As European markets navigate a landscape marked by interest rate assessments and trade uncertainties, the pan-European STOXX Europe 600 Index remains steady, while major indices like Italy's FTSE MIB and Germany's DAX show modest gains. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals that can withstand economic fluctuations and capitalize on growth opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Dekpol | 64.28% | 10.52% | 14.34% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative (ENXTPA:CNDF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative offers a range of banking products and financial services in France, with a market capitalization of approximately €1.48 billion.

Operations: The company generates revenue primarily from its retail banking segment, amounting to €632.82 million. It has a market capitalization of approximately €1.48 billion, reflecting its scale in the financial services sector in France.

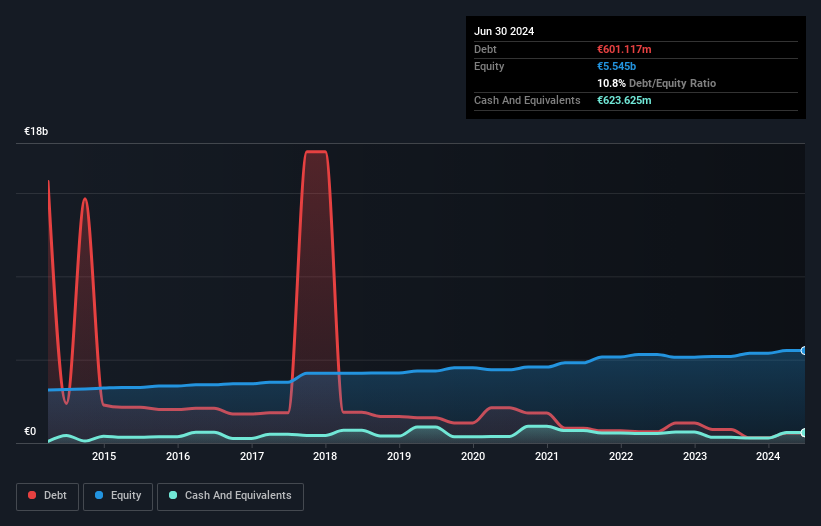

Crédit Agricole Nord de France stands out with a robust asset base of €38.2 billion and equity of €5.7 billion, supported by total deposits of €31 billion against loans of €28.3 billion. Its earnings growth at 26.6% outpaces the broader banking sector's -0.3%, indicating strong performance, while maintaining an appropriate bad loan ratio at 1.7%. The bank benefits from primarily low-risk funding sources, with customer deposits making up 95% of liabilities, and its price-to-earnings ratio at 8.5x suggests good value compared to the French market average of 16x.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse customer segments in France, with a market cap of €1.58 billion.

Operations: The cooperative generates revenue through its diverse banking services offered to various customer segments in France, contributing to its market capitalization of €1.58 billion.

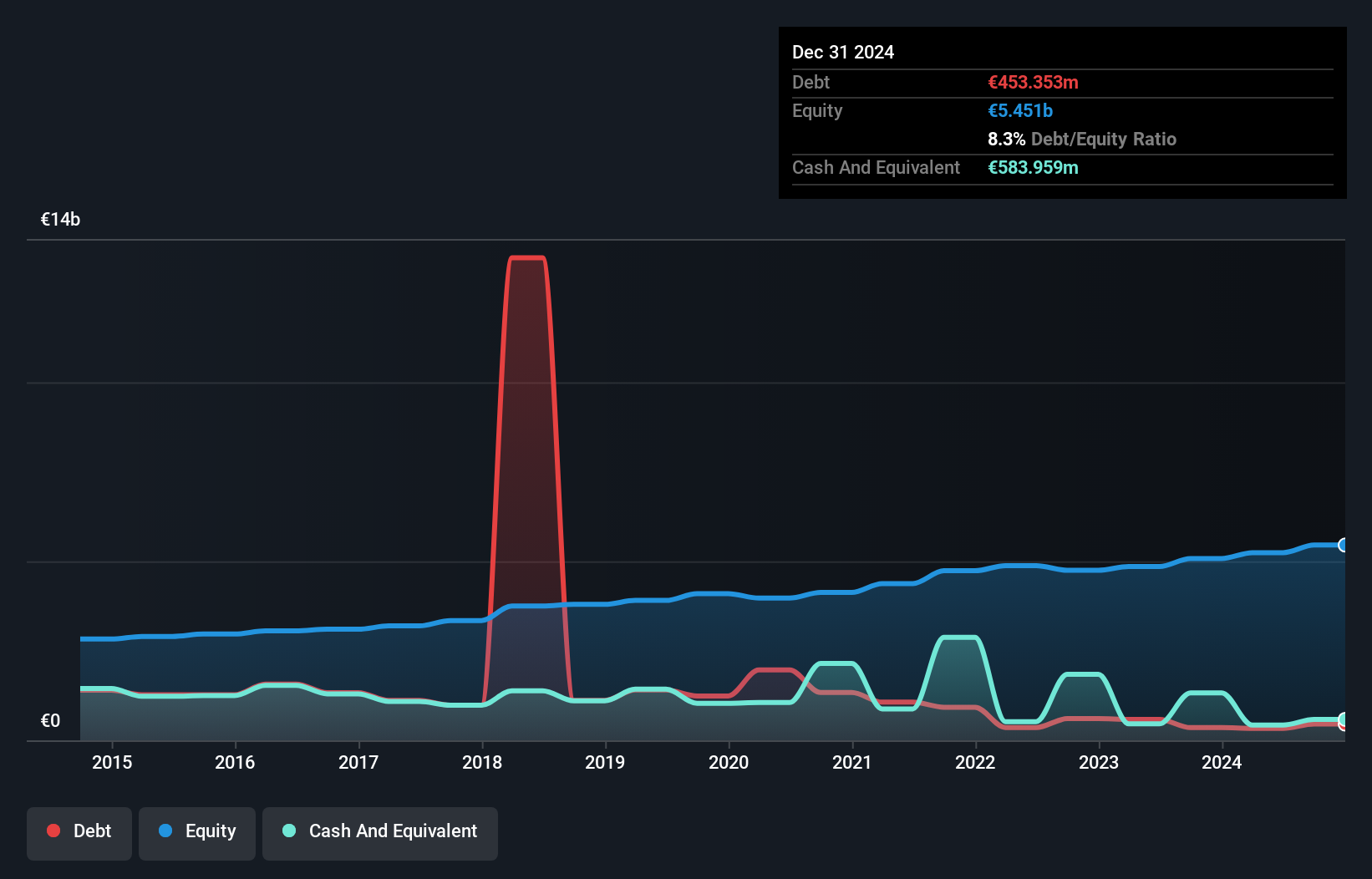

Caisse Régionale de Crédit Agricole Mutuel du Languedoc, a small yet robust player in the banking sector, boasts total assets of €35.9 billion and equity of €5.7 billion. Its liabilities are primarily low-risk, with 95% sourced from customer deposits. The bank has an appropriate level of bad loans at 1.5%, backed by a sufficient allowance for these loans at 136%. With earnings growth of 1.2% over the past year, it outpaces the industry average decline of -0.3%. The price-to-earnings ratio stands attractively at 8.6x against the French market's 16x benchmark.

PFISTERER Holding (XTRA:PFSE)

Simply Wall St Value Rating: ★★★★★☆

Overview: PFISTERER Holding SE specializes in the production and distribution of cable fittings, insulators for overhead lines, and components for energy networks and renewable energy generation, with a market capitalization of €1.31 billion.

Operations: PFISTERER Holding SE generates revenue primarily from High Voltage Cable Accessories (€158.17 million), Components (€102.73 million), Overhead Lines (€86.46 million), and Medium Voltage Cable Accessories (€54.24 million).

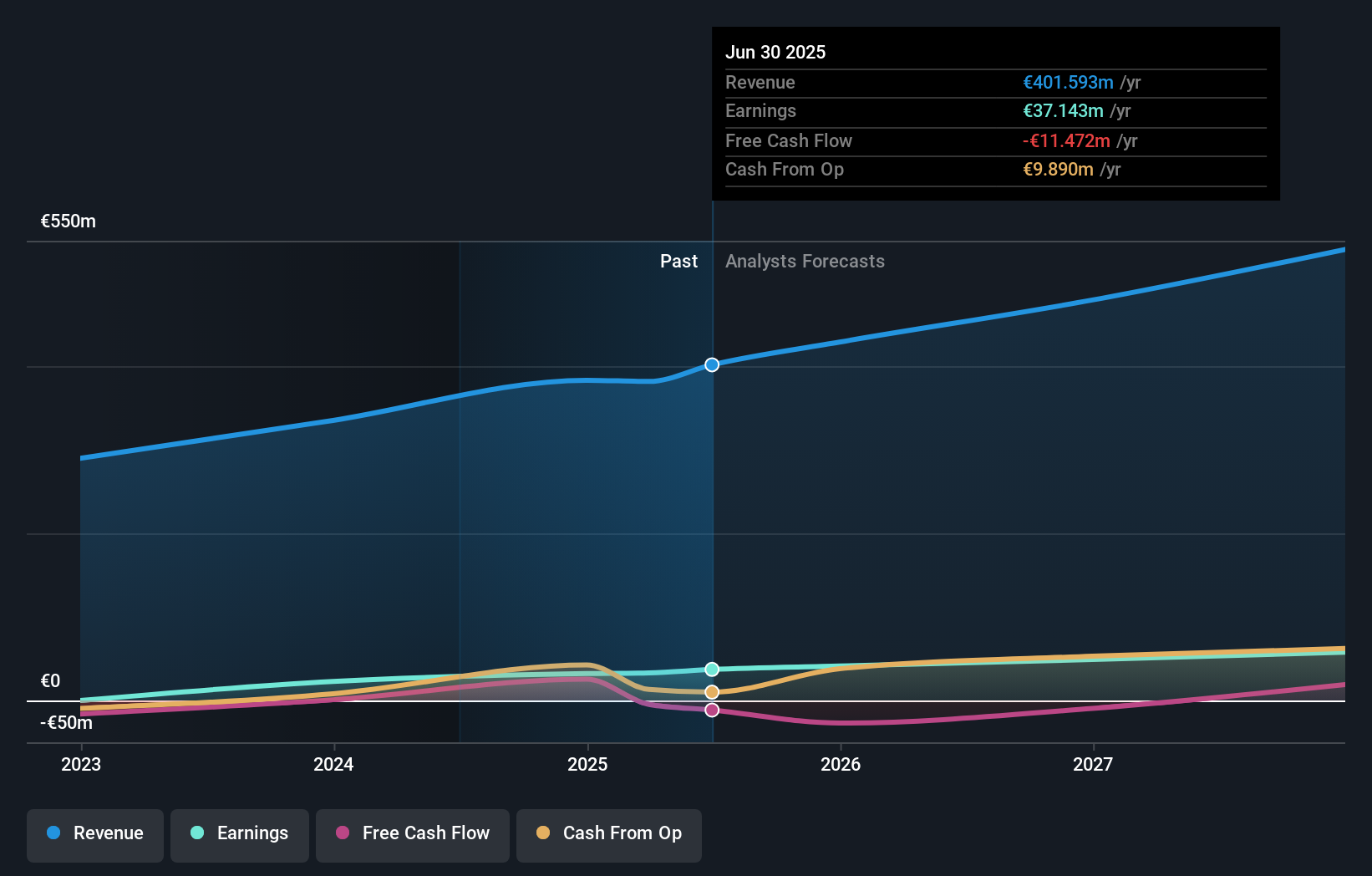

PFISTERER Holding, a niche player in the electrical industry, boasts a price-to-earnings ratio of 35.3x, which is notably below the sector's average of 52.5x. Despite not outpacing the industry's earnings growth last year, it achieved an impressive annual profit increase of 69.6% over five years. The company has more cash than total debt and covers interest payments well with EBIT at 17.8 times coverage, yet it remains free cash flow negative recently with -€11 million as of June 2025 due to capital expenditures like its €30 million investment in a high-voltage testing lab for HVDC technology expansion by mid-2027.

Taking Advantage

- Explore the 336 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CNDF

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société cooperative provides banking products and financial services in France.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives