To the annoyance of some shareholders, AdCapital AG (FRA:ADC) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Longer-term, the stock has been solid despite a difficult 30 days, gaining 15% in the last year.

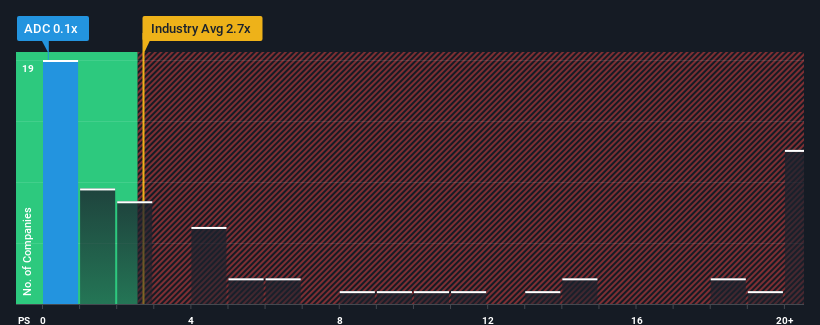

After such a large drop in price, AdCapital may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Capital Markets industry in Germany have P/S ratios greater than 2.7x and even P/S higher than 19x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AdCapital

How Has AdCapital Performed Recently?

It looks like revenue growth has deserted AdCapital recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on AdCapital will help you shine a light on its historical performance.How Is AdCapital's Revenue Growth Trending?

In order to justify its P/S ratio, AdCapital would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 5.6% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 3.6% either.

With this information, it's perhaps strange but not a major surprise that AdCapital is trading at a lower P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet, despite the industry heading down in unison. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

What Does AdCapital's P/S Mean For Investors?

AdCapital's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that AdCapital currently trades on a lower than expected P/S since its recent three-year revenue growth is no worse than the forecasts for a struggling industry. There could be some further unobserved threats to revenue preventing the P/S ratio from keeping up with the industry average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for AdCapital (1 doesn't sit too well with us) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:ADC

AdCapital

An industrial holding company, invests in electrical engineering, metal and plastics processing, machine and tool construction, and automotive businesses in Germany and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives