- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Will Infineon Technologies (XTRA:IFX) Sensor Push Enhance Its Automotive Edge or Stretch Resources Thin?

Reviewed by Sasha Jovanovic

- Infineon Technologies AG participated in AutoSens Europe 2025 at the Palau de Congressos in Barcelona from October 7th to 9th, where its senior marketing and technical leaders presented on key automotive sensor innovations.

- This active engagement highlights Infineon's expanding focus on advanced sensor technology for automotive applications, directly addressing emerging demand trends in the mobility sector.

- We'll examine how Infineon's visibility in automotive sensor innovation at AutoSens Europe 2025 may influence its investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Infineon Technologies Investment Narrative Recap

Investors in Infineon Technologies are typically focused on the promise of growing demand for power and sensor solutions in key markets like automotive, AI, and renewables. The company's strong presence at AutoSens Europe 2025 underscores its efforts to strengthen its automotive pipeline, but this alone is unlikely to materially shift the near-term catalyst of broad-based volume recovery as customer inventories normalize; margin pressure from elevated idle charges remains the most significant current risk.

Among recent announcements, Infineon's July automotive software innovation partnership is strikingly relevant, it aligns with the AutoSens spotlight by advancing safety-compliant, next-generation automotive electronics. This kind of collaboration reinforces Infineon's pursuit of high-margin, resilient growth drivers while positioning it for an eventual rebound in automotive volumes.

Yet, in contrast to the optimism around new partnerships, investors should remain mindful of margin pressure as a key risk to Infineon's outlook...

Read the full narrative on Infineon Technologies (it's free!)

Infineon Technologies' narrative projects €19.1 billion revenue and €3.4 billion earnings by 2028. This requires 9.4% yearly revenue growth and a €2.3 billion earnings increase from €1.1 billion today.

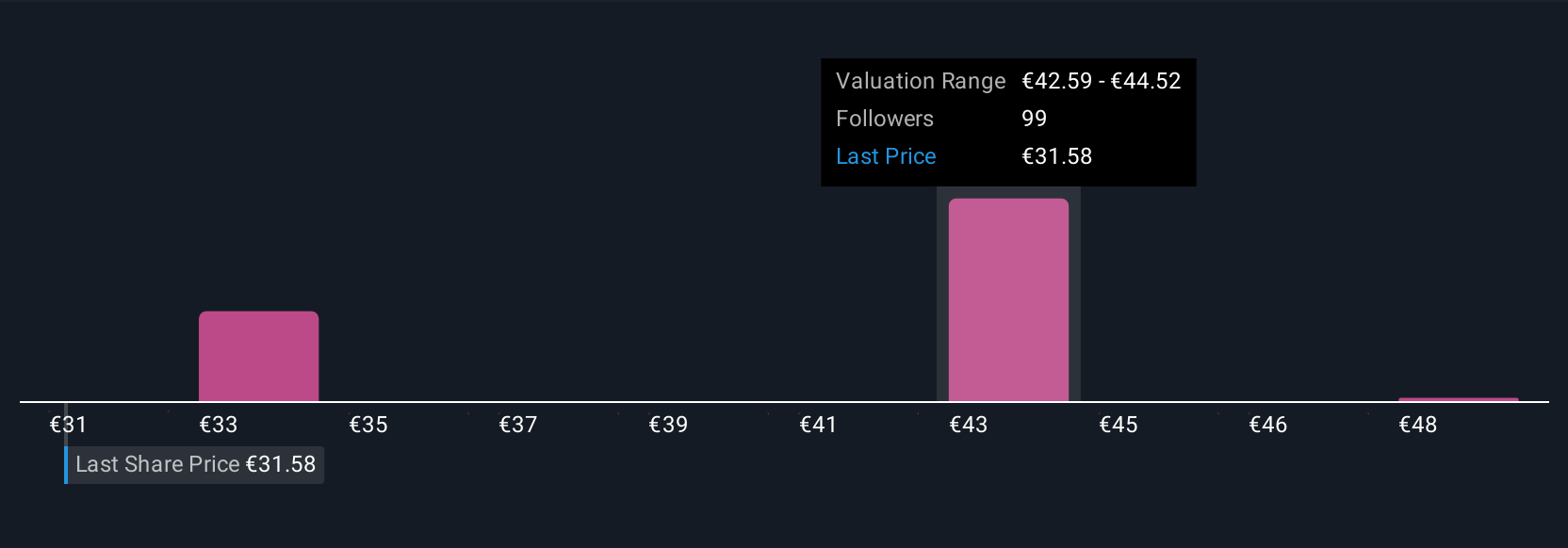

Uncover how Infineon Technologies' forecasts yield a €42.95 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Six recent fair value estimates from the Simply Wall St Community span €31.75 to €50.32, highlighting wide differences in opinion on Infineon's valuation. Despite these diverse outlooks, margin challenges from elevated idle charges could become a central issue shaping the company’s future performance; review the full range of community perspectives for further insights.

Explore 6 other fair value estimates on Infineon Technologies - why the stock might be worth just €31.75!

Build Your Own Infineon Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infineon Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Infineon Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infineon Technologies' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Engages in the design, development, manufacture, and marketing of semiconductors and semiconductor-based solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives