As the German economy faces a challenging year with forecasts of contraction and declining factory orders, the DAX index has still managed to post gains, reflecting some resilience in investor sentiment. In this context, identifying undervalued stocks becomes particularly compelling for investors seeking opportunities amidst economic uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.20 | €30.77 | 47.4% |

| init innovation in traffic systems (XTRA:IXX) | €35.80 | €52.14 | 31.3% |

| 2G Energy (XTRA:2GB) | €23.30 | €41.24 | 43.5% |

| Formycon (XTRA:FYB) | €52.50 | €81.65 | 35.7% |

| CeoTronics (DB:CEK) | €5.25 | €10.03 | 47.7% |

| Schweizer Electronic (XTRA:SCE) | €3.90 | €7.19 | 45.8% |

| OTRS (DB:TR9) | €10.40 | €17.09 | 39.1% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.33 | 42.3% |

| MTU Aero Engines (XTRA:MTX) | €308.80 | €561.76 | 45% |

| Basler (XTRA:BSL) | €8.50 | €12.59 | 32.5% |

Underneath we present a selection of stocks filtered out by our screen.

Formycon (XTRA:FYB)

Overview: Formycon AG is a biotechnology company that develops biosimilar drugs in Germany and Switzerland, with a market cap of €926.99 million.

Operations: The company's revenue segment includes Drug Delivery Systems, generating €60.80 million.

Estimated Discount To Fair Value: 35.7%

Formycon AG is trading significantly below its estimated fair value of €81.65, with a current price of €52.5, presenting potential undervaluation based on discounted cash flows. Despite reporting a net loss in H1 2024, the company's revenue and earnings are forecast to grow substantially faster than the German market at 32.5% and 30.7% per year respectively. Recent FDA approval for Otulfi enhances its biosimilar portfolio, potentially boosting future cash flows despite past shareholder dilution concerns.

- Our expertly prepared growth report on Formycon implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Formycon here with our thorough financial health report.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG develops, manufactures, markets, and maintains commercial and military aircraft engines as well as aero-derivative industrial gas turbines globally, with a market cap of €16.62 billion.

Operations: The company generates revenue primarily from its Commercial Maintenance Business (MRO) segment, which accounts for €4.45 billion, and the Commercial and Military Engine Business (OEM) segment, contributing €1.32 billion.

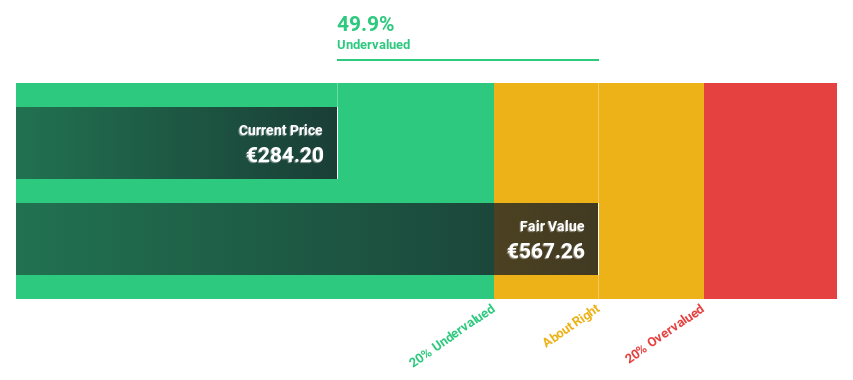

Estimated Discount To Fair Value: 45%

MTU Aero Engines is trading at €308.8, significantly below its estimated fair value of €561.76, indicating potential undervaluation based on discounted cash flows. The company's earnings are expected to grow 33.95% annually, with revenue growth projected at 11.8%, surpassing the German market's average of 5.4%. Recent financial activities include a completed fixed-income offering of €745.88 million in September 2024, which could support future growth and profitability initiatives over the next three years.

- Our earnings growth report unveils the potential for significant increases in MTU Aero Engines' future results.

- Click to explore a detailed breakdown of our findings in MTU Aero Engines' balance sheet health report.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market capitalization of approximately €245.06 billion.

Operations: The company generates revenue of €32.54 billion from its Applications, Technology & Services segment worldwide.

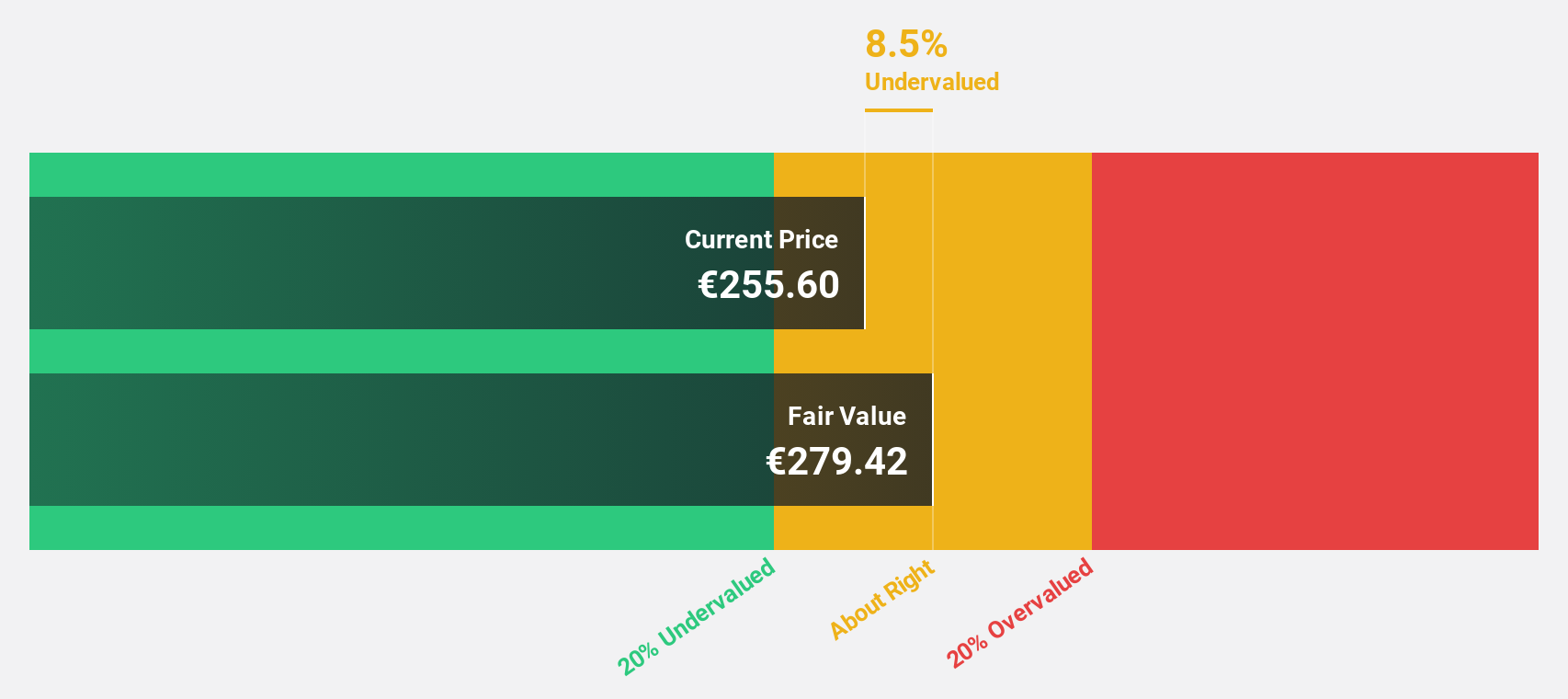

Estimated Discount To Fair Value: 23.5%

SAP, currently priced at €210.65, is trading over 20% below its estimated fair value of €275.28, suggesting undervaluation based on discounted cash flows. The company's earnings are projected to grow significantly at 37.9% annually, outpacing the German market average of 19.9%. Recent developments include strategic integrations with partners like UiPath and DeepHow to enhance automation and AI capabilities across its platforms, potentially boosting operational efficiency and customer engagement in the long term.

- In light of our recent growth report, it seems possible that SAP's financial performance will exceed current levels.

- Take a closer look at SAP's balance sheet health here in our report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued German Stocks Based On Cash Flows screener has unearthed 18 more companies for you to explore.Click here to unveil our expertly curated list of 21 Undervalued German Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

High growth potential with excellent balance sheet.