- Germany

- /

- Diversified Financial

- /

- XTRA:PBB

German Exchange's October 2024 Stocks Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As the German market navigates through heightened caution due to escalating Middle East tensions and a potential rate cut by the European Central Bank, investors are keeping a close eye on opportunities within the DAX, which recently saw a decline of 1.81%. In this environment, identifying stocks trading below their estimated fair value can present compelling opportunities for those looking to capitalize on market inefficiencies and long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €17.45 | €31.15 | 44% |

| init innovation in traffic systems (XTRA:IXX) | €36.10 | €52.31 | 31% |

| Gerresheimer (XTRA:GXI) | €78.20 | €111.71 | 30% |

| Formycon (XTRA:FYB) | €52.70 | €81.59 | 35.4% |

| Schaeffler (XTRA:SHA0) | €4.958 | €6.94 | 28.6% |

| Schweizer Electronic (XTRA:SCE) | €3.78 | €7.19 | 47.5% |

| elumeo (XTRA:ELB) | €2.08 | €3.84 | 45.9% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.36 | 42.7% |

| Vectron Systems (XTRA:V3S) | €12.15 | €17.25 | 29.6% |

| Basler (XTRA:BSL) | €8.80 | €13.91 | 36.7% |

Here's a peek at a few of the choices from the screener.

adidas (XTRA:ADS)

Overview: adidas AG, along with its subsidiaries, is engaged in the design, development, production, and marketing of athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America; it has a market cap of €42.55 billion.

Operations: The company's revenue segments include Greater China with €3.26 billion, Latin America at €2.39 billion, and North America contributing €5.07 billion.

Estimated Discount To Fair Value: 14.7%

adidas AG reported strong earnings growth in the second quarter, with net income rising to €190 million from €84 million a year ago. The company has raised its full-year guidance, expecting operating profit to reach around €1 billion despite unfavorable currency effects. Trading at 14.7% below fair value, adidas is undervalued based on discounted cash flow analysis, with earnings forecasted to grow significantly faster than the German market over the next three years.

- In light of our recent growth report, it seems possible that adidas' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of adidas.

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG specializes in commercial real estate and public investment finance across Europe and the United States, with a market cap of €807.52 million.

Operations: The company's revenue segments include €223 million from Real Estate Finance and €103 million from Non-Core activities.

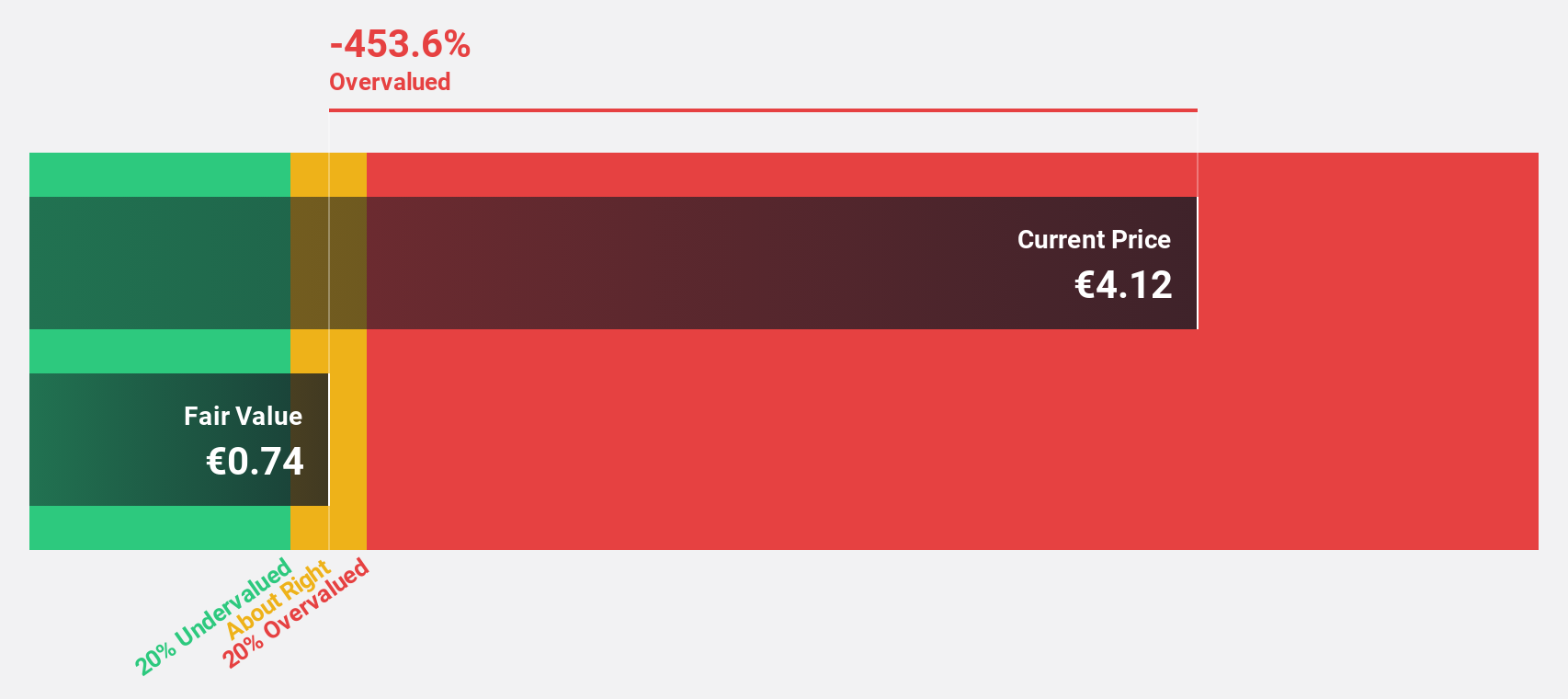

Estimated Discount To Fair Value: 13.5%

Deutsche Pfandbriefbank is trading at €6.01, approximately 13.5% below its estimated fair value of €6.94, making it undervalued based on cash flows. Despite a forecasted earnings growth rate of 40.2% annually, recent financial results show a decline in net income to €40 million for the first half of 2024 from €69 million the previous year. The bank's high level of bad loans and reliance on riskier external borrowing are concerns for investors.

- Upon reviewing our latest growth report, Deutsche Pfandbriefbank's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Deutsche Pfandbriefbank with our detailed financial health report.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific; it has a market cap of €5.61 billion.

Operations: The company's revenue segments include Automotive Technologies at €9.80 billion, Vehicle Lifetime Solutions at €2.43 billion, and Bearings & Industrial Solutions at €4.10 billion.

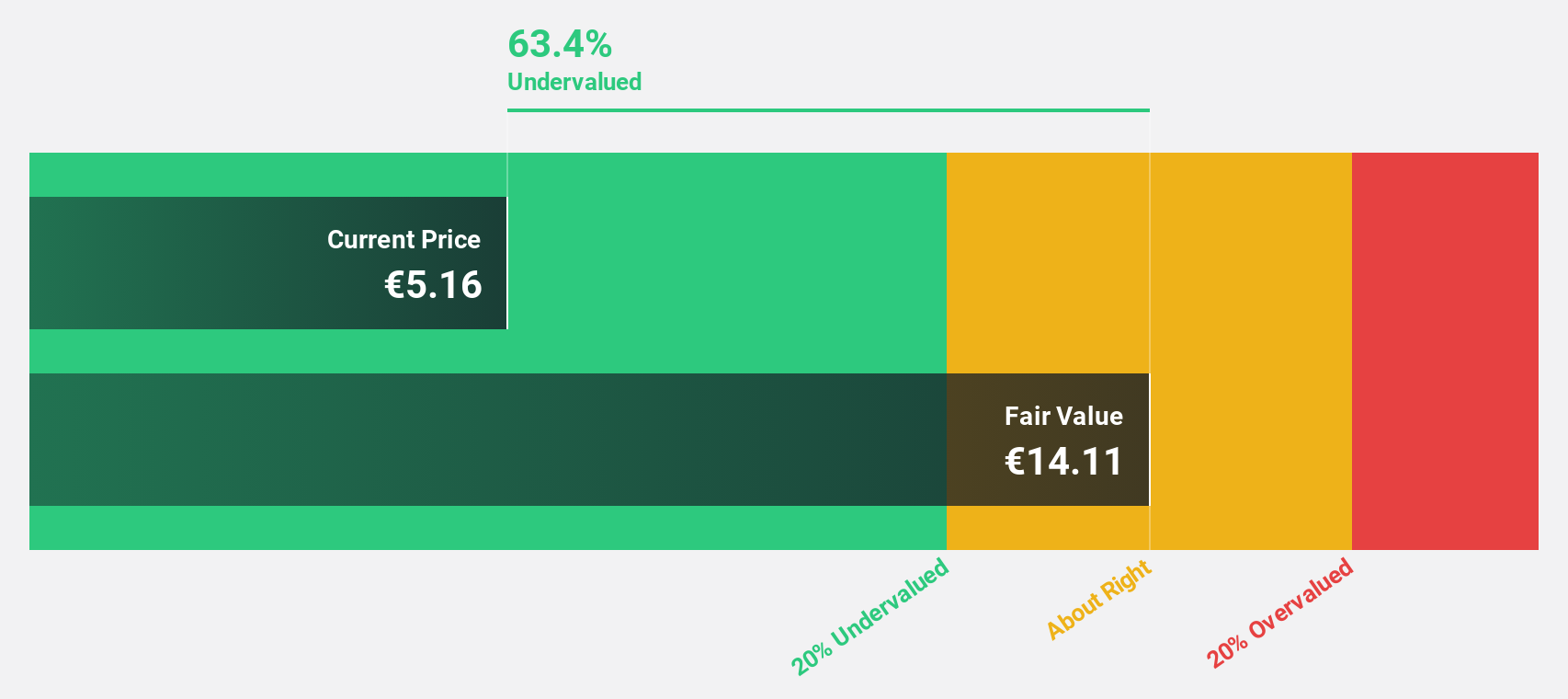

Estimated Discount To Fair Value: 28.6%

Schaeffler is trading at €4.96, about 28.6% below its estimated fair value of €6.94, highlighting its undervaluation based on cash flows. Although earnings are forecast to grow significantly at 38.1% annually, recent results show a drop in net income to €33 million for Q2 2024 from €138 million the previous year, with profit margins also declining from 3.5% to 1.9%. The company's shares remain highly illiquid despite expected revenue growth outpacing the German market.

- Our growth report here indicates Schaeffler may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Schaeffler stock in this financial health report.

Where To Now?

- Dive into all 18 of the Undervalued German Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PBB

Deutsche Pfandbriefbank

Provides commercial real estate and public investment finance in Europe and the United States of America.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives