NAGA Group (XTRA:N4G): Revenue Forecast to Grow 19.7% Annually Heading Into Earnings Season

Reviewed by Simply Wall St

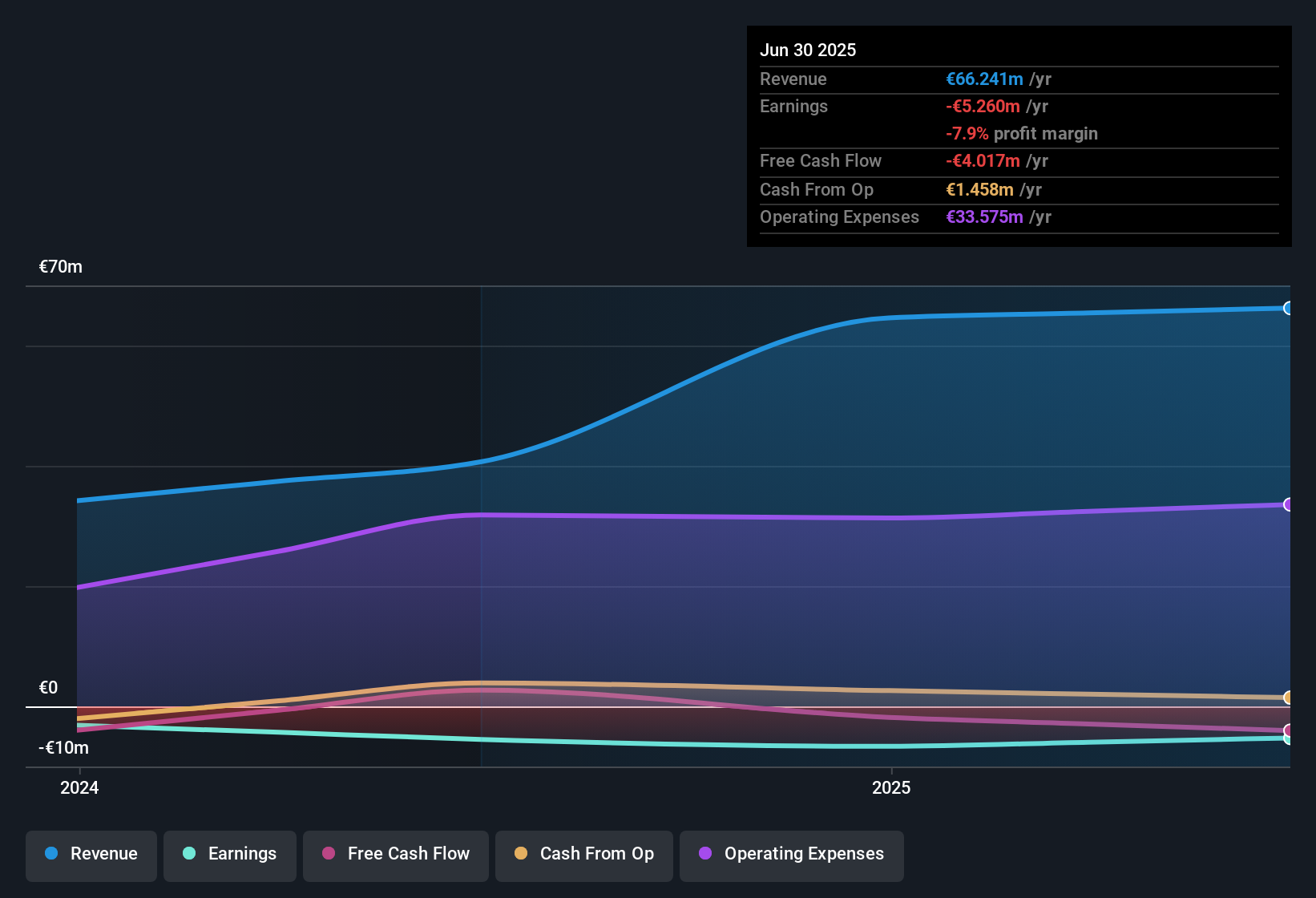

NAGA Group (XTRA:N4G) is currently unprofitable, but the company is forecast to see revenue rise at a brisk 19.7% per year, outpacing the wider German market’s 6.1% annual growth. With earnings expected to climb 58.41% annually and profitability anticipated within the next three years, investors see a strong upside story. However, recent share dilution remains a consideration for current stakeholders.

See our full analysis for NAGA Group.Now we will compare these headline figures to the market’s prevailing narratives to see where the recent performance supports or challenges investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Nearly 2.6x Above Share Price

- NAGA Group's current share price is €0.61, which is considerably below its DCF fair value estimate of €1.61. This reveals a 62% discount relative to this metric.

- Investors weighing this valuation gap may see a stronger upside if the company’s rapid projected earnings growth (58.41% annually) is realized.

- However, this discount also reflects continued unprofitability and recent share dilution, which can limit the market’s willingness to reward future earnings at this stage.

- While the industry average price-to-sales ratio is 2.3x and NAGA trades at 2.1x, indicating a modest value case versus peers, the large fair value discount hinges on future profit materializing as forecast.

Share Dilution Stands Out in Risk Profile

- The company has issued new shares within the past year, making dilution a current and material factor that impacts per-share value for existing investors.

- Bears argue that ongoing losses could continue to pressure margins and force further dilution.

- This is especially true with no net profit margin improvement reported and no historical margin data available, which limits visibility into true earnings durability.

- This risk is particularly relevant while NAGA remains unprofitable, since raising capital by issuing new shares directly reduces upside for longer-term holders.

Growth Forecasts Outpace Industry Trends

- NAGA’s forecast revenue growth of 19.7% per year far exceeds the broader German market’s expectation of 6.1% annually, positioning it among the more aggressively expanding fintech names.

- This momentum heavily supports the bullish case that NAGA can capture outsized sector opportunity and that high revenue and earnings growth projections, if met, may be rewarded with a higher valuation.

- However, with less than three years of public market history and no track record of profitability, bullish investors still rely largely on forward-looking statements rather than a proven performance base.

- The optimism stands on a strong top-line trajectory but must overcome challenges signaled by lack of margin evidence and prior share dilution.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NAGA Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NAGA's lack of profitability, ongoing share dilution, and absence of historical margin improvement raise concerns about its financial resilience and earnings durability.

If you are looking for companies with stronger balance sheets and fewer dilution risks, check out solid balance sheet and fundamentals stocks screener built to weather uncertainty and protect shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NAGA Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:N4G

NAGA Group

Develops and offers fintech products and services in Latin America, the Middle East, North Africa, and Southeast Asia.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026