Discovering FRoSTA And 2 Hidden German Small Caps with Robust Metrics

Reviewed by Simply Wall St

The German market, like many global indices, has faced recent declines amid concerns over economic growth and fluctuating industrial output. Despite these challenges, the resilience of small-cap stocks with robust financial metrics offers a promising avenue for investors seeking stability and potential growth. In this article, we explore three such hidden gems in Germany's small-cap sector, starting with FRoSTA.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, develops, produces, and markets frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market cap of €412.16 million.

Operations: FRoSTA generates revenue primarily from the sale of frozen food products across multiple European countries. The company has a market cap of €412.16 million.

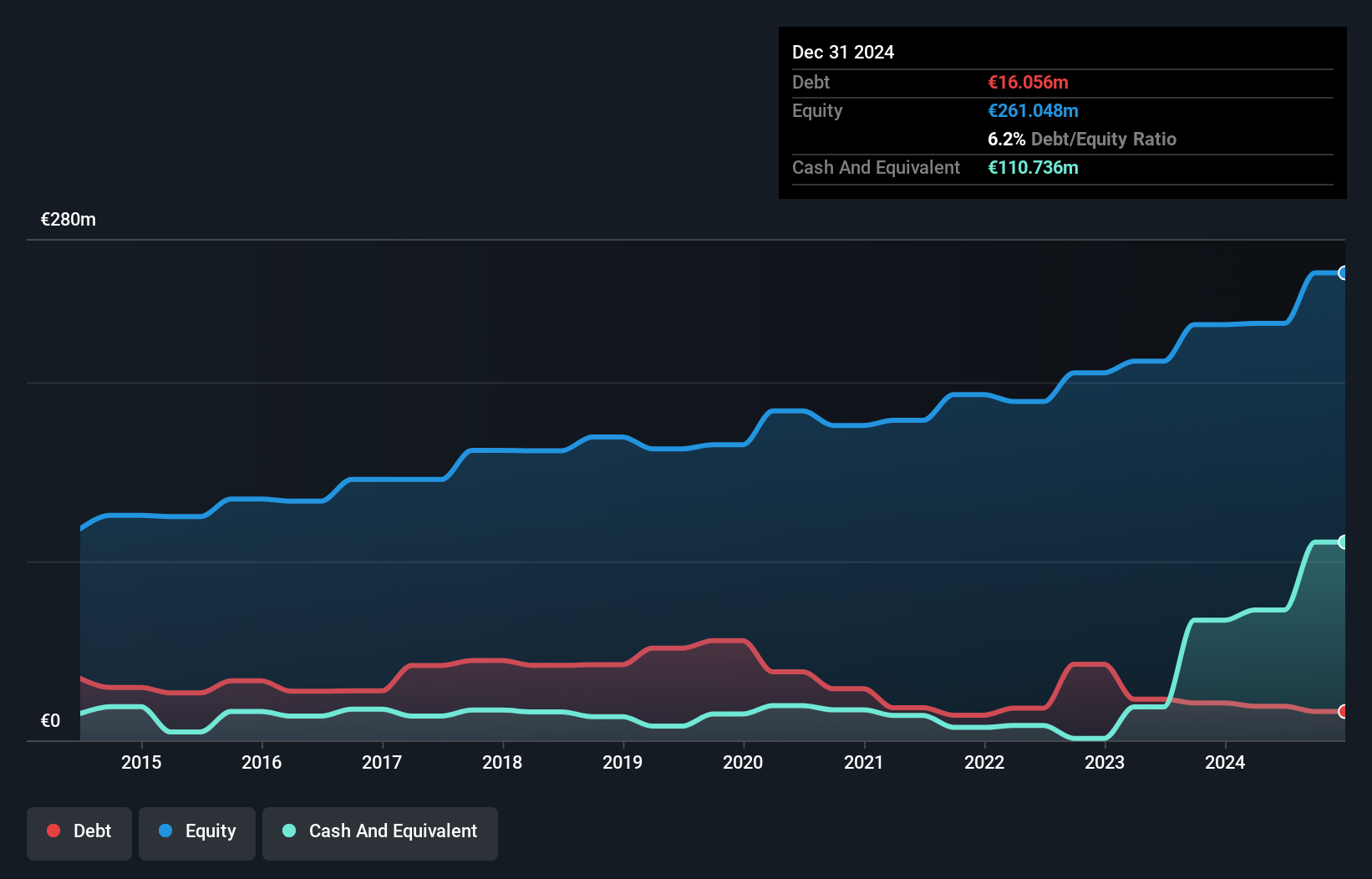

FRoSTA, a small cap in Germany's food industry, has shown consistent earnings growth of 16% annually over the past five years. The company reported half-year sales of €315.94M and net income of €15.5M for June 2024, both stable compared to last year. With a debt-to-equity ratio reduced from 31.6% to 8.2%, FRoSTA's financial health is solid, and its P/E ratio of 12.2x remains attractive against the German market's average of 16.5x.

