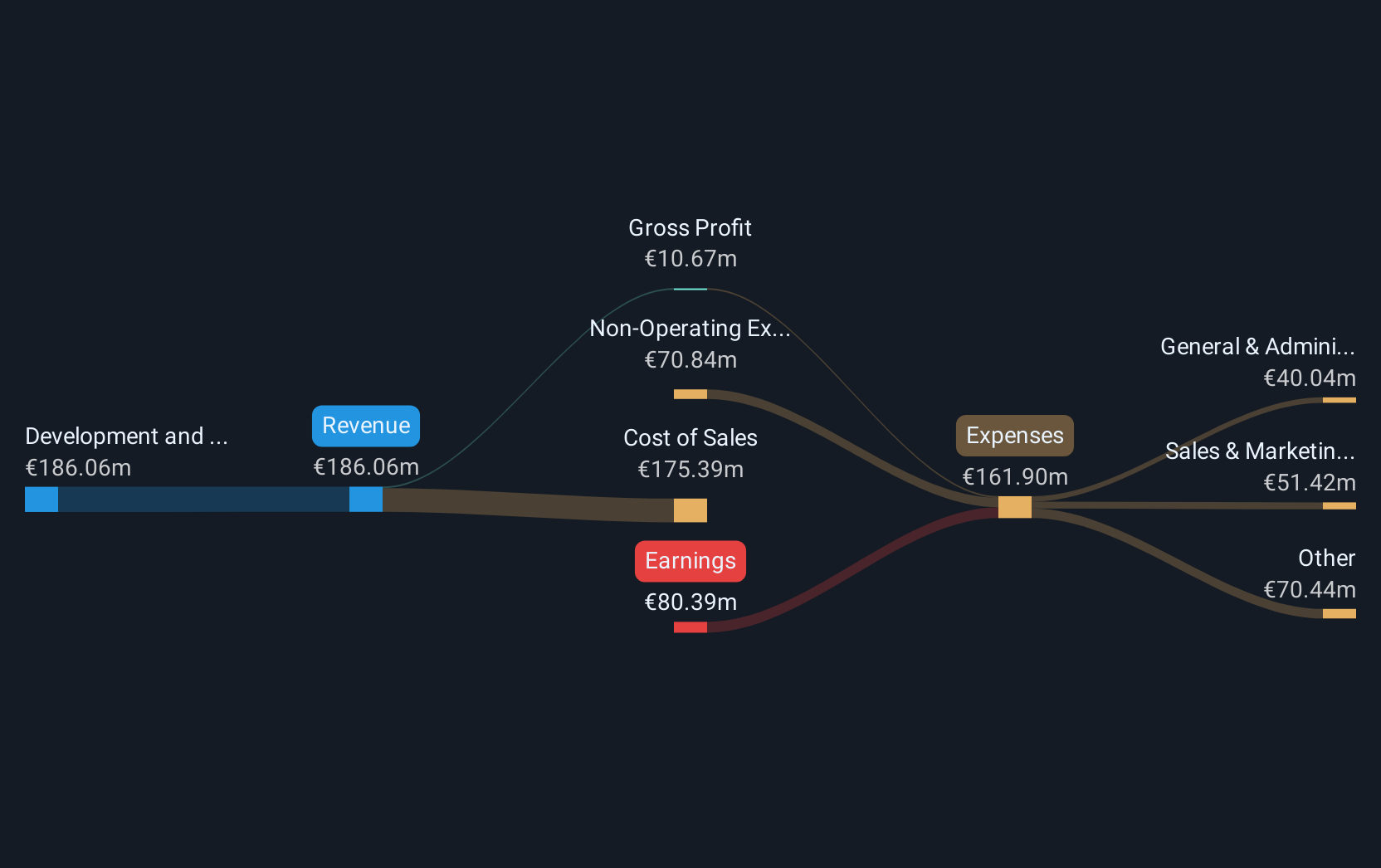

Operations: Valneva SE focuses on creating vaccines for infectious diseases, addressing areas with unmet medical needs. The company engages in the development, manufacturing, and commercialization of these prophylactic vaccines.

Valneva, navigating through a challenging landscape, is poised for potential growth with its recent strategic moves in the vaccine market. The company's revenue is expected to grow by 20.8% annually, outpacing the French market's 6% growth rate. Despite a forecasted average earnings decline of 17.1% over the next three years, Valneva has made significant strides in expanding its vaccine portfolio. The European Medicines Agency’s positive opinion on extending IXCHIQ's label to younger demographics marks a pivotal advancement, potentially boosting market reach upon approval. Additionally, securing a $32.8 million contract with the U.S Department of Defense underscores Valneva's critical role in public health solutions globally, enhancing its financial stability and future revenue streams.

- Navigate through the intricacies of Valneva with our comprehensive health report here.

Gain insights into Valneva's historical performance by reviewing our past performance report.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

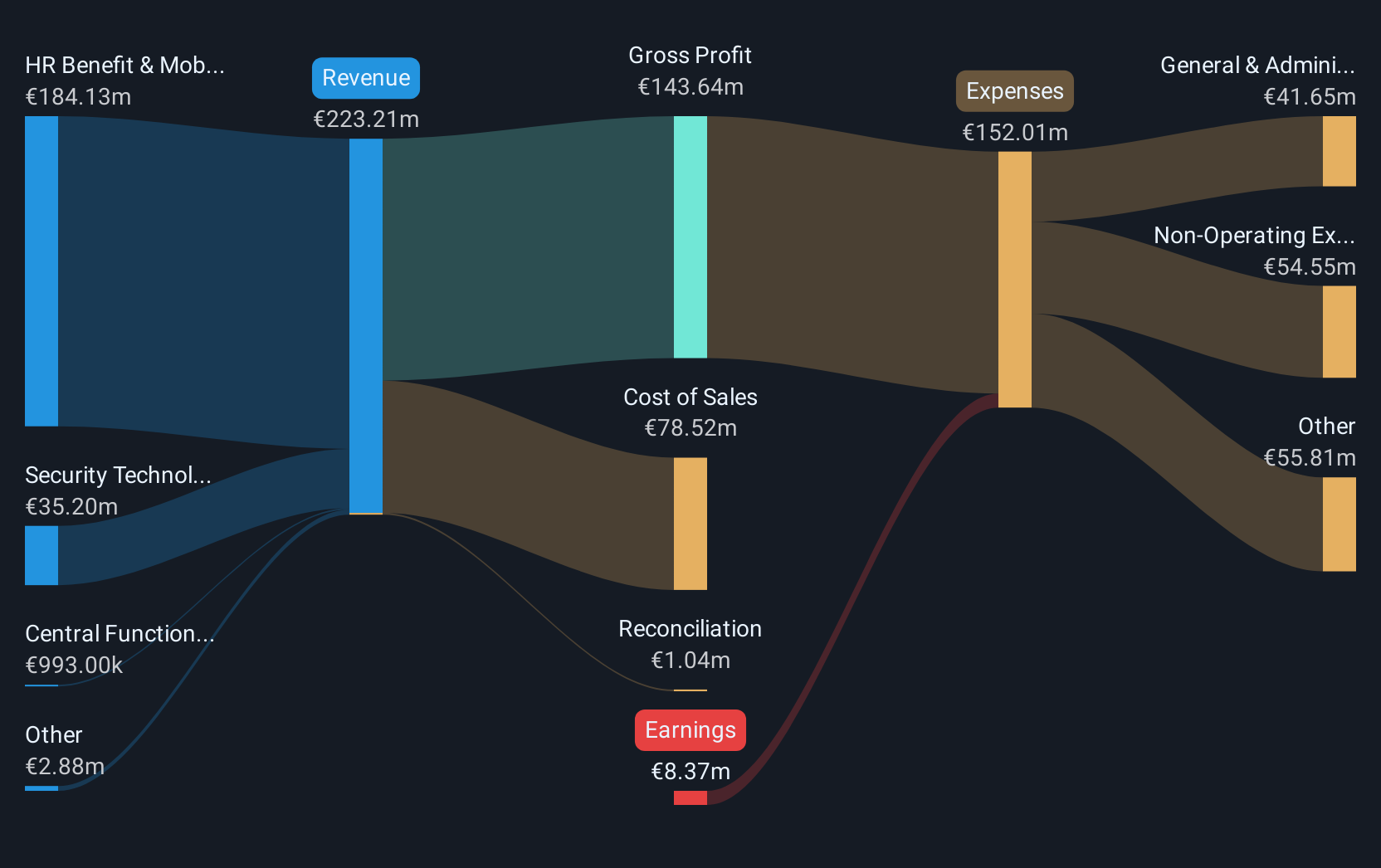

Overview: Brockhaus Technologies AG is a private equity firm with a market capitalization of approximately €236.12 million.

Operations: The firm's revenue primarily stems from its HR Benefit & Mobility Platform and Security Technologies segments, generating approximately €184.13 million and €35.20 million, respectively. Central Functions contribute a smaller portion of the revenue at around €0.99 million.

Brockhaus Technologies, navigating the competitive landscape of European tech, is poised for significant transformations with its forecasted revenue growth of 12.6% annually, outpacing Germany's average of 5.8%. Despite current unprofitability, the firm is expected to pivot into profitability within three years, a testament to its strategic direction and operational adjustments. With R&D expenses geared towards innovation—critical in sustaining long-term competitiveness—the company's earnings are projected to surge by an impressive 114.4% annually. This financial trajectory, coupled with a robust free cash flow status, underscores Brockhaus' potential in reshaping its market segment and strengthening its economic foothold amidst evolving industry demands.

- Get an in-depth perspective on Brockhaus Technologies' performance by reading our health report here.

Assess Brockhaus Technologies' past performance with our detailed historical performance reports.

Next Steps

- Delve into our full catalog of 245 European High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VLA

Valneva

A specialty vaccine company, develops, manufactures, and commercializes prophylactic vaccines for infectious diseases with unmet needs.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)