RENK Group AG's (FRA:R3NK) 26% Price Boost Is Out Of Tune With Revenues

RENK Group AG (FRA:R3NK) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

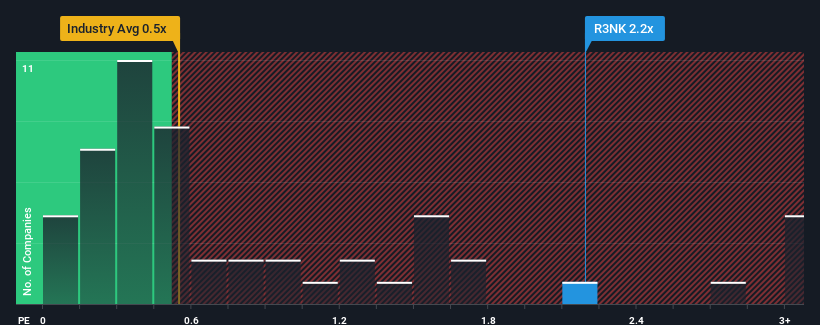

Since its price has surged higher, given close to half the companies operating in Germany's Machinery industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider RENK Group as a stock to potentially avoid with its 2.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for RENK Group

What Does RENK Group's P/S Mean For Shareholders?

RENK Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think RENK Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like RENK Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 51% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 15% per annum, which is not materially different.

In light of this, it's curious that RENK Group's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From RENK Group's P/S?

RENK Group's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting RENK Group's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with RENK Group (at least 1 which is concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on RENK Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.