- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Can Infineon Technologies (XTRA:IFX) Turn India Engagement Into Sustainable Competitive Advantage?

Reviewed by Simply Wall St

- Infineon Technologies AG participated in SEMICON India 2025 on September 2 at the Yashobhoomi India International Convention and Expo Centre in New Delhi, with Executive VP Alexander Gorski speaking on behalf of the company.

- This appearance highlights Infineon's focus on industry visibility and potential engagement with the fast-growing Indian semiconductor ecosystem, which may open up additional opportunities for collaboration and market expansion.

- To understand what this means for Infineon's outlook, we'll assess how its engagement with India's chip sector may impact the investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Infineon Technologies Investment Narrative Recap

To see value in Infineon Technologies as a shareholder, you need confidence in the company’s ability to grow through innovation in power semiconductors and software-defined automotive technologies, despite cyclical downturns and margin challenges. The recent SEMICON India 2025 participation signals intent to build presence in the Indian market, but does not materially shift the short-term catalyst: volume recovery in automotive and industrial chip demand as inventory correction cycles normalize. The biggest risk remains margin pressure from persistent excess capacity and elevated inventories.

Of the company’s recent announcements, the June 18 collaboration with Tata Elxsi to develop EV solutions for India stands out as most directly relevant. This partnership, alongside Infineon’s appearance at SEMICON India, underscores the company’s commitment to capturing growth in India’s electrification sector, a potential medium-term catalyst that could support demand, but may not quickly offset near-term headwinds from soft automotive markets and inventory management challenges.

However, investors should also be aware of ongoing risks related to excess capacity and margin pressure, especially as...

Read the full narrative on Infineon Technologies (it's free!)

Infineon Technologies' outlook anticipates €19.1 billion in revenue and €3.4 billion in earnings by 2028. Achieving this will require annual revenue growth of 9.4% and an earnings increase of €2.3 billion from the current €1.1 billion level.

Uncover how Infineon Technologies' forecasts yield a €42.95 fair value, a 30% upside to its current price.

Exploring Other Perspectives

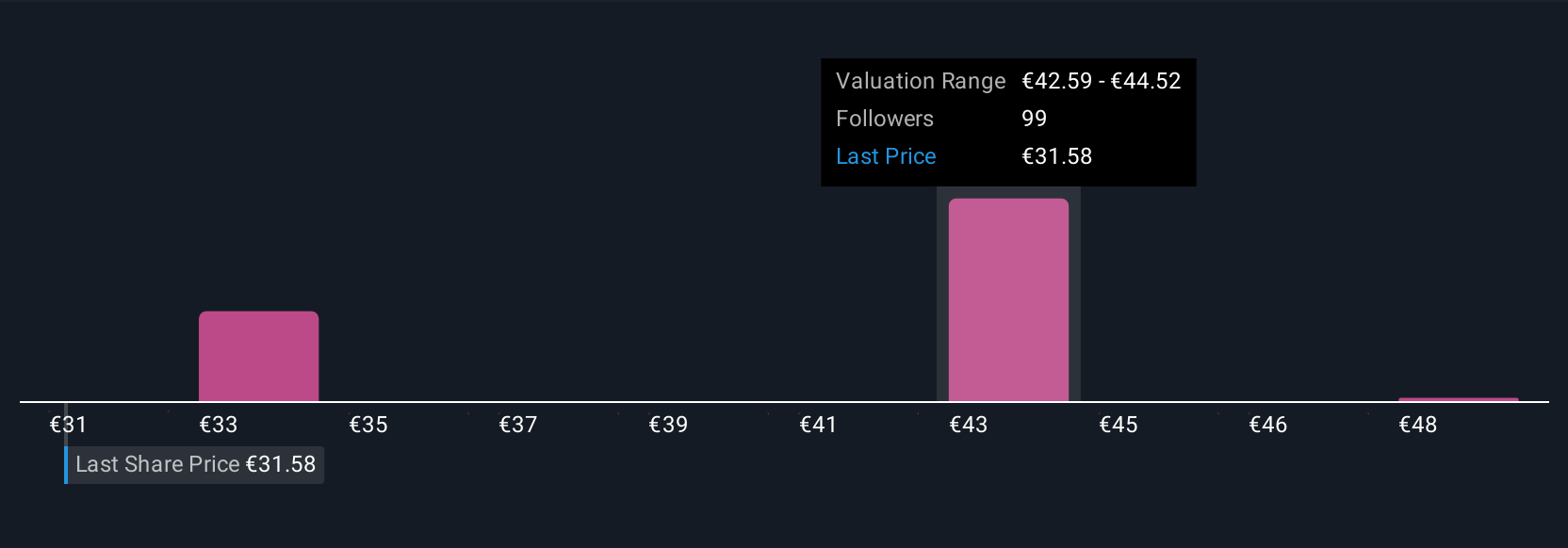

Five Simply Wall St Community members estimate Infineon’s fair value between €31 and €50.32. While inventory-driven margin risks are in focus this year, you can compare these views with your own research and explore the broader implications for Infineon’s market position.

Explore 5 other fair value estimates on Infineon Technologies - why the stock might be worth as much as 52% more than the current price!

Build Your Own Infineon Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infineon Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Infineon Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infineon Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Engages in the design, development, manufacture, and marketing of semiconductors and semiconductor-based solutions worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives