- Switzerland

- /

- Capital Markets

- /

- SWX:LEON

European Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its longest streak of weekly gains since August 2012, driven by encouraging company results and resilience against U.S. trade policy uncertainties, investors are increasingly focusing on growth companies with strong insider ownership as a potential source of stability and confidence. In a market environment where mixed economic signals persist, such as varying inflation rates across major European economies and contractions in Germany's and France's GDPs, stocks that demonstrate high insider ownership can provide an added layer of assurance due to the vested interest insiders have in their company's success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.1% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| Ortoma (OM:ORT B) | 27.7% | 73.4% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 114.3% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's dive into some prime choices out of the screener.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) is a company that develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across various regions including Sweden, the United Kingdom, Europe, North America, and Asia with a market cap of SEK6.97 billion.

Operations: The company's revenue segments include SEK502.10 million from Europe, SEK676.70 million from Production, and SEK1.57 billion from North America, with Group Adjustments of -SEK213.50 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 34.4% p.a.

Swedencare demonstrates strong growth potential with earnings forecast to increase 34.4% annually, outpacing the Swedish market's 9.4%. Despite a low future return on equity of 3.6%, the company trades at nearly 70% below its estimated fair value, suggesting upside potential. Recent earnings reports show significant improvement, with net income rising to SEK 98.9 million from SEK 58.6 million last year, while insider buying indicates confidence in future performance without substantial selling in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of Swedencare.

- Upon reviewing our latest valuation report, Swedencare's share price might be too pessimistic.

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG offers derivative investment products and services across Switzerland, Europe, Asia, and internationally, with a market cap of CHF315.19 million.

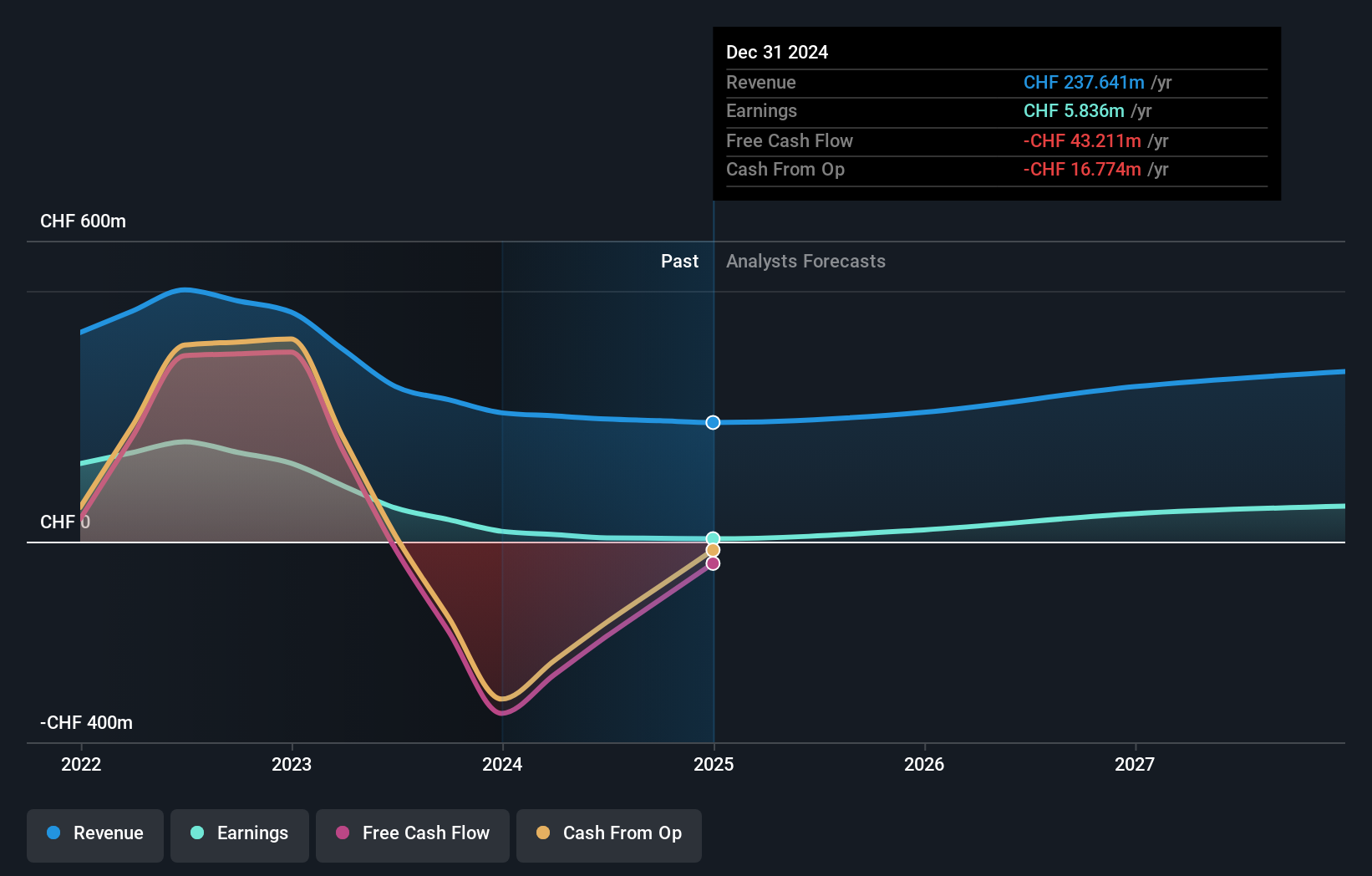

Operations: The company generates revenue from its brokerage segment, amounting to CHF237.64 million.

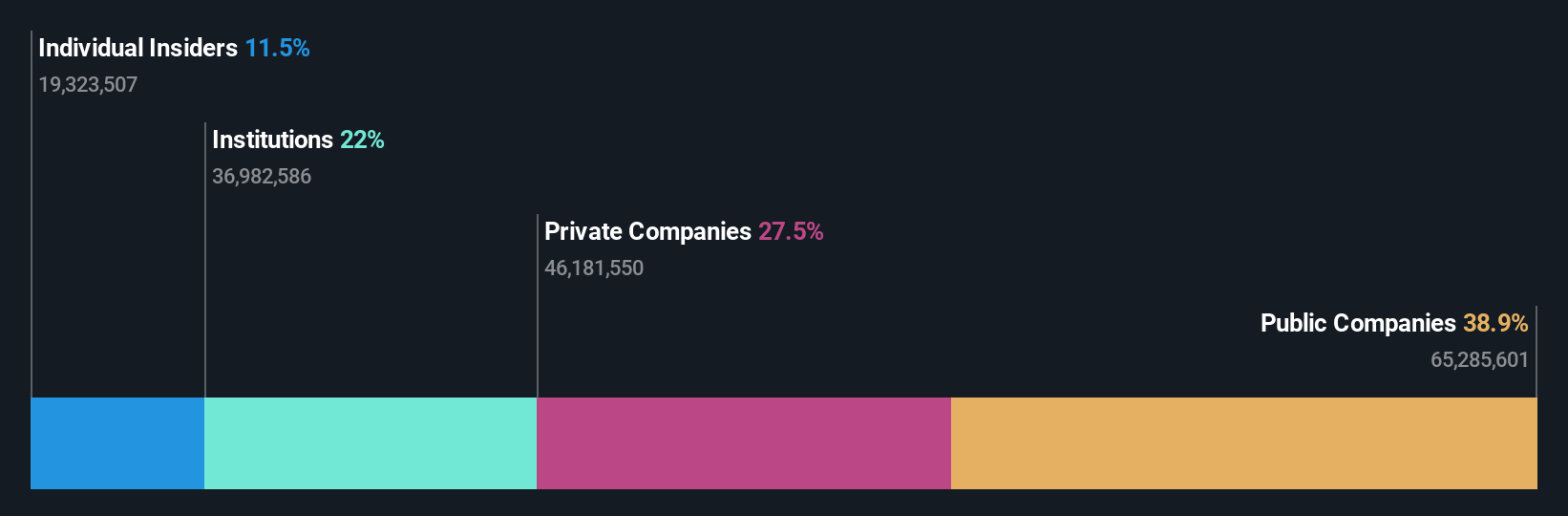

Insider Ownership: 17.9%

Earnings Growth Forecast: 35.2% p.a.

Leonteq's earnings are projected to grow significantly at 35.2% annually, surpassing the Swiss market's growth rate. Despite a recent decline in net income to CHF 5.84 million and reduced profit margins, the company remains undervalued, trading at 73.2% below its fair value estimate. The appointment of Christian Spieler as CEO may bring strategic advantages given his extensive experience in financial markets, though insider ownership movements remain stable with no substantial recent buying or selling activity noted.

- Navigate through the intricacies of Leonteq with our comprehensive analyst estimates report here.

- Our valuation report here indicates Leonteq may be overvalued.

HomeToGo (XTRA:HTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HomeToGo SE operates a marketplace for vacation rentals, connecting users searching for accommodations in Luxembourg and internationally, with a market cap of €298.57 million.

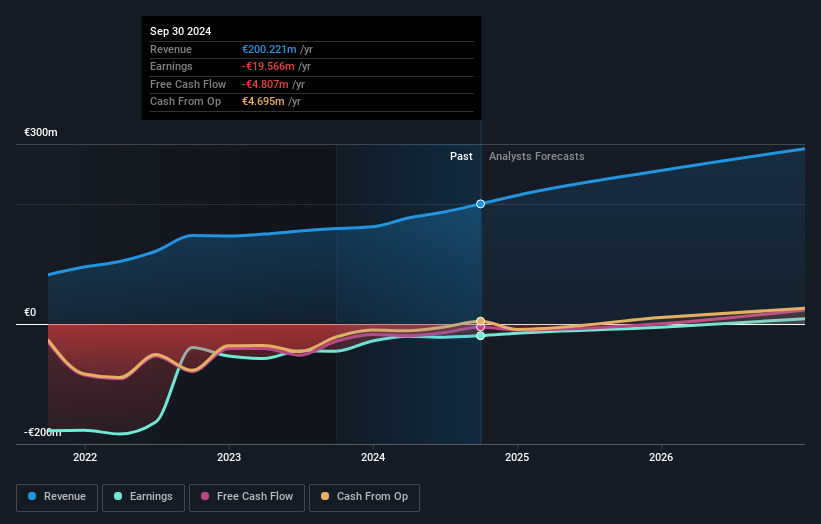

Operations: The company generates revenue of €200.22 million from its Internet Information Providers segment, facilitating vacation rental connections.

Insider Ownership: 8.7%

Earnings Growth Forecast: 99.2% p.a.

HomeToGo is positioned for substantial growth, with earnings expected to rise 99.23% annually and revenue anticipated to grow at 16.8% per year, outpacing the German market's average. Despite past shareholder dilution and a low forecasted return on equity of 0.9%, the stock trades significantly below its estimated fair value and analysts predict a potential price increase of over 100%. Recent private placements have been approved by shareholders, indicating strategic financial maneuvers.

- Click to explore a detailed breakdown of our findings in HomeToGo's earnings growth report.

- Our comprehensive valuation report raises the possibility that HomeToGo is priced lower than what may be justified by its financials.

Make It Happen

- Click this link to deep-dive into the 224 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Leonteq, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEON

Leonteq

Provides derivative investment products and services in Switzerland, Europe, and Asia, and internationally.

Reasonable growth potential slight.