- Delve into the full analysis health report here for a deeper understanding of FRoSTA.

Gain insights into FRoSTA's historical performance by reviewing our past performance report.

M1 Kliniken (XTRA:M12)

Simply Wall St Value Rating: ★★★★★☆

Overview: M1 Kliniken AG, with a market cap of €302.20 million, provides aesthetic medicine and plastic surgery services across Germany, Austria, the Netherlands, Switzerland, the United Kingdom, Croatia, Hungary, Bulgaria, Romania, and Australia.

Operations: M1 Kliniken AG generates revenue primarily through its Trade segment (€245.49 million) and Beauty segment (€70.83 million). The company has a market cap of €302.20 million.

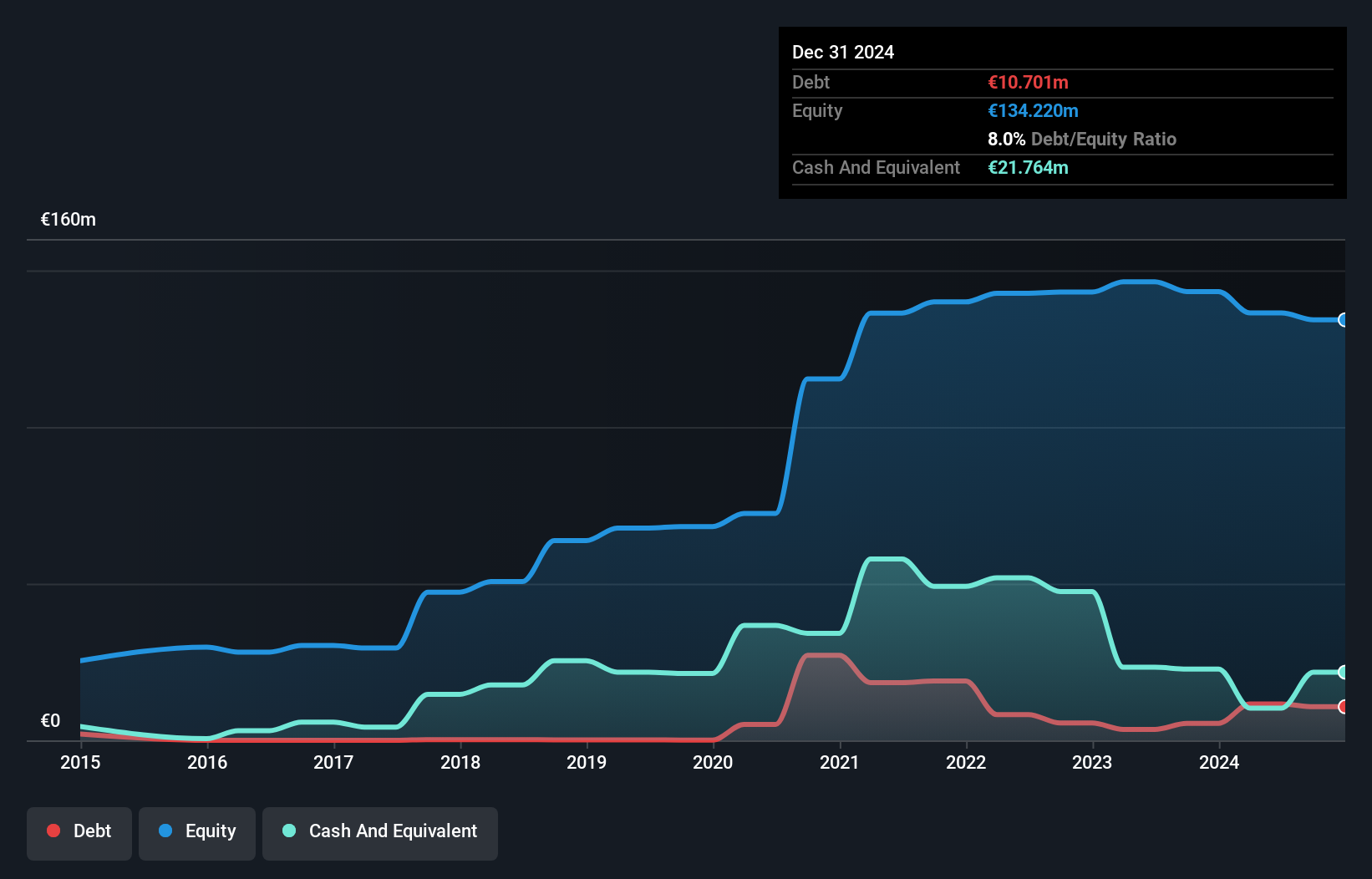

Earnings at M1 Kliniken have surged 138% in the past year, outpacing the healthcare sector's 30.9% growth. The company is trading at 73.2% below its estimated fair value, suggesting potential upside. Despite a volatile share price recently, it has maintained high-quality earnings and remains profitable with sufficient cash to cover debt obligations. Notably, its debt-to-equity ratio rose from 0.2 to 3.8 over five years, reflecting increased leverage for expansion.

- Take a closer look at M1 Kliniken's potential here in our health report.

Assess M1 Kliniken's past performance with our detailed historical performance reports.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market cap of €737.08 million.

Operations: Logwin AG generates revenue primarily from its Air + Ocean segment (€954.25 million) and Solutions segment (€275.78 million). The company has a consolidation adjustment of -€3.72 million.

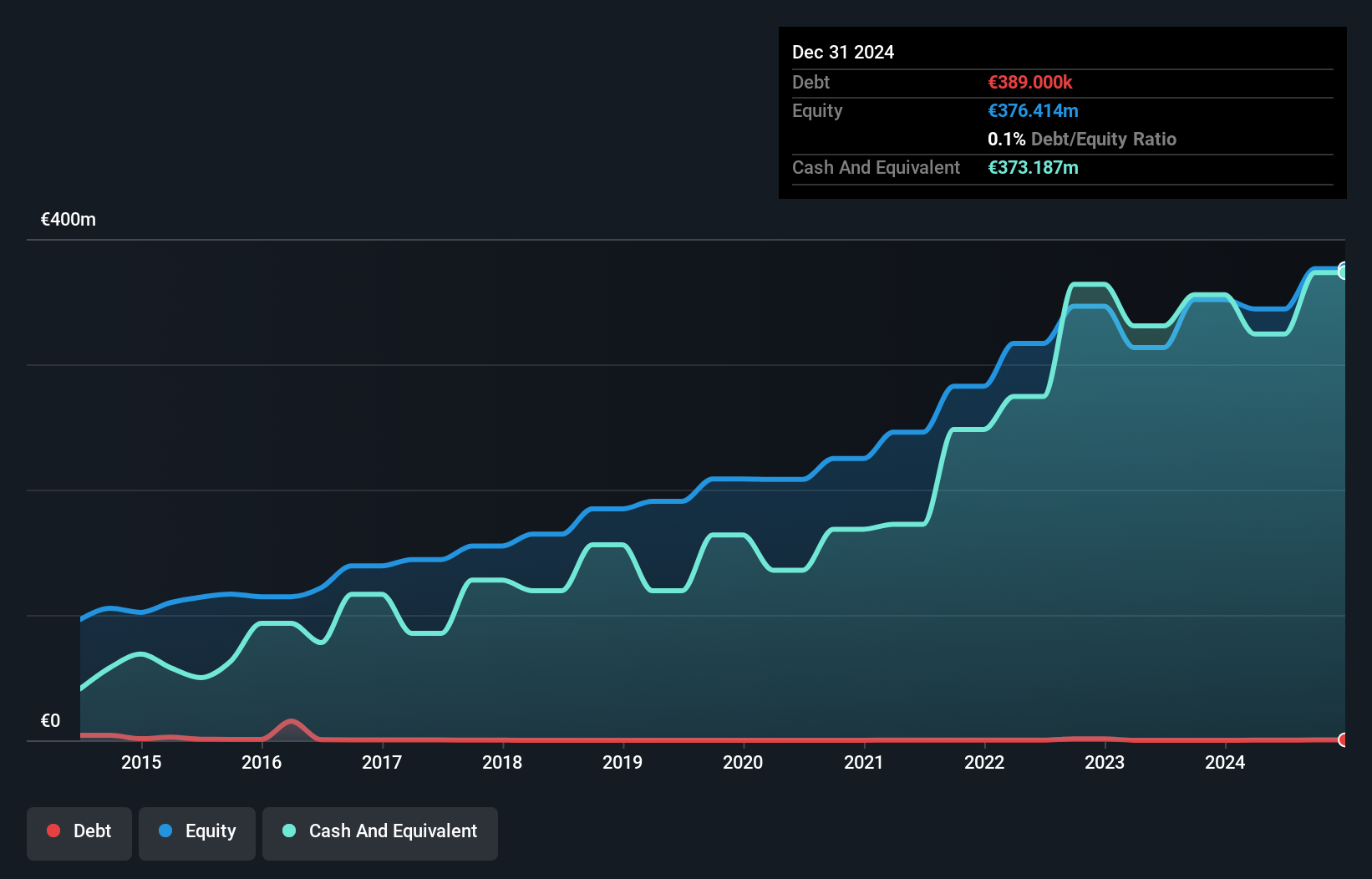

Logwin, a notable player in the logistics sector, reported half-year sales of €643.5 million for June 2024, down from €672.97 million the previous year. Net income also dipped to €31.86 million compared to €40.49 million previously, with basic earnings per share at €11.07 versus last year's €14.06. The company's debt-to-equity ratio improved from 0.04% to 0.03% over five years and it trades at about 30% below its estimated fair value.

- Unlock comprehensive insights into our analysis of Logwin stock in this health report.

Gain insights into Logwin's past trends and performance with our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 50 German Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TGHN

Logwin

Provides logistics and transport solutions in Germany, Austria, other European countries, Asia/Pacific, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)