- Germany

- /

- Construction

- /

- XTRA:NCH2

Assessing thyssenkrupp nucera (XTRA:NCH2) Valuation After Major Middle East Electrolyser Contract Win

Reviewed by Simply Wall St

thyssenkrupp nucera KGaA (XTRA:NCH2) just landed a high double digit million euro contract to supply electrolysers for a new large scale Chlor Alkali plant in the Middle East, sharpening attention on its stock.

See our latest analysis for thyssenkrupp nucera KGaA.

The latest contract win comes after a choppy spell for the stock, with a 90 day share price return of minus 19.54 percent and a 1 year total shareholder return of minus 23.44 percent. This suggests sentiment may be stabilising rather than accelerating.

If this deal has you thinking about where the next wave of industrial winners could emerge, it might be worth exploring fast growing stocks with high insider ownership.

With the shares still trading well below analyst targets despite signs of improving profitability, the key question now is whether thyssenkrupp nucera is quietly undervalued or if the market already sees and prices in its next phase of growth.

Most Popular Narrative: 25.9% Undervalued

With thyssenkrupp nucera last closing at €7.97 against a narrative fair value of about €10.75, the market gap here is hard to ignore.

Expansion of the service and aftermarket business in the chlor-alkali segment (with rising orders from the Middle East, Central Europe, U.S., and China) is boosting recurring, higher-margin revenues, as evidenced by the stable or growing EBIT in this segment. This supports gross margin expansion and enhanced earnings quality over time.

Curious how a shrinking revenue base can still underpin a higher valuation multiple and richer margins. The narrative leans on specific profitability upgrades and long dated earnings power. Want to see which forward assumptions really carry this upside case and how they bridge today’s losses to tomorrow’s cash flows.

Result: Fair Value of €10.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a thinner order pipeline and delays in final investment decisions on flagship green hydrogen projects could quickly reverse this upside case.

Find out about the key risks to this thyssenkrupp nucera KGaA narrative.

Another View: Valuation Multiples Flash a Warning

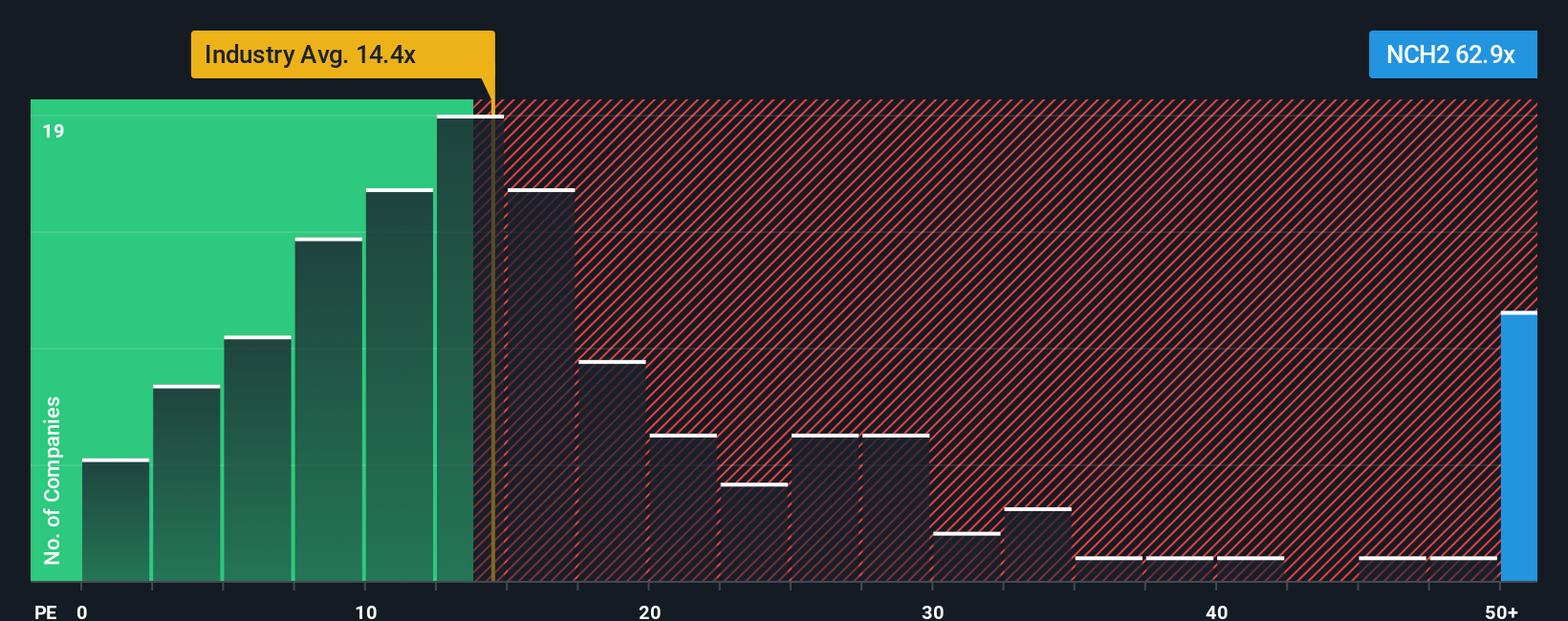

While narratives and fair value models hint at upside, the current valuation looks stretched on earnings. NCH2 trades on a P E ratio of about 62.9 times, roughly double peers at 30.9 times and triple our fair ratio of 20.3 times, leaving little room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own thyssenkrupp nucera KGaA Narrative

If you see the story differently or want to stress test every assumption yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your thyssenkrupp nucera KGaA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge

Do not stop at a single stock when the market is full of opportunities. Use the Simply Wall Street Screener to uncover ideas others overlook.

- Target reliable income by reviewing these 13 dividend stocks with yields > 3% that could strengthen your portfolio with steady cash returns when markets turn choppy.

- Capitalize on structural shifts in medicine and automation by assessing these 30 healthcare AI stocks shaping the future of diagnostics and patient care.

- Position yourself ahead of the next digital payment wave by evaluating these 80 cryptocurrency and blockchain stocks building real businesses around blockchain and tokenized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NCH2

thyssenkrupp nucera KGaA

Engages in the development, engineering, procurement, commissioning, and licensing of high-performance electrolysis technologies in Germany, Italy, the Middle East, Africa, South America, Asia, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